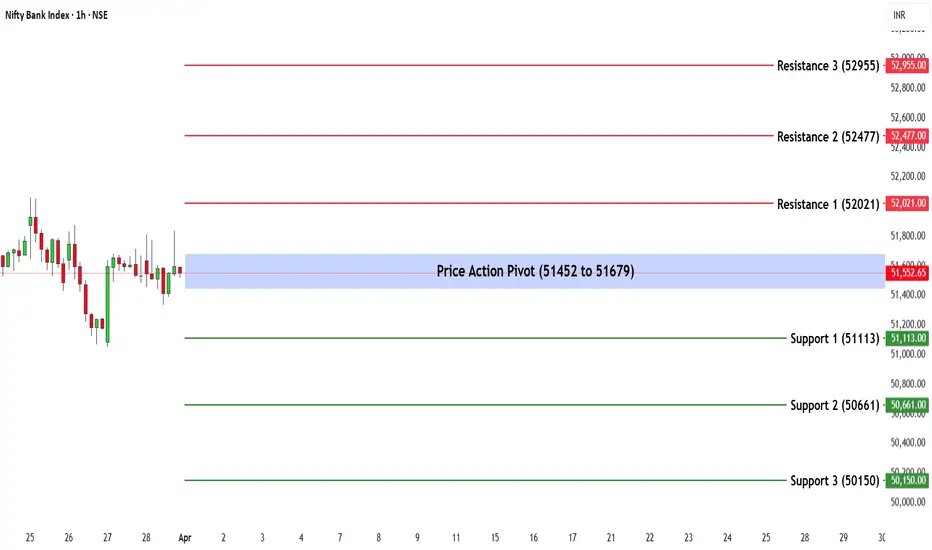

Bank Nifty ended the week at 51,564.85, registering a strong gain of 1.92%.

Key Levels for the Upcoming Week

🔹Price Action Pivot Zone:

The critical range to monitor for potential trend reversals or continuation is 51,452 - 51,679.

🔹Support & Resistance Levels:

Support Levels:

S1: 51,113

S2: 50,661

S3: 50,156

Resistance Levels:

R1: 52,021

R2: 52,477

R3: 52,955

Market Outlook

✅Bullish Scenario: A sustained move above 51,679 could trigger buying momentum, potentially driving Bank Nifty towards R1 (52,021) and beyond.

❌Bearish Scenario: If the index falls below 51,452, selling pressure may increase, pulling it towards S1 (51,113) and lower levels.

Disclaimer: This analysis is for educational purposes only. Investors should conduct their own research before making any trading decisions.

Key Levels for the Upcoming Week

🔹Price Action Pivot Zone:

The critical range to monitor for potential trend reversals or continuation is 51,452 - 51,679.

🔹Support & Resistance Levels:

Support Levels:

S1: 51,113

S2: 50,661

S3: 50,156

Resistance Levels:

R1: 52,021

R2: 52,477

R3: 52,955

Market Outlook

✅Bullish Scenario: A sustained move above 51,679 could trigger buying momentum, potentially driving Bank Nifty towards R1 (52,021) and beyond.

❌Bearish Scenario: If the index falls below 51,452, selling pressure may increase, pulling it towards S1 (51,113) and lower levels.

Disclaimer: This analysis is for educational purposes only. Investors should conduct their own research before making any trading decisions.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.