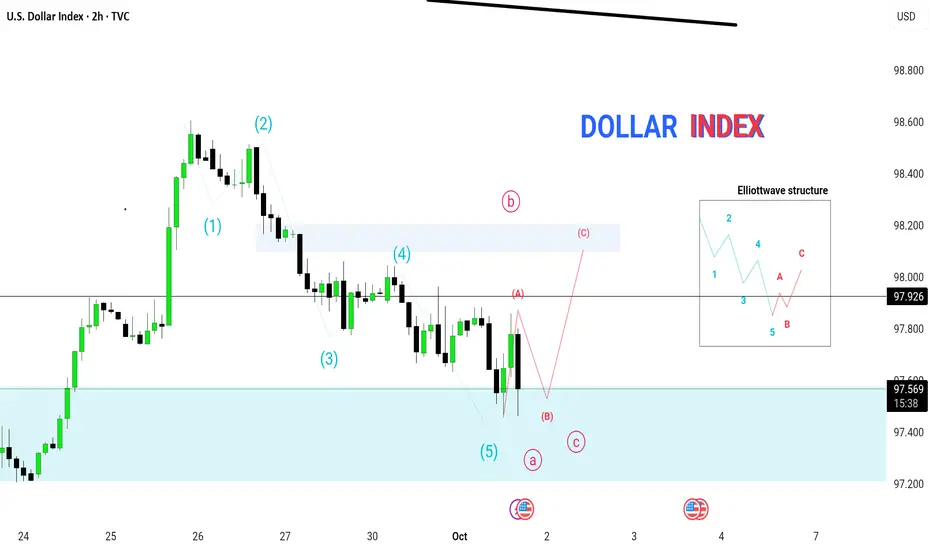

In this , we break down the U.S. Dollar Index (DXY) using Elliott Wave Theory. 📊

✅ 5-wave impulsive structure (1–5) has completed

✅ Market entering corrective phase (ABC)

✅ Key support: 97.40 – 97.20

✅ Resistance zone: 98.00

✅ Short-term bias: Possible corrective upside before continuation

This analysis is crucial for EUR/USD traders, as Dollar Index movement directly impacts Euro strength. Watch till the end to understand the upcoming correction and trading opportunities. 🚀

#ElliottWave #DollarIndex #ForexAnalysis #DXY #EURUSD

✅ 5-wave impulsive structure (1–5) has completed

✅ Market entering corrective phase (ABC)

✅ Key support: 97.40 – 97.20

✅ Resistance zone: 98.00

✅ Short-term bias: Possible corrective upside before continuation

This analysis is crucial for EUR/USD traders, as Dollar Index movement directly impacts Euro strength. Watch till the end to understand the upcoming correction and trading opportunities. 🚀

#ElliottWave #DollarIndex #ForexAnalysis #DXY #EURUSD

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.