🚩CPB | Long Setup | Defensive Staples Mean-Reversion off 52-Week Support | Sep 15, 2025

🔹 Thesis Summary

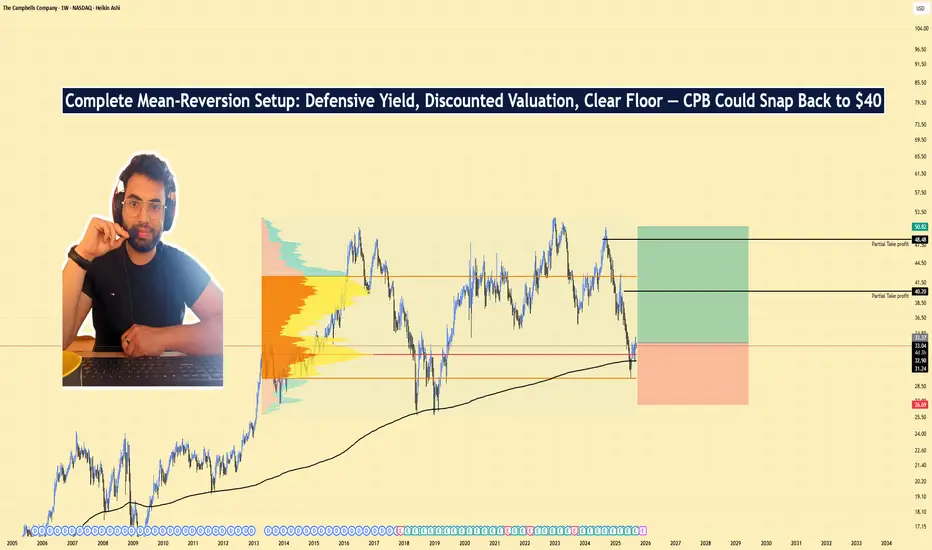

Campbell’s (CPB) is basing just above its 52-week low with a 4.7% dividend and a discounted forward multiple. A modest earnings reset appears priced in; a staples rotation plus cost discipline can drive mean-reversion toward mid-30s/upper-30s.

🔹 Trade Setup

Bias: Long

Entry Zone: $31.20–$32.10 (staggered bids toward the 52-week floor at $30.41)

Stop Loss: $26 (clear break of the 52-week floor)

Take-Profits:

TP1: $40

TP2: $50

Max Target: $50.00 (mean-reversion band)

🔹 Narrative & Context

Structure: Price has carved a multi-month base around $30–33 after a persistent 1Y drawdown. Defensive bid plus dividend support favors accumulation near the lower third of the 52-week range ($30.41–$51.56). Beta = 0.26, fitting a low-vol rotation backdrop.

🔹 Catalysts: Upcoming Q1 FY26 report early Dec; watch gross-margin commentary (inputs/tariffs), elasticity in Snacks/Meals, and Sovos integration run-rate.

Ownership: ~35% insider and ~65% institutional ownership underpins stability and alignment.

Dividend: 4.69% indicated yield provides carry while the base resolves.

🔹 Valuation & Context (Pro Metrics, Framed Simply)

Forward P/E = 12.45× vs peer set ~13–16× (GIS 12.99×, HRL 15.9×, KHC 9.7×, MDLZ 18.6×) → Slight discount to staples ex-value outliers → Market pricing in weak near-term EPS → Supports a mean-reversion long.

P/FCF = 13.9× → FCF Yield ≈ 7.2% (mid-pack vs GIS ~8.7%, KHC ~11.4%, MDLZ ~3.6%) → Solid cash coverage of dividend and reinvestment → Helps defend the base.

Growth: EPS This Y −15.5% (reset) vs Next Y +5.2% → Near-term trough dynamics with modest rebound potential → A small beat/guide raise could unlock multiple expansion.

Risk: Beta 0.26 and ESG risk score ~27 (medium) → Low market-beta but operational execution still matters → Suits a defensive sleeve.

🔹 Contrarian Angle (Your Edge)

Street sits at “Hold/Reduce” with ~mid-$34 targets. The market priced in the FY26 reset; however, a low-teens forward P/E, a 7% FCF yield, and base-building above $30 set a floor. If gross margins surprise on mix/sourcing, CPB can re-rate toward 14–15×, implying $38–$40 without heroic growth assumptions.

🔹 Risks (Balanced)

Further input-cost/tariff pressure compressing gross margin.

Volume share loss to private label/“better-for-you” categories.

Integration slippage on Sovos or incremental promo spend to defend shelf space.

🔹 Macro Considerations

Staples leadership typically improves during risk-off or rising-volatility regimes; monitor XLP/SPY relative strength.

Rates/inflation path drives grocery pricing power and promo cadence.

Track category scans (soup/snacks/sauces) for elasticity and private-label encroachment into FY26.

🔹 Bottom Line

CPB screens slightly cheap on forward earnings with durable cash flow and dividend carry. The $30–33 base offers a defined-risk entry for a mean-reversion long into year-end and early 2026. Execution on costs and stable volumes are the swing factors.

🔹 Forward Path

⚠️ Disclaimer: This is not financial advice. Always do your own research. Charts and visuals may include AI enhancements.

🔹 Footnote

Forward P/E: Price divided by expected earnings over the next 12 months. Lower = cheaper relative to profits.

P/FCF (Price-to-Free-Cash-Flow): Price vs. the cash left after investments. A measure of efficiency.

FCF Yield: Free cash flow per share ÷ price per share. Higher = more cash returned for each dollar invested.

ROE (Return on Equity): Net income ÷ shareholder equity. Shows management efficiency with investor capital.

ROIC (Return on Invested Capital): Net income ÷ all invested capital (equity + debt). A purer profitability gauge.

