We will discussing many strategies based on market psychology- our strategies are not buy and sell indications or mechanical methods as crossover etc . Are strategies are based on discovered market behaviors that we seen price do enough times to take notary. It’s these lil things that we’ll be presenting in our book that help our readers make better trading decisions as the most complex part of trading for traders is entries.

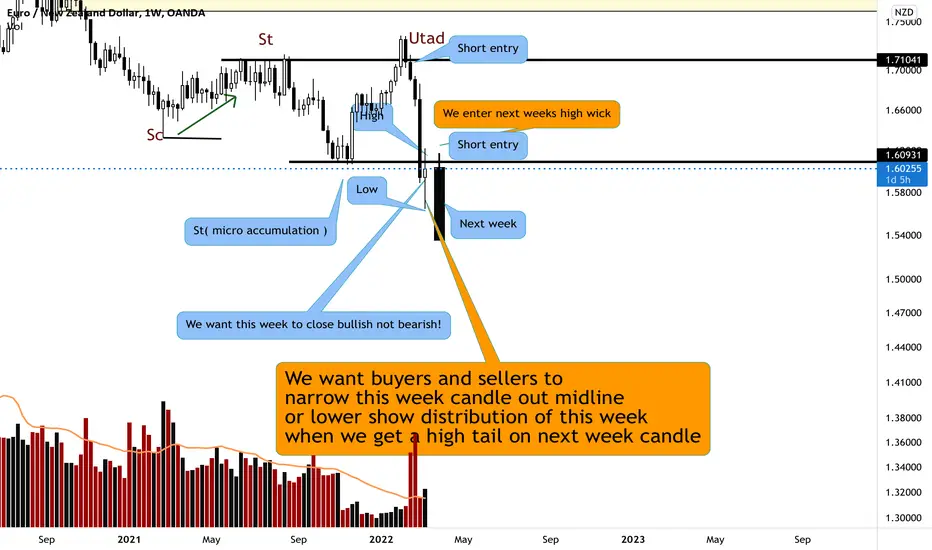

So let’s look at this chart here and let’s drop some nuggets

Nuggets

1. When u have a seller climatic (sc) and price run to it high and don’t retest the sc - this is a sign of buyers

2. If the buyers here failed to maintain above the sc after it ran its high and price drops to or below the sc - this is a give up bar(s)

3. Any move up to the resistance of the sc in this case is a (st) secondary test. Here the buyers failed (2.)

This failure took price to the low below the sc!

4. Price will retest this failure at the st in this case .Why? Remember after any strong aggressive move that fails price WILL retest that area of previous dominance! So here the move up to make an st was aggressive we see this by the multiple days at the high. Then it failed and accumulation at the low from the st

5.after these types of movements the failure at the high the drop to the low and the accumulation there to the retest of the st. You can expect a break of the st. Meaning expect price to go above the resistance to grab the liquidity of the sellers that stopped the st from breaking the resistance!

6. It’s here at number 5 where we get the signal to trade. Remember from previous lessons. You must have 3 reasons to trade 1. Signal bars 2. Entry bar 3. Confirmation bars. The rejection above the st is a Utad soon as price dropped into the st cluster that’s was the short signal !

Understand labels mean nothing we don’t want you to focus on labels how they work or what they mean all this is irrelevant! What you need to do ONLY and I repeat ONLY .. the only thing you need to do is and this is one of those best trading advices anyone can give is understand when the market flavors buyers or sellers within any trend or correction. As the participants gauge market strengths vs weakness within any direction. So what we just explained we gauges the strengths and weakness and called buyers failure to break above their aggressive move up to the sc. remember the move up was aggressive because price didn’t retest the sc! Now if price wasn’t so aggressively push pass the sc we would need more indications to short here but a fail break above a previous aggressive more high is a signal to short bar!

Now this is the psychology now we keep these mentioning as we apply the strategy

The strategy

Our strategies are based off of feeding of manipulation!

