Market context (quick read)

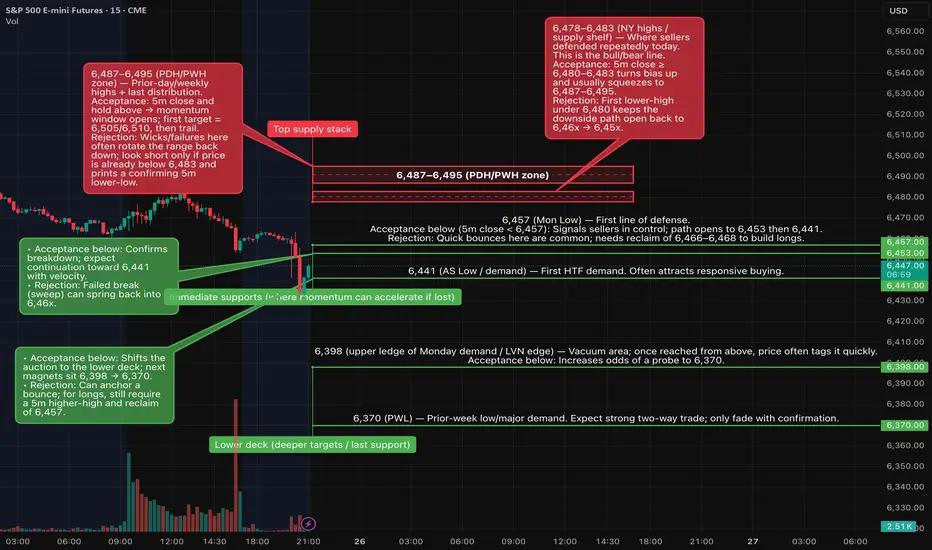

Price closed beneath the mid-range pivot (6,466–6,468) after repeated rejections from the 6,478–6,483 supply shelf. Immediate downside magnets are 6,457 → 6,453 → 6,441; deeper LVN/demand sits 6,398 → 6,370. Overhead, a squeeze can develop if we accept back above 6,48x toward 6,495 and the 6,50x handle.

Key levels (how to use them)

• 6,487–6,495 (PDH/PWH) – Last distribution. Acceptance above can extend to 6,505/6,510; rejection often rotates back to 6,48x.

• 6,478–6,483 (Supply shelf / bull-bear line) – Reclaiming/holding this band flips bias up; failure keeps pressure lower.

• 6,466–6,468 (Pivot shelf) – Doorway between upper/lower halves of the day’s composite.

• 6,457 (Monday’s low) – First support; loss opens 6,453 quickly.

• 6,453 (NYPM Low) – Breakdown confirmation level; below it, sellers typically press 6,441.

• 6,441 (AS Low / demand) – First HTF demand; acceptance below shifts auction to the lower deck.

• 6,398 → 6,370 (LVN / PWL) – Deeper targets if momentum expands.

Primary A++ setups (rule-based)

1. Acceptance Short (A++)

• Trigger: First 5m close < 6,452.

• Entry: 6,452 → 6,449 continuation.

• Initial SL: 6,460 (≤8 pts).

• TP1: 6,437 (+15) • TP2: 6,425 (+27) • TP3: 6,398 (+54).

• Management: If no extension within 2×5m bars, reduce/scratch; hard invalidate on 5m close > 6,457.

2. Acceptance Long (A++)

• Trigger: First 5m close ≥ 6,480–6,483.

• Entry: 6,480–6,483.

• Initial SL: 6,474 (6–9 pts; keep ≤8 if entering near 6,482).

• TP1: 6,495 (+12–15) • TP2: 6,505/6,510.

• Management: Invalidate on 5m close < 6,478 or no progress within 2×5m bars.

Fundamental “Risk Clock” — Tue, Aug 26 (ET)

• 08:30 — Advance Durable Goods Orders (July), U.S. Census Bureau. Official schedule lists Aug 26 at 8:30 a.m. ET.

• 09:00 — S&P CoreLogic Case-Shiller Home Price Index (June). SPDJI notes release 9:00 a.m. ET on the last Tuesday; FRED lists the next release date Aug 26, 2025.

• 09:00 — FHFA House Price Index (June + Q2 report). FHFA calendar confirms Aug 26 (Quarterly with monthly tables).

• 10:00 — Conference Board Consumer Confidence (Aug), next release Tue, Aug 26, 10:00 a.m. ET.

• 10:00 — Richmond Fed Manufacturing Index (Aug). Richmond Fed schedule shows Tue, Aug 26 (10:00 a.m. typical).

• 13:00 — U.S. Treasury 2-Year Note Auction. Official offering announcement sets auction date Aug 26, 2025; competitive close is typically 1:00 p.m. ET (non-comp 12:00 p.m. ET).

• Bills (same day) — Treasury “Upcoming Auctions” lists 17-Week and 4-Week bills for Aug 26.

