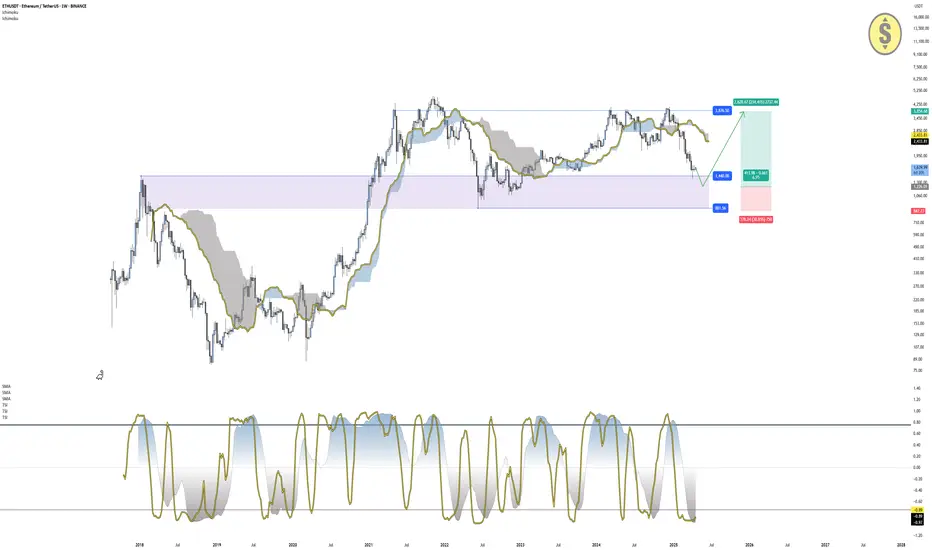

Ethereum is currently approaching a major support zone between $1,440 and $880, a level that acted as strong demand during previous market cycles. Price is currently below the Ichimoku cloud (Span A: $2,433 | Span B: $2,746), and the overall structure remains bearish unless price starts to break above recent swing highs.

Both Trend Strength Index (TSI) indicators are firmly in oversold territory:

TSI(10): -0.89

TSI(20): -0.97

This reflects deeply negative momentum, but historically, these levels have preceded strong reversals, especially when price enters high-timeframe support zones, like the one ETH is approaching now.

The $1,440–$880 range can be seen as a potential accumulation zone, and unless ETH breaks below $880, the bullish continuation setup remains valid. If price stabilizes here and begins reclaiming structure, especially above the $1,750–$1,950 levels, we could anticipate a move toward the $3,875 high or beyond.

Trade Setup Summary:

Accumulation Zone: $1,440 – $880

Invalidation: Break and close below $880

Bullish Trigger: Reclaim of recent swing highs

Target: $3,875 (major resistance)

Bias: Bullish while holding above $880

TSI: Deep oversold – conditions favorable for mid-term reversal

Ethereum fundamentals remain solid despite recent weakness. The upcoming upgrades to the Ethereum network (such as scalability and rollups) continue to support long-term utility, while institutional interest grows through ETH-based products and DeFi developments. Macroeconomic uncertainty, along with renewed ETF talks, could fuel a stronger recovery in the second half of the year. However, technicals must align with improving sentiment for this reversal setup to activate.

Disclaimer: This content is for educational and informational purposes only. It does not represent financial advice or a recommendation to buy or sell any financial instrument. Trading involves risk, and you should only trade with money you can afford to lose.

Both Trend Strength Index (TSI) indicators are firmly in oversold territory:

TSI(10): -0.89

TSI(20): -0.97

This reflects deeply negative momentum, but historically, these levels have preceded strong reversals, especially when price enters high-timeframe support zones, like the one ETH is approaching now.

The $1,440–$880 range can be seen as a potential accumulation zone, and unless ETH breaks below $880, the bullish continuation setup remains valid. If price stabilizes here and begins reclaiming structure, especially above the $1,750–$1,950 levels, we could anticipate a move toward the $3,875 high or beyond.

Trade Setup Summary:

Accumulation Zone: $1,440 – $880

Invalidation: Break and close below $880

Bullish Trigger: Reclaim of recent swing highs

Target: $3,875 (major resistance)

Bias: Bullish while holding above $880

TSI: Deep oversold – conditions favorable for mid-term reversal

Ethereum fundamentals remain solid despite recent weakness. The upcoming upgrades to the Ethereum network (such as scalability and rollups) continue to support long-term utility, while institutional interest grows through ETH-based products and DeFi developments. Macroeconomic uncertainty, along with renewed ETF talks, could fuel a stronger recovery in the second half of the year. However, technicals must align with improving sentiment for this reversal setup to activate.

Disclaimer: This content is for educational and informational purposes only. It does not represent financial advice or a recommendation to buy or sell any financial instrument. Trading involves risk, and you should only trade with money you can afford to lose.

Trade forex, indices, stocks and metals with up to US$100.000 in company's funding.

Complete a challenge to access funding or go for instant deposit.

Trading involves substantial risk. Not financial advice

Complete a challenge to access funding or go for instant deposit.

Trading involves substantial risk. Not financial advice

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Trade forex, indices, stocks and metals with up to US$100.000 in company's funding.

Complete a challenge to access funding or go for instant deposit.

Trading involves substantial risk. Not financial advice

Complete a challenge to access funding or go for instant deposit.

Trading involves substantial risk. Not financial advice

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.