HOW TO USE NFP RANGE STATS TO PREPARE YOUR PLAYBOOK

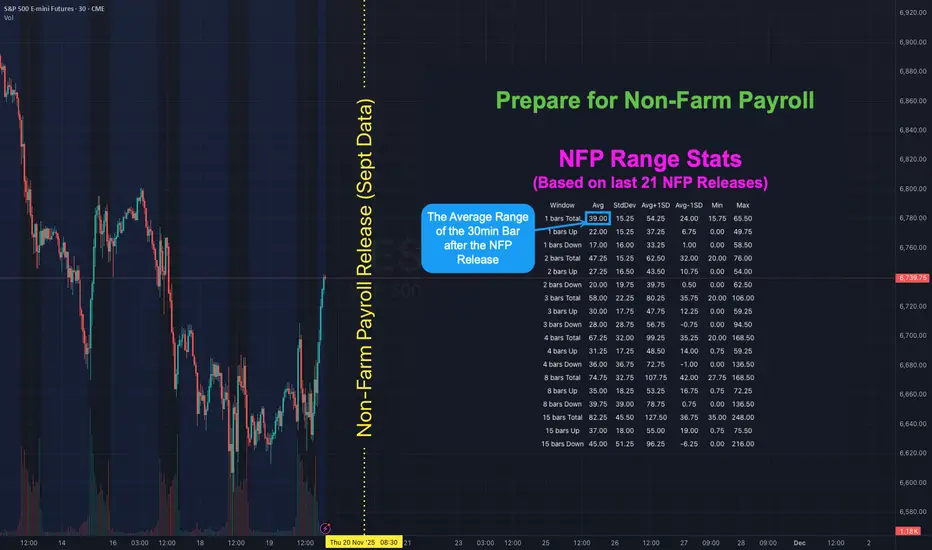

There has not been a Non-Farm Payroll release since Friday 5 September 2025. Due to the government shutdown the September report that was originally set for Friday 3 October was postponed. It will finally be released on Thursday 20 November - a 48 day delay. With uncertainty around the labour data higher than usual it helps to know what “normal” looks like for ES S&P Futures. The table shows historical ranges after the 08:30 ET release on a 30-minute chart: 1 bar (30mins), 2 bars (60mins) 3 bars (90mins), 4 bars (2hrs), 8 bars (4hrs) and 15 bars (up to ~16:00 ET). The stats are based on the last 21 NFP releases (approx 2-years).

👉 If you think this would be useful as a script you can run yourself let me know (boost and drop a comment) and if there's enough interest I'll see if I can publish something.

WHAT THE COLUMNS MEAN

WAYS TO USE IT

1) Set guardrails for price discovery

Use Avg + 1 StdDev as a first “stretch” expectation for the window you trade. If price pushes beyond that level early you know we are outside normal and can adapt position size and expectations.

2) Pre-plan targets and emergency exits

Before 08:30 ET map a base scenario. Example for ES: if the 30m Avg post-release is X then a first take-profit can sit near X and a stretch target near Avg + 1 StdDev. Place an emergency stop beyond the Avg - 1 StdDev line if fading the first move.

3) Size positions to volatility

Translate the Avg 30m range into ticks or points and size so that a typical NFP bar does not exceed your defined risk. If your stats say the first 30m averages 9 points on ES do not run a size that cannot survive a 9-12 point swing.

4) Choose a playbook by window

With the report 48 days late the probability of surprise is elevated. Go into the print with your ranges pre-mapped and your position sizing tied to those Avg and Avg ± StdDev bands. Clarity beats adrenaline.

👉 REMINDER:

If you think this would be useful as a script you can run yourself let me know (boost and drop a comment) and if there's enough interest I'll see if I can publish something.

There has not been a Non-Farm Payroll release since Friday 5 September 2025. Due to the government shutdown the September report that was originally set for Friday 3 October was postponed. It will finally be released on Thursday 20 November - a 48 day delay. With uncertainty around the labour data higher than usual it helps to know what “normal” looks like for ES S&P Futures. The table shows historical ranges after the 08:30 ET release on a 30-minute chart: 1 bar (30mins), 2 bars (60mins) 3 bars (90mins), 4 bars (2hrs), 8 bars (4hrs) and 15 bars (up to ~16:00 ET). The stats are based on the last 21 NFP releases (approx 2-years).

👉 If you think this would be useful as a script you can run yourself let me know (boost and drop a comment) and if there's enough interest I'll see if I can publish something.

WHAT THE COLUMNS MEAN

- Avg - the typical move for that window based on past NFPs

- StdDev - the variability around that average

- Avg + 1 StdDev and Avg - 1 StdDev - quick upper and lower guardrails for a “normal” day

- Min / Max - historical extremes in the sample

WAYS TO USE IT

1) Set guardrails for price discovery

Use Avg + 1 StdDev as a first “stretch” expectation for the window you trade. If price pushes beyond that level early you know we are outside normal and can adapt position size and expectations.

2) Pre-plan targets and emergency exits

Before 08:30 ET map a base scenario. Example for ES: if the 30m Avg post-release is X then a first take-profit can sit near X and a stretch target near Avg + 1 StdDev. Place an emergency stop beyond the Avg - 1 StdDev line if fading the first move.

3) Size positions to volatility

Translate the Avg 30m range into ticks or points and size so that a typical NFP bar does not exceed your defined risk. If your stats say the first 30m averages 9 points on ES do not run a size that cannot survive a 9-12 point swing.

4) Choose a playbook by window

- 1 bar (30m) - breakout or first-reaction mean-reversion

- 2-4 bars (60-120m) - continuation or reversal probabilities stabilise around the Avg envelope

- 8-15 bars - when the full session range is already at or beyond Avg + 1 StdDev be cautious chasing late moves

With the report 48 days late the probability of surprise is elevated. Go into the print with your ranges pre-mapped and your position sizing tied to those Avg and Avg ± StdDev bands. Clarity beats adrenaline.

👉 REMINDER:

If you think this would be useful as a script you can run yourself let me know (boost and drop a comment) and if there's enough interest I'll see if I can publish something.

Trader & Systems Architect

Co-founder of Rfactory & TSL

Board Member at the Society of Technical Analysts

Helping traders grow with mindset & tools

📈 Tools ➝ rfactory.io/tradingview

🎧 Podcast ➝ rfactory.io/blog/categories/podcast

Co-founder of Rfactory & TSL

Board Member at the Society of Technical Analysts

Helping traders grow with mindset & tools

📈 Tools ➝ rfactory.io/tradingview

🎧 Podcast ➝ rfactory.io/blog/categories/podcast

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Trader & Systems Architect

Co-founder of Rfactory & TSL

Board Member at the Society of Technical Analysts

Helping traders grow with mindset & tools

📈 Tools ➝ rfactory.io/tradingview

🎧 Podcast ➝ rfactory.io/blog/categories/podcast

Co-founder of Rfactory & TSL

Board Member at the Society of Technical Analysts

Helping traders grow with mindset & tools

📈 Tools ➝ rfactory.io/tradingview

🎧 Podcast ➝ rfactory.io/blog/categories/podcast

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.