he relationship between UniCredit and Alpha Bank is reaching a turning point, as all indications suggest the Italian banking giant is accelerating its push to acquire more than 30% of the Greek systemic lender. If confirmed, the move would not only make UniCredit the dominant shareholder but also allow it to fully consolidate Alpha’s earnings under IFRS standards.

After acquiring the stake held by Dutch investor Rob Holterman, UniCredit brought its holding close to 20%. Following stalled merger talks with Germany’s Commerzbank and Italy’s Banco BPM, attention has now firmly shifted to Greece. Athens is becoming a strategic hub, and Alpha Bank the key growth vehicle.

The timing aligns with UniCredit’s record Q2 2025 profits (+25%), supported by strong liquidity and capital. Behind-the-scenes efforts are reportedly underway, potentially involving secondary market purchases or private deals with current shareholders.

Technical Analysis

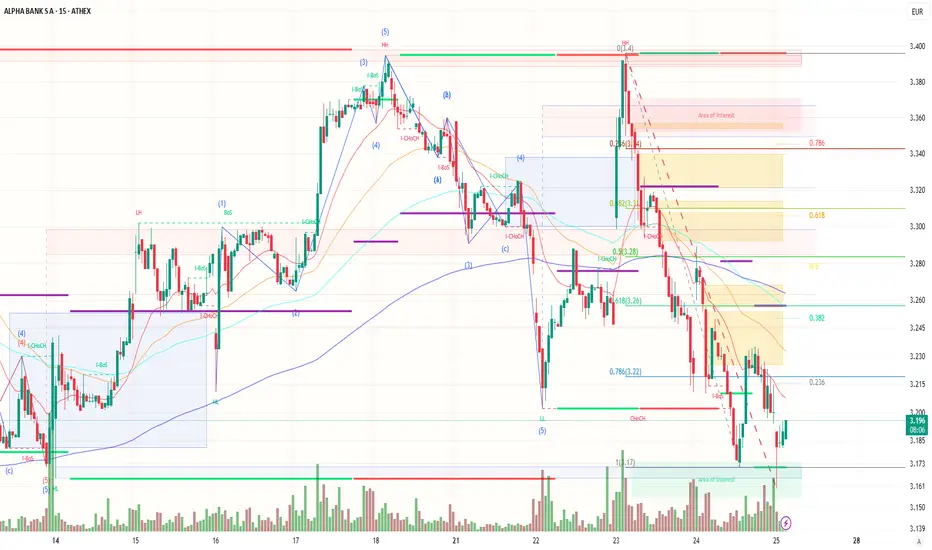

Alpha Bank’s stock (ATHEX: ALPHA) trades at €3.186, currently in a corrective phase after completing a strong five-wave bullish cycle peaking at €3.384. A clear A-B-C retracement has followed, with support emerging near €3.17, confirmed by high-volume buying. The stock faces key resistances at €3.245 and €3.28 (Fibonacci 0.382 & 0.5 levels), which it must reclaim to reverse the short-term downtrend. Failing that, a break below €3.17 could trigger further downside. Market structure shifts (CHoCH, BoS) suggest high sensitivity to any new buying pressure. Investor sentiment around UniCredit’s strategic intentions may be the catalyst for the next major move.

After acquiring the stake held by Dutch investor Rob Holterman, UniCredit brought its holding close to 20%. Following stalled merger talks with Germany’s Commerzbank and Italy’s Banco BPM, attention has now firmly shifted to Greece. Athens is becoming a strategic hub, and Alpha Bank the key growth vehicle.

The timing aligns with UniCredit’s record Q2 2025 profits (+25%), supported by strong liquidity and capital. Behind-the-scenes efforts are reportedly underway, potentially involving secondary market purchases or private deals with current shareholders.

Technical Analysis

Alpha Bank’s stock (ATHEX: ALPHA) trades at €3.186, currently in a corrective phase after completing a strong five-wave bullish cycle peaking at €3.384. A clear A-B-C retracement has followed, with support emerging near €3.17, confirmed by high-volume buying. The stock faces key resistances at €3.245 and €3.28 (Fibonacci 0.382 & 0.5 levels), which it must reclaim to reverse the short-term downtrend. Failing that, a break below €3.17 could trigger further downside. Market structure shifts (CHoCH, BoS) suggest high sensitivity to any new buying pressure. Investor sentiment around UniCredit’s strategic intentions may be the catalyst for the next major move.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.