Debt/Equity: Debt divided by equity. <1 usually means balance sheet is conservative.

R:R (Risk-to-Reward): Ratio of expected upside vs. downside. 3:1 = you risk $1 to make $3.

🔹 Thesis Summary

Campbell’s (CPB) is basing just above its 52-week low with a 4.7% dividend and a discounted forward multiple. A modest earnings reset appears priced in; a staples rotation plus cost discipline can drive mean-reversion toward mid-30s/upper-30s.

🔹 Trade Setup

Bias: Long

Entry Zone: $31.20–$32.10 (staggered bids toward the 52-week floor at $30.41)

Stop Loss: $26 (clear break of the 52-week floor)

Take-Profits:

TP1: $40

TP2: $50

Max Target: $50.00 (mean-reversion band)

🔹 Narrative & Context

Structure: Price has carved a multi-month base around $30–33 after a persistent 1Y drawdown. Defensive bid plus dividend support favors accumulation near the lower third of the 52-week range ($30.41–$51.56). Beta = 0.26, fitting a low-vol rotation backdrop.

🔹 Catalysts: Upcoming Q1 FY26 report early Dec; watch gross-margin commentary (inputs/tariffs), elasticity in Snacks/Meals, and Sovos integration run-rate.

Ownership: ~35% insider and ~65% institutional ownership underpins stability and alignment.

Dividend: 4.69% indicated yield provides carry while the base resolves.

🔹 Valuation & Context (Pro Metrics, Framed Simply)

Forward P/E = 12.45× vs peer set ~13–16× (GIS 12.99×, HRL 15.9×, KHC 9.7×, MDLZ 18.6×) → Slight discount to staples ex-value outliers → Market pricing in weak near-term EPS → Supports a mean-reversion long.

P/FCF = 13.9× → FCF Yield ≈ 7.2% (mid-pack vs GIS ~8.7%, KHC ~11.4%, MDLZ ~3.6%) → Solid cash coverage of dividend and reinvestment → Helps defend the base.

Growth: EPS This Y −15.5% (reset) vs Next Y +5.2% → Near-term trough dynamics with modest rebound potential → A small beat/guide raise could unlock multiple expansion.

Risk: Beta 0.26 and ESG risk score ~27 (medium) → Low market-beta but operational execution still matters → Suits a defensive sleeve.

🔹 Contrarian Angle (Your Edge)

Street sits at “Hold/Reduce” with ~mid-$34 targets. The market priced in the FY26 reset; however, a low-teens forward P/E, a 7% FCF yield, and base-building above $30 set a floor. If gross margins surprise on mix/sourcing, CPB can re-rate toward 14–15×, implying $38–$40 without heroic growth assumptions.

🔹 Risks (Balanced)

Further input-cost/tariff pressure compressing gross margin.

Volume share loss to private label/“better-for-you” categories.

Integration slippage on Sovos or incremental promo spend to defend shelf space.

🔹 Macro Considerations

Staples leadership typically improves during risk-off or rising-volatility regimes; monitor XLP/SPY relative strength.

Rates/inflation path drives grocery pricing power and promo cadence.

Track category scans (soup/snacks/sauces) for elasticity and private-label encroachment into FY26.

🔹 Bottom Line

CPB screens slightly cheap on forward earnings with durable cash flow and dividend carry. The $30–33 base offers a defined-risk entry for a mean-reversion long into year-end and early 2026. Execution on costs and stable volumes are the swing factors.

🔹 Forward Path

If this post gains traction (10+ likes), I’ll publish:

A weekly-chart update with level-by-level triggers,

Post-earnings read-through on margins/mix, and

A peer-relative valuation refresh (GIS, KHC, HRL, MDLZ).

Like & Follow for structured ideas, not signals. I post high-conviction setups here before broader narratives play out.

⚠️ Disclaimer: This is not financial advice. Always do your own research. Charts and visuals may include AI enhancements.

🔹 Footnote

Forward P/E: Price divided by expected earnings over the next 12 months. Lower = cheaper relative to profits.

P/FCF (Price-to-Free-Cash-Flow): Price vs. the cash left after investments. A measure of efficiency.

FCF Yield: Free cash flow per share ÷ price per share. Higher = more cash returned for each dollar invested.

ROE (Return on Equity): Net income ÷ shareholder equity. Shows management efficiency with investor capital.

ROIC (Return on Invested Capital): Net income ÷ all invested capital (equity + debt). A purer profitability gauge.

Debt/Equity: Debt divided by equity. <1 usually means balance sheet is conservative.

R:R (Risk-to-Reward): Ratio of expected upside vs. downside. 3:1 = you risk $1 to make $3.

2 Ways I Help Serious Traders Win | Real Trades. Ruthless Edge.

1️⃣ Fix Your Trading Fast – My 4-step:

sentientinstitutes.com/

2️⃣ Get My Weekly Recap and Setup Drops here:

t.me/TradeSimple_with_Mo

P.S. Mentor MO❤️

1️⃣ Fix Your Trading Fast – My 4-step:

sentientinstitutes.com/

2️⃣ Get My Weekly Recap and Setup Drops here:

t.me/TradeSimple_with_Mo

P.S. Mentor MO❤️

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

2 Ways I Help Serious Traders Win | Real Trades. Ruthless Edge.

1️⃣ Fix Your Trading Fast – My 4-step:

sentientinstitutes.com/

2️⃣ Get My Weekly Recap and Setup Drops here:

t.me/TradeSimple_with_Mo

P.S. Mentor MO❤️

1️⃣ Fix Your Trading Fast – My 4-step:

sentientinstitutes.com/

2️⃣ Get My Weekly Recap and Setup Drops here:

t.me/TradeSimple_with_Mo

P.S. Mentor MO❤️

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.