I’m still an Elliott Wave noob, so the drawing on my chart is purely theoretical. It’s based on personal speculation — not financial advice.

Right now, I’m working under the assumption that we’re either in a corrective Wave A heading down, or in Wave 2 of a larger structure on a higher timeframe.

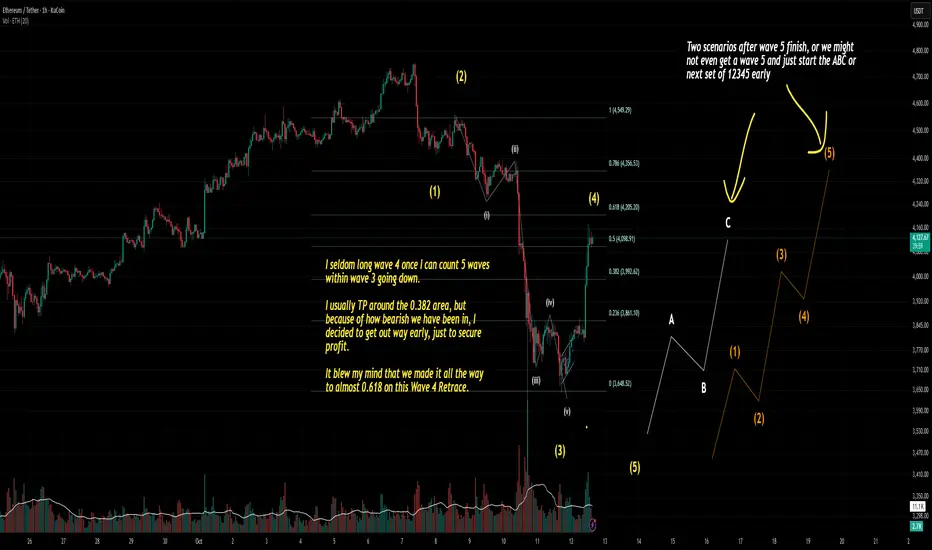

Last night, I counted five waves down within Wave 3 and started to notice signs of support. So instead of riding it out for a retrace back to the usual 0.382 Fib, I decided to long Wave 4 early and took profit once it hit an amount I was comfortable with.

Given how sharp the recent drop was, I was worried this might be one of those weak sub-Wave 4 retracements. I honestly doubted we’d even make it to 0.382, and even if we did, I expected it to take another 12–24 hours.

This morning, ETH shot up another $200 to $4000 right after I TP’d. I won’t lie — I definitely felt some ROMO (regret of missing out). An hour later, I checked again and saw it nearly tagged the 0.618 Fib. I was shocked at how fast it recovered.

But I reminded myself: don’t FOMO in and end up stuck in a long while Wave 5 is setting up to go down. I’ve learned that less profit is better than no profit. So I’m sticking to my plan and moving on.

My outlook from here:

I’m expecting Wave 5 to start between now and the London session open. Then, during the U.S. session, we might see another impulsive 1-2-3-4-5 leg up or begin corrective Wave B (if we really are in corrective Wave A down).

Good luck, everyone. Stay disciplined and trade your plan.

Right now, I’m working under the assumption that we’re either in a corrective Wave A heading down, or in Wave 2 of a larger structure on a higher timeframe.

Last night, I counted five waves down within Wave 3 and started to notice signs of support. So instead of riding it out for a retrace back to the usual 0.382 Fib, I decided to long Wave 4 early and took profit once it hit an amount I was comfortable with.

Given how sharp the recent drop was, I was worried this might be one of those weak sub-Wave 4 retracements. I honestly doubted we’d even make it to 0.382, and even if we did, I expected it to take another 12–24 hours.

This morning, ETH shot up another $200 to $4000 right after I TP’d. I won’t lie — I definitely felt some ROMO (regret of missing out). An hour later, I checked again and saw it nearly tagged the 0.618 Fib. I was shocked at how fast it recovered.

But I reminded myself: don’t FOMO in and end up stuck in a long while Wave 5 is setting up to go down. I’ve learned that less profit is better than no profit. So I’m sticking to my plan and moving on.

My outlook from here:

I’m expecting Wave 5 to start between now and the London session open. Then, during the U.S. session, we might see another impulsive 1-2-3-4-5 leg up or begin corrective Wave B (if we really are in corrective Wave A down).

Good luck, everyone. Stay disciplined and trade your plan.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.