The market continues to move within the framework of the main hypothesis — a potential completion of the correction from historical highs and the early signs of a possible trend reversal, as discussed in my recent market review:

https://www.tradingview.com/chart/BTCUSD/4FXGCnwn-BTC-and-ETH-key-levels-to-watch-in-coming-weeks/

As long as #BTC maintains weekly closes above 102K, the base scenario (both for #BTC and #ETH) remains unchanged — gradual recovery, consolidation, and a move toward new highs. I wouldn’t rule out the possibility that this could happen even before year-end.

However, a weekly close below 102K would signal an increased probability that the four-year macro growth cycle has ended and the market could be transitioning into a macro corrective phase across the crypto sphere.

Updated key levels and charts:

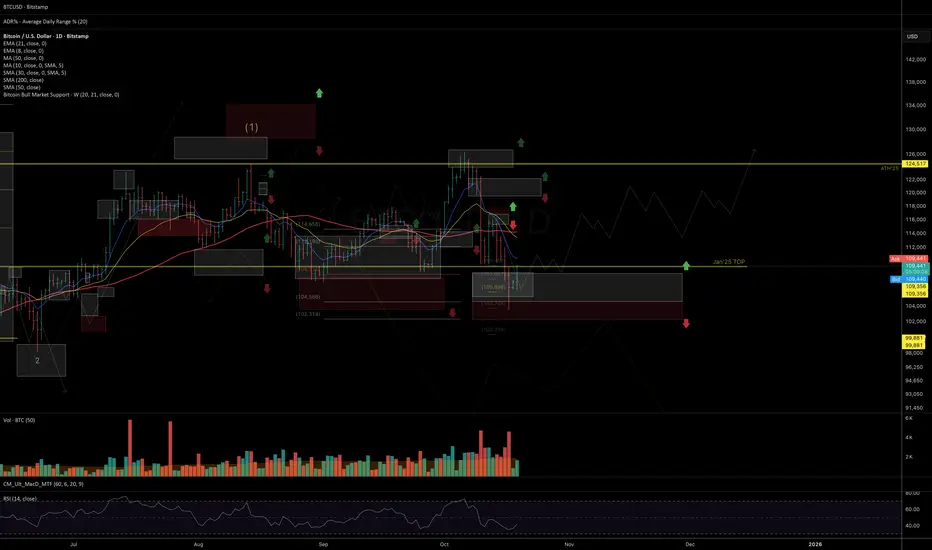

BTCUSD

BTCUSD

Support: 106K | Resistance: 110–112K

Chart:

ETHUSD

ETHUSD

Support: 3680 | Resistance: 4360

Chart:

Thank you for your attention, and I wish you a productive start to the week and successful trading decisions ahead!

https://www.tradingview.com/chart/BTCUSD/4FXGCnwn-BTC-and-ETH-key-levels-to-watch-in-coming-weeks/

As long as #BTC maintains weekly closes above 102K, the base scenario (both for #BTC and #ETH) remains unchanged — gradual recovery, consolidation, and a move toward new highs. I wouldn’t rule out the possibility that this could happen even before year-end.

However, a weekly close below 102K would signal an increased probability that the four-year macro growth cycle has ended and the market could be transitioning into a macro corrective phase across the crypto sphere.

Updated key levels and charts:

Support: 106K | Resistance: 110–112K

Chart:

Support: 3680 | Resistance: 4360

Chart:

Thank you for your attention, and I wish you a productive start to the week and successful trading decisions ahead!

Note

Hedging at current levels for existing medium- and long-term long positions looks like a reasonable decision under possible market turbulence. Risk reference zones can be considered around 112K and 114.5K.BTC — 1H chart (4H view):

To confirm momentum and ensure a confident continuation of the uptrend, it’s important to see a breakout and price consolidation above the 65 EMA on the hourly timeframe.

📊 Daily FREE Market Insights | Crypto + US Stocks

⚡ Technical analysis, setups & commentary

🌍 t.me/MarketArtistryENG | 🇷🇺 t.me/marketartistry

Join and let's grow together! 🚀

⚡ Technical analysis, setups & commentary

🌍 t.me/MarketArtistryENG | 🇷🇺 t.me/marketartistry

Join and let's grow together! 🚀

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

📊 Daily FREE Market Insights | Crypto + US Stocks

⚡ Technical analysis, setups & commentary

🌍 t.me/MarketArtistryENG | 🇷🇺 t.me/marketartistry

Join and let's grow together! 🚀

⚡ Technical analysis, setups & commentary

🌍 t.me/MarketArtistryENG | 🇷🇺 t.me/marketartistry

Join and let's grow together! 🚀

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.