BTC/USD – Intraday Scalping Setup

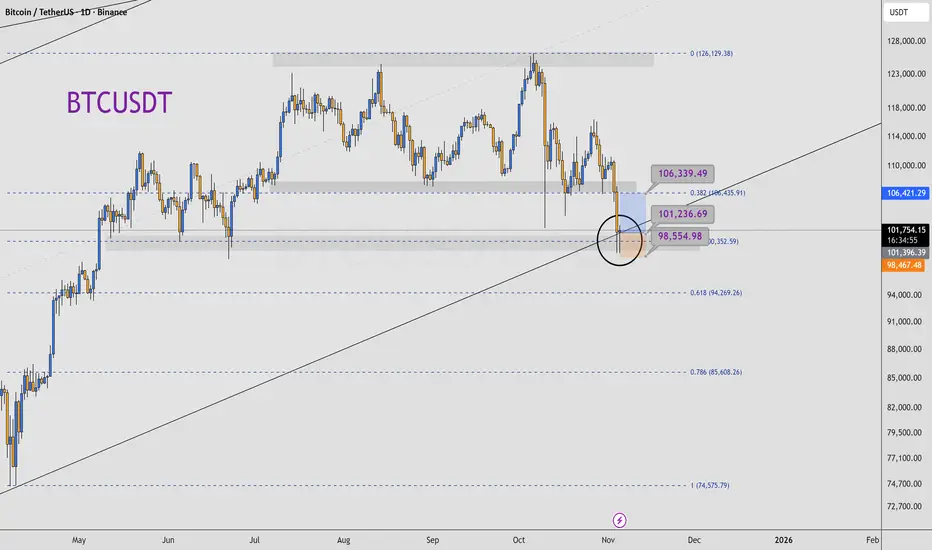

Bitcoin has respected the ascending trendline and the 0.5 Fibonacci retracement level, showing signs of holding short-term bullish structure.

After a sharp drop like the recent one, it’s common to see pullbacks or consolidation phases before the next major move.

For today, I’m looking for a scalping opportunity targeting the 105,000–106,000 area, which previously acted as a key support zone and could now serve as short-term resistance.

⚠️ This is a high-risk trade, as price remains in a corrective phase.

If BTC breaks below the trendline, we could easily see a move toward the 94,300 zone, where the next liquidity area lies.

Summary:

📈 Possible bullish scalping setup while above trendline

🎯 Target: 105,000–106,000

❌ Invalidation: Break below trendline

⚠️ Risk level: High – pullback scenario only

Bitcoin has respected the ascending trendline and the 0.5 Fibonacci retracement level, showing signs of holding short-term bullish structure.

After a sharp drop like the recent one, it’s common to see pullbacks or consolidation phases before the next major move.

For today, I’m looking for a scalping opportunity targeting the 105,000–106,000 area, which previously acted as a key support zone and could now serve as short-term resistance.

⚠️ This is a high-risk trade, as price remains in a corrective phase.

If BTC breaks below the trendline, we could easily see a move toward the 94,300 zone, where the next liquidity area lies.

Summary:

📈 Possible bullish scalping setup while above trendline

🎯 Target: 105,000–106,000

❌ Invalidation: Break below trendline

⚠️ Risk level: High – pullback scenario only

Trade active

On the way to TP, i'll take some profits and set BETrade closed: target reached

Finally, after some days we hit TP, remember patience pays off.Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.