Hey everyone — I’ve been digging into the recent developments at CleanSpark, and I think there’s a compelling risk/reward asymmetry here. Below is a breakdown of where things stand, what’s going right, what to watch out for, and why this could be more than a speculative play.

What’s Going Well

Milestones in Hashrate & Operational Scale

- CleanSpark recently hit 50 exahashes/sec (EH/s) of operational hashrate as of June 2025 — and crucially, this was done entirely through fully self-operated infrastructure - with plans for 60EH.

- The fleet efficiency is improving: ~16.15 J/Th in June, ~16–17 J/Th average recently.

- Power contracts and infrastructure are also scaling: over 1 gigawatt of contracted power across multiple states.

Bitcoin Treasury Accumulation

- The treasury is growing: ~12,827+ BTC

- Their strategy seems disciplined: they are selling some BTC strategically (when favorable price) to fund operations, but not raising money via dilution or by issuing more equity

Strong Revenue Growth & Improving Financials

- YoY revenue growth is very strong (60‑100%+ depending on period).

- Net income has had some quarters of losses, but margins (adjusted including BTC treasury effects) are showing promise.

- Valuation has analyst support: some target prices are significantly higher than current trading price.

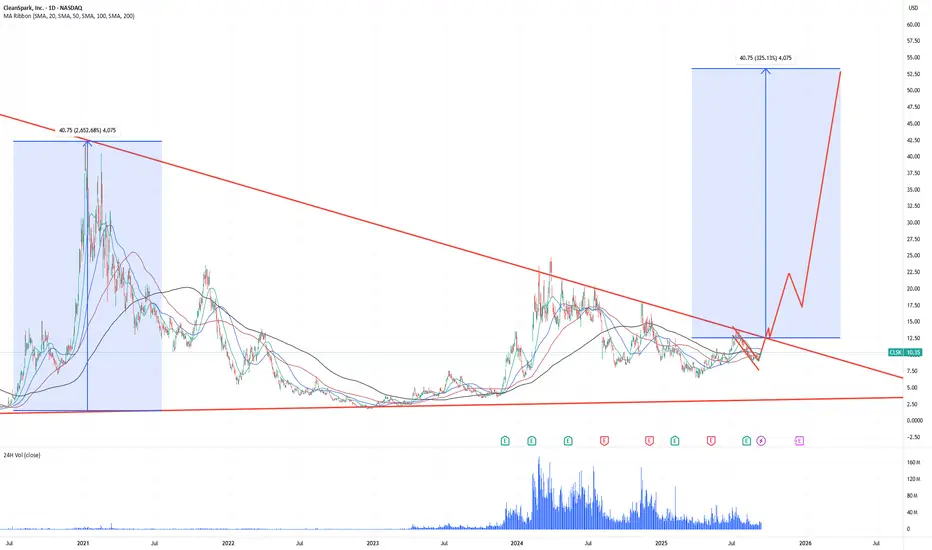

Positive Stock Price Momentum

- +11% weekly gain — strong price action, breaking out of recent consolidation.

- Bullish options flow — call volume surging, rising implied volatility.

- Closed above 200DMA — long-term trend reversal signal confirmed.

What to Watch / Risks

- Volatility & Exposure to BTC Price — The value of their BTC treasury moves with Bitcoin’s price, which means big swings. If BTC drops, that value drops.

- Energy Costs, Grid Issues, Regulatory Risk — Mining is energy‑intensive. Power under contract is great, but energy costs + reliability + regulation (e.g. carbon / environmental policies) remain risk factors.

Why the Upside Might Be Bigger Than the Downside ?

Here’s why I think the risk/reward looks attractive:

- With 50 EH/s already achieved self‑operated, efficiency improving, and BTC treasury increasing, there’s real asset backing. If BTC price rises, their treasury gives upside beyond just mining operations.

- The market seems to be acknowledging the potential: improved RS rating, analyst upgrades, and the 13% jump on news. That suggests that positive news can move the stock significantly.

- If they hit future targets (60 EH/s or more), keep power contracts tight, and maintain or improve cost of mining, CleanSpark may start delivering consistent profitability. That tends to attract institutional interest.

- Downside seems somewhat limited if current revenue growth continues and they avoid heavy dilution: even with modest BTC price or slight slowdown, the infrastructure, contracts, and treasury give a floor of value.

- Potential Expansion into AI and High-Performance Computing (HPC). - While CleanSpark has traditionally focused on Bitcoin mining, the company is exploring opportunities in AI and HPC. The global HPC market is projected to reach $49.3 billion by 2025, presenting a significant growth opportunity. CleanSpark's existing infrastructure and expertise in energy optimization position it well to leverage this market shift.

My View: Great Entry Opportunity

Given all that, I think CleanSpark is primed to outperform from here. If BTC moves higher or remains stable, CleanSpark should benefit on two fronts: mining revenue + appreciation in treasury holdings.

If I were investing now, I’d consider making a position here and holding for ~12 months, watching for:

- Next earnings report: does it show margin improvement / shrinking losses?

- BTC price trend: if it rises, CleanSpark benefits heavily.

- Any new power contracts / expansions, particularly in low‑cost / renewable/immersion‑cooled operations.

- Expansion into AI and High-Performance Computing (HPC) news.

- Any dilution risk (equity raises) or major cost pressures.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.