Fundamental

Price: ~IDR 4,140 per share.

Earnings: EPS ~376, showing good profit generation.

Dividend Yield: ~8.4%, quite attractive.

Assets & Equity: Growing steadily, though debt is also increasing.

Strength: Strong in micro/SME lending, wide customer base.

Risk: Economic slowdown, rising interest rates, and loan defaults (NPL).

Technical

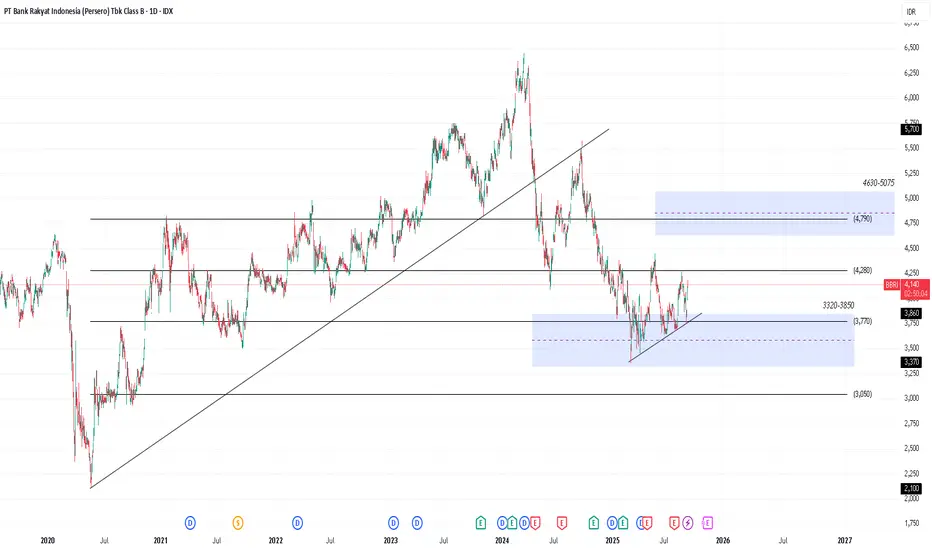

Support: IDR 3,740–3,900

Resistance: IDR 4,290–4,380

Trend: Short-term downtrend, but near oversold → possible rebound.

Current Action: Price is consolidating (sideways).

Outlook

For long-term investors: Good for dividend and growth exposure.

For short-term traders: Buy near support, sell near resistance.

Risks: Economy, regulation, and loan quality.

Price: ~IDR 4,140 per share.

Earnings: EPS ~376, showing good profit generation.

Dividend Yield: ~8.4%, quite attractive.

Assets & Equity: Growing steadily, though debt is also increasing.

Strength: Strong in micro/SME lending, wide customer base.

Risk: Economic slowdown, rising interest rates, and loan defaults (NPL).

Technical

Support: IDR 3,740–3,900

Resistance: IDR 4,290–4,380

Trend: Short-term downtrend, but near oversold → possible rebound.

Current Action: Price is consolidating (sideways).

Outlook

For long-term investors: Good for dividend and growth exposure.

For short-term traders: Buy near support, sell near resistance.

Risks: Economy, regulation, and loan quality.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.