Amazon.com, Inc (AMZN)_Forecast Model _2025 _2026 _Distribution Cycle

Execution Venue: NASDAQ

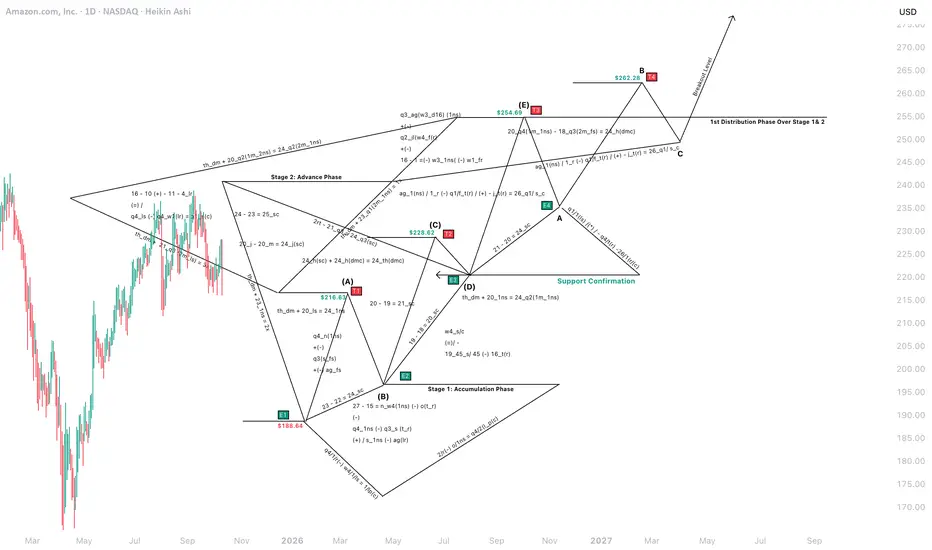

AMZN is currently positioned to drop toward the key level of $188.64, unless a strong support base is confirmed beforehand. This zone represents a critical point of structural validation within the ongoing cycle.

Distribution Levels:

Level 1: $216.63

Level 2: $228.62

Level 3: $254.69

Level 4: $262.28

Price behaviour around $188.64 will determine whether accumulation resumes or if further downside pressure unfolds before the next distribution sequence initiates.

Model- based forecast. Accuracy derived from proprietary cycle and distribution analysis.

This forecast maps out a complete cyclical sequence: an initial distribution at upper resistance zones, a corrective drop into the primary accumulation base, a secondary accumulation before the next advance, and a final upside move into higher distribution territory.

This model calculates price action based on distribution phases, economic timing cycles, and natural market imbalances.

Model Integrity:

This forecast is built using a proprietary cycle-based structure. Once established, the model remains fixed until the final distribution phase, allowing traders to execute with clarity and conviction. This approach contrasts sharply with conventional indicators that frequently repaint or adjust with each new data point, often compromising decision-making.

I’ll continue publishing live cycle forecasts across key assets - built with institutional discipline and retail accessibility.

Disclaimer:

The following forecast is derived from a proprietary, hand-crafted mathematical model developed independently over several years. It does not rely on traditional indicators, technical patterns, or third-party frameworks such as Elliott Wave Theory.

#(AMZN ) #MarketForecast #DistributionCycle #TradingModel #QuantitativeAnalysis #InstitutionalTrading #Stage3Distribution #AssetManagement #TradingStrategy #SymmetryInMarkets #ForecastAccuracy

Execution Venue: NASDAQ

AMZN is currently positioned to drop toward the key level of $188.64, unless a strong support base is confirmed beforehand. This zone represents a critical point of structural validation within the ongoing cycle.

Distribution Levels:

Level 1: $216.63

Level 2: $228.62

Level 3: $254.69

Level 4: $262.28

Price behaviour around $188.64 will determine whether accumulation resumes or if further downside pressure unfolds before the next distribution sequence initiates.

Model- based forecast. Accuracy derived from proprietary cycle and distribution analysis.

This forecast maps out a complete cyclical sequence: an initial distribution at upper resistance zones, a corrective drop into the primary accumulation base, a secondary accumulation before the next advance, and a final upside move into higher distribution territory.

This model calculates price action based on distribution phases, economic timing cycles, and natural market imbalances.

Model Integrity:

This forecast is built using a proprietary cycle-based structure. Once established, the model remains fixed until the final distribution phase, allowing traders to execute with clarity and conviction. This approach contrasts sharply with conventional indicators that frequently repaint or adjust with each new data point, often compromising decision-making.

I’ll continue publishing live cycle forecasts across key assets - built with institutional discipline and retail accessibility.

Disclaimer:

The following forecast is derived from a proprietary, hand-crafted mathematical model developed independently over several years. It does not rely on traditional indicators, technical patterns, or third-party frameworks such as Elliott Wave Theory.

#(AMZN ) #MarketForecast #DistributionCycle #TradingModel #QuantitativeAnalysis #InstitutionalTrading #Stage3Distribution #AssetManagement #TradingStrategy #SymmetryInMarkets #ForecastAccuracy

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.