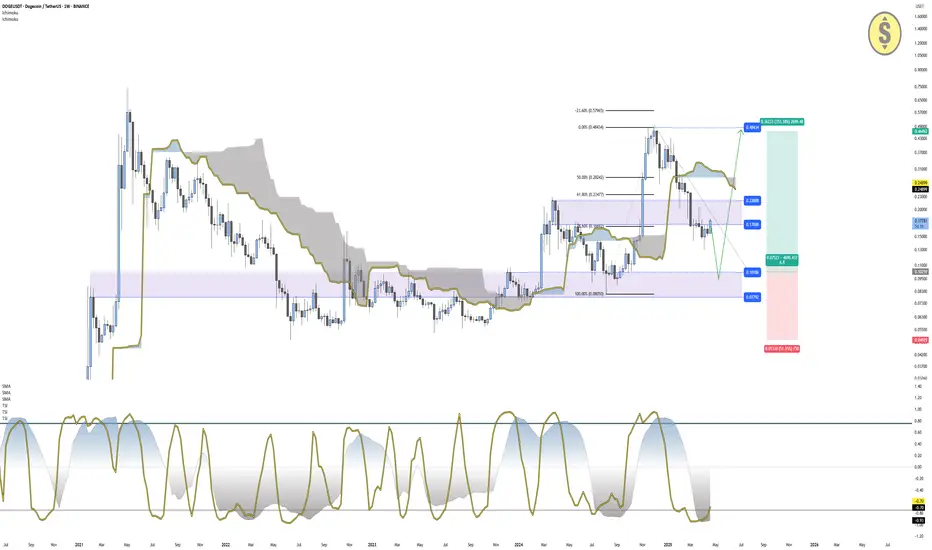

Dogecoin is currently trading around $0.178, after completing a significant retracement of more than 61.8% from the recent rally, suggesting a potential end-of-correction scenario. Price is currently below the Ichimoku cloud (Span A at $0.248, Span B at $0.282), reflecting a short-term bearish context, though longer-term structure remains potentially bullish.

The Trend Strength Index (TSI) indicators are both in oversold territory:

TSI(10): -0.91

TSI(20): -0.93

Historically, these levels on the TSI have often preceded strong reversals during uptrends or after deep corrections.

A break and close above $0.22 would confirm bullish continuation, suggesting that DOGE may be ready to target higher zones, particularly $0.48–0.57, aligning with the 0.0% and -23.6% Fibonacci extension levels.

However, if price fails to break above $0.22, the ideal long entry zone lies between $0.10 and $0.07, a historical high-volume support range, where previous accumulation occurred. A bullish reaction from this zone with renewed TSI momentum could provide one of the best risk-reward setups on this chart.

Trade Setup Summary:

Breakout Confirmation: Above $0.22

Buy Zone (if pullback deepens): $0.10 – $0.07

Targets: $0.48 – $0.57 (prior highs and extension)

Invalidation: Close below $0.07

TSI: Deeply oversold – signaling potential for trend reactivation

DOGE continues to trade as a sentiment-driven asset, often tied to broader crypto momentum and social/institutional interest. While lacking strong fundamentals compared to large-cap projects, it benefits from speculative cycles and has historically seen rapid price expansion after corrections. With Bitcoin stabilizing and broader altcoin interest returning, a technical breakout on DOGE could attract strong inflows, particularly above the $0.22 level.

Disclaimer: This content is for educational and informational purposes only. It does not represent financial advice or a recommendation to buy or sell any financial instrument. Trading involves risk, and you should only trade with money you can afford to lose.

The Trend Strength Index (TSI) indicators are both in oversold territory:

TSI(10): -0.91

TSI(20): -0.93

Historically, these levels on the TSI have often preceded strong reversals during uptrends or after deep corrections.

A break and close above $0.22 would confirm bullish continuation, suggesting that DOGE may be ready to target higher zones, particularly $0.48–0.57, aligning with the 0.0% and -23.6% Fibonacci extension levels.

However, if price fails to break above $0.22, the ideal long entry zone lies between $0.10 and $0.07, a historical high-volume support range, where previous accumulation occurred. A bullish reaction from this zone with renewed TSI momentum could provide one of the best risk-reward setups on this chart.

Trade Setup Summary:

Breakout Confirmation: Above $0.22

Buy Zone (if pullback deepens): $0.10 – $0.07

Targets: $0.48 – $0.57 (prior highs and extension)

Invalidation: Close below $0.07

TSI: Deeply oversold – signaling potential for trend reactivation

DOGE continues to trade as a sentiment-driven asset, often tied to broader crypto momentum and social/institutional interest. While lacking strong fundamentals compared to large-cap projects, it benefits from speculative cycles and has historically seen rapid price expansion after corrections. With Bitcoin stabilizing and broader altcoin interest returning, a technical breakout on DOGE could attract strong inflows, particularly above the $0.22 level.

Disclaimer: This content is for educational and informational purposes only. It does not represent financial advice or a recommendation to buy or sell any financial instrument. Trading involves risk, and you should only trade with money you can afford to lose.

Trade forex, indices, stocks and metals with up to US$100.000 in company's funding.

Complete a challenge to access funding or go for instant deposit.

Trading involves substantial risk. Not financial advice

Complete a challenge to access funding or go for instant deposit.

Trading involves substantial risk. Not financial advice

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Trade forex, indices, stocks and metals with up to US$100.000 in company's funding.

Complete a challenge to access funding or go for instant deposit.

Trading involves substantial risk. Not financial advice

Complete a challenge to access funding or go for instant deposit.

Trading involves substantial risk. Not financial advice

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.