Opendoor Technology's ( OPEN) recent surge (20x of lows) caused me to wonder what the theme is. After all, rarely is a movement motivated by nothing.

OPEN) recent surge (20x of lows) caused me to wonder what the theme is. After all, rarely is a movement motivated by nothing.

I've determined the only logical conclusion is the correlation of Real Estate to interest rates.

Opendoor is a REIT disguised as a tech company and without the hefty dividend. While they offer tools for homeowners to exit / enter homes quickly, they really are just operating a fat inventory of housing. This is a difficult asset to manage at scale and of course is why they had a difficult 3.5 years after IPO AND the quickest increase of interest rates since the 1980s. This post isn't meant to talk trash on OPEN. I am very happy with what the asset did and may very well continue to do.

Compass, Inc. ( COMP) operates a set of tools to allow real estate agents a simpler buying / selling process for their clients. A very similar value proposition to OPEN, but without the heavy real estate inventory on the balance sheet. The lack of bloat on the balance sheet allows COMP to focus on their main customers intently. What this means is a decrease in interest rates will likely allow their base to do more business and frankly a significantly larger amount of business when compared to 2022-2024.

COMP) operates a set of tools to allow real estate agents a simpler buying / selling process for their clients. A very similar value proposition to OPEN, but without the heavy real estate inventory on the balance sheet. The lack of bloat on the balance sheet allows COMP to focus on their main customers intently. What this means is a decrease in interest rates will likely allow their base to do more business and frankly a significantly larger amount of business when compared to 2022-2024.

The current DD is simple.

* COMP price-to-sales of 0.7, i.e. they're market capitalization is 70% of their annual revenue. This means they are trading at a discount to their current business model and NO growth is priced in.

* Interest rates are coming down next week. The only question is if the Federal Reserve will lower rates by 0.25 of 0.5. If you think I'm just making this up, check out this link --> cmegroup.com/markets/interest-rates/cme-fedwatch-tool.html

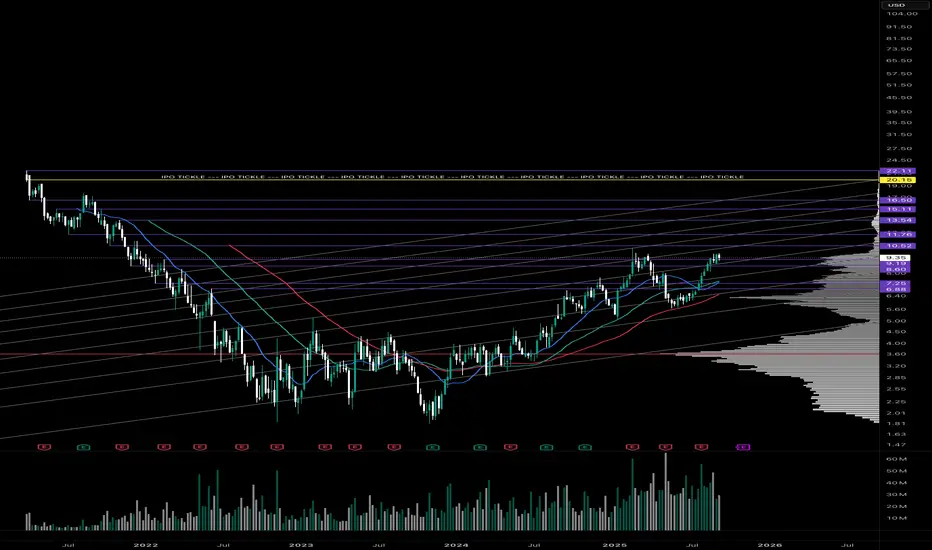

* The chart suggest Compass has completed a multi-year Cup and Handle pattern. The end of the handle is generally quite bullish. As well, the volume profile notates only a single node of transaction volume above at about ~$13.5. Outside of that level, it's wide open above without much price resistance.

My main price target for this trade is IPO value, which is around ~$18 aka 100% away.

I've determined the only logical conclusion is the correlation of Real Estate to interest rates.

Opendoor is a REIT disguised as a tech company and without the hefty dividend. While they offer tools for homeowners to exit / enter homes quickly, they really are just operating a fat inventory of housing. This is a difficult asset to manage at scale and of course is why they had a difficult 3.5 years after IPO AND the quickest increase of interest rates since the 1980s. This post isn't meant to talk trash on OPEN. I am very happy with what the asset did and may very well continue to do.

Compass, Inc. (

The current DD is simple.

* COMP price-to-sales of 0.7, i.e. they're market capitalization is 70% of their annual revenue. This means they are trading at a discount to their current business model and NO growth is priced in.

* Interest rates are coming down next week. The only question is if the Federal Reserve will lower rates by 0.25 of 0.5. If you think I'm just making this up, check out this link --> cmegroup.com/markets/interest-rates/cme-fedwatch-tool.html

* The chart suggest Compass has completed a multi-year Cup and Handle pattern. The end of the handle is generally quite bullish. As well, the volume profile notates only a single node of transaction volume above at about ~$13.5. Outside of that level, it's wide open above without much price resistance.

My main price target for this trade is IPO value, which is around ~$18 aka 100% away.

Trade closed manually

Purchasing a rival is apparently, not bullish.Closed the position.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.