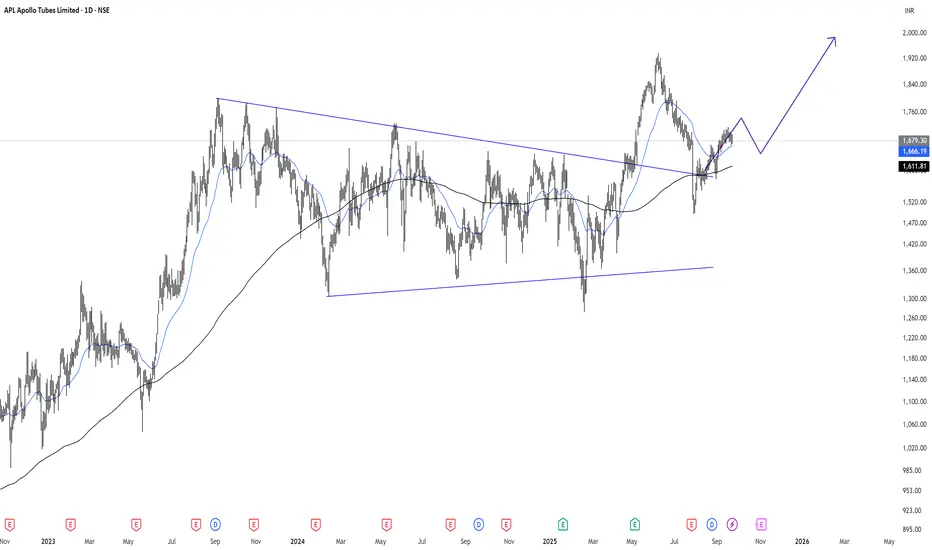

APLAPOLLO has seen a bullish breakout from a consolidation pattern.

APL Apollo Tubes – Growth, Margins & Market Outlook (Fundamentls)

-> 5Y Revenue CAGR ~25% → ₹8,500 Cr (FY21) → ₹20,690 Cr (FY25).

-> Margins steady: OPM 6–8%, NPM ~3.7–4.8%. FY25 ended with OPM ~6%, PAT ₹757 Cr.

-> Quarterly trend: Q1 FY26 revenue ₹5,170 Cr, OPM ~7%, PAT ₹237 Cr (steady recovery after a weak Sep-24).

-> Working capital strength: Debtor days ~5, Cash Conversion Cycle negative (–8 days) in FY25 → cash collected before supplier payments.

-> End-market mix: ~64% revenue from housing/residential sector.

Residential Housing Market Context

-> India’s housing demand cooled in H1 2025 (sales –30% YoY from 2024 highs) but prices still rising ~6–10% YoY.

-> Affordable/mid-segment (<₹1 Cr) still accounts for >50% of sales.

-> Policy tailwinds (PMAY extended to Dec-25, 94 lakh homes delivered) and repo rate cuts (to 5.5%) support demand.

Takeaway:

APL Apollo is structurally positioned to benefit from India’s housing upcycle. Even if volumes consolidate in 2025, steel tubes are gaining wallet share in construction, margins remain resilient, and the negative cash cycle offers strong cash-flow advantage.

Technicals

A breakout seen from a consolidation pattern, also retested. Best option looks like keeping a long position until price > 200 Daily Moving Average. I would also like to look at 34 EMA. Faster EMA helps trailing profit once momentum has started.

Overall, I would invest around 2% of my overall equity market capital.

Views informational only, not a trading advise.

APL Apollo Tubes – Growth, Margins & Market Outlook (Fundamentls)

-> 5Y Revenue CAGR ~25% → ₹8,500 Cr (FY21) → ₹20,690 Cr (FY25).

-> Margins steady: OPM 6–8%, NPM ~3.7–4.8%. FY25 ended with OPM ~6%, PAT ₹757 Cr.

-> Quarterly trend: Q1 FY26 revenue ₹5,170 Cr, OPM ~7%, PAT ₹237 Cr (steady recovery after a weak Sep-24).

-> Working capital strength: Debtor days ~5, Cash Conversion Cycle negative (–8 days) in FY25 → cash collected before supplier payments.

-> End-market mix: ~64% revenue from housing/residential sector.

Residential Housing Market Context

-> India’s housing demand cooled in H1 2025 (sales –30% YoY from 2024 highs) but prices still rising ~6–10% YoY.

-> Affordable/mid-segment (<₹1 Cr) still accounts for >50% of sales.

-> Policy tailwinds (PMAY extended to Dec-25, 94 lakh homes delivered) and repo rate cuts (to 5.5%) support demand.

Takeaway:

APL Apollo is structurally positioned to benefit from India’s housing upcycle. Even if volumes consolidate in 2025, steel tubes are gaining wallet share in construction, margins remain resilient, and the negative cash cycle offers strong cash-flow advantage.

Technicals

A breakout seen from a consolidation pattern, also retested. Best option looks like keeping a long position until price > 200 Daily Moving Average. I would also like to look at 34 EMA. Faster EMA helps trailing profit once momentum has started.

Overall, I would invest around 2% of my overall equity market capital.

Views informational only, not a trading advise.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.