This week’s broader context: Markets are watching NVIDIA and other tech/retail earnings plus Friday’s PCE inflation read; these can shift risk appetite around our levels.

⸻

Playbook integration (how the data can affect execution)

• Stronger durables / firmer confidence: If yields back up into the 2-year auction, equity indices often lean heavy—watch for rejection under 6,466–6,468 and a 5m break < 6,452 to trigger the short plan. (Scenario guidance, not a guarantee.)

• Softer durables / cooler housing prints: If risk appetite improves and we accept ≥ 6,480–6,483, use the long plan toward 6,495 → 6,505/6,510.

• Auction hour (12:50–13:10 ET): Expect a brief liquidity air-pocket; avoid fresh entries into the print and reassess after the first post-auction rotation. (Auction timing per Treasury norms above.)

Price closed beneath the mid-range pivot (6,466–6,468) after repeated rejections from the 6,478–6,483 supply shelf. Immediate downside magnets are 6,457 → 6,453 → 6,441; deeper LVN/demand sits 6,398 → 6,370. Overhead, a squeeze can develop if we accept back above 6,48x toward 6,495 and the 6,50x handle.

Key levels (how to use them)

• 6,487–6,495 (PDH/PWH) – Last distribution. Acceptance above can extend to 6,505/6,510; rejection often rotates back to 6,48x.

• 6,478–6,483 (Supply shelf / bull-bear line) – Reclaiming/holding this band flips bias up; failure keeps pressure lower.

• 6,466–6,468 (Pivot shelf) – Doorway between upper/lower halves of the day’s composite.

• 6,457 (Monday’s low) – First support; loss opens 6,453 quickly.

• 6,453 (NYPM Low) – Breakdown confirmation level; below it, sellers typically press 6,441.

• 6,441 (AS Low / demand) – First HTF demand; acceptance below shifts auction to the lower deck.

• 6,398 → 6,370 (LVN / PWL) – Deeper targets if momentum expands.

Primary A++ setups (rule-based)

1. Acceptance Short (A++)

• Trigger: First 5m close < 6,452.

• Entry: 6,452 → 6,449 continuation.

• Initial SL: 6,460 (≤8 pts).

• TP1: 6,437 (+15) • TP2: 6,425 (+27) • TP3: 6,398 (+54).

• Management: If no extension within 2×5m bars, reduce/scratch; hard invalidate on 5m close > 6,457.

2. Acceptance Long (A++)

• Trigger: First 5m close ≥ 6,480–6,483.

• Entry: 6,480–6,483.

• Initial SL: 6,474 (6–9 pts; keep ≤8 if entering near 6,482).

• TP1: 6,495 (+12–15) • TP2: 6,505/6,510.

• Management: Invalidate on 5m close < 6,478 or no progress within 2×5m bars.

Fundamental “Risk Clock” — Tue, Aug 26 (ET)

• 08:30 — Advance Durable Goods Orders (July), U.S. Census Bureau. Official schedule lists Aug 26 at 8:30 a.m. ET.

• 09:00 — S&P CoreLogic Case-Shiller Home Price Index (June). SPDJI notes release 9:00 a.m. ET on the last Tuesday; FRED lists the next release date Aug 26, 2025.

• 09:00 — FHFA House Price Index (June + Q2 report). FHFA calendar confirms Aug 26 (Quarterly with monthly tables).

• 10:00 — Conference Board Consumer Confidence (Aug), next release Tue, Aug 26, 10:00 a.m. ET.

• 10:00 — Richmond Fed Manufacturing Index (Aug). Richmond Fed schedule shows Tue, Aug 26 (10:00 a.m. typical).

• 13:00 — U.S. Treasury 2-Year Note Auction. Official offering announcement sets auction date Aug 26, 2025; competitive close is typically 1:00 p.m. ET (non-comp 12:00 p.m. ET).

• Bills (same day) — Treasury “Upcoming Auctions” lists 17-Week and 4-Week bills for Aug 26.

This week’s broader context: Markets are watching NVIDIA and other tech/retail earnings plus Friday’s PCE inflation read; these can shift risk appetite around our levels.

⸻

Playbook integration (how the data can affect execution)

• Stronger durables / firmer confidence: If yields back up into the 2-year auction, equity indices often lean heavy—watch for rejection under 6,466–6,468 and a 5m break < 6,452 to trigger the short plan. (Scenario guidance, not a guarantee.)

• Softer durables / cooler housing prints: If risk appetite improves and we accept ≥ 6,480–6,483, use the long plan toward 6,495 → 6,505/6,510.

• Auction hour (12:50–13:10 ET): Expect a brief liquidity air-pocket; avoid fresh entries into the print and reassess after the first post-auction rotation. (Auction timing per Treasury norms above.)

If you want to contact me Email: info@algoindex.com or algoindex.com

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

If you want to contact me Email: info@algoindex.com or algoindex.com

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.