We use the weekly chart for this. It’s the best chart for trading and with lil practice you can easily master it and be able to see what the 15min is doing on it.

Now so far we see price broken the low! And then retraced back n broke above the support at the micro accumulation area.

Now typical retail traders see this as a retest and in the lower time frames the market is selling down currently after this retest and many traders will enter short here hoping for a bearish continuation. But by looking at the weekly chart we see the buyers wicked the low (weekly low tail) so they are present as we seen their aggressions as mentioned above we don’t completely forget above these because signs of repeat strengths within a area or signs that buyers are taking back the market we need to keep mental track so we can see early signals of strengths and be a buyer while the others are sellers ! Cus the don’t know how to record keep market strengths ( or never taught)

So the strategies finally!

Since it’s Thursday with one day left of the week and fri the most volatile day. We don’t take this sell signal on the daily and lower! We let the week play out . As if the market continues to drop on fri after being within a narrow range all week the probability increase that the move will be a burn out move which buyers will take advantage.

What we want to see is the buyers failure to break back above the accumulation! Give them Friday to do so as the weekly outlook will tell us so. This will be as a narrow bull bar. As the mark manipulation retail traders to short only to hit their Sl. And then we can short next weeks weekly high tail as the buyers failure and exhausted themselves last week as the market manipulated the high and low. Giving the sellers a fresh week to sell down buy adding theirs orders within this narrow weekly range. Remember narrow ranges ultimately means order placement! Massive orders are placed with a market SLOWS DOWN.!!! thus a narrow candle this week and then a high tell next week is a good confirmation that sellers won

Redefine the move-

Sine we have a break low support and a immediately move back - this shows the market is manipulating buyers and sellers by the narrow weekly candle we have thus far! If the bears drive price aggressively lower on fri this increases the probabilities of an exhausted move lower! But to short the market we need to see the buyers! Get exhausted this can only be done by the seller stopping the buyers from breaking above the re accumulation zone here the weekly failure to do so will show that the market manipulation sellers who took the short signal rn but the buyers brought the market up as the fought to go higher but ultimately failing at the weekly close. In which next week we can short the next move down

This strategy plays out all the time. why? Cuz the markets greatest accomplishment is to convince traders to do the opposite. Traders are trend traders - the markets goals is to fake out as many early traders as possible cus we are not taught how to look within the background to see weakness or strengths. So ex a market can be in a downtrend and a pullback comes and traders take the short entry on the pullback betting a continuation but there are more signs of strengths then weakness. The market knows most traders are retest traders . So here we see the break below support but a immediate pullback to the support- this per say isn’t a retest! For a retest price must drift away from the area as we see from the st to the micro accumulation- price drifted away! So a move up afterward is a retest. What we have here is a fake break below the accumulation thus we give the buyers the rest of the week remember since it’s one day left to go high as Friday is the most volatile day and the market can be manipulated sellers to enter today only for their sl to get ran on fri! With the market ultimately dropping lower if the market drops Friday it’ll overextend sellers increasing a buy up next week. So we want to be sellers right now cus the trend hadn’t be changed but also we see buyers strengths so we need to see buyers get exhausted not seller !!

Re read this post and understand what is being presented as these nuggets are rare indeed and it took us years to understand many of these phenomenons we will present.. look at the graph for visual aid

So let’s look at this chart here and let’s drop some nuggets

Nuggets

1. When u have a seller climatic (sc) and price run to it high and don’t retest the sc - this is a sign of buyers

2. If the buyers here failed to maintain above the sc after it ran its high and price drops to or below the sc - this is a give up bar(s)

3. Any move up to the resistance of the sc in this case is a (st) secondary test. Here the buyers failed (2.)

This failure took price to the low below the sc!

4. Price will retest this failure at the st in this case .Why? Remember after any strong aggressive move that fails price WILL retest that area of previous dominance! So here the move up to make an st was aggressive we see this by the multiple days at the high. Then it failed and accumulation at the low from the st

5.after these types of movements the failure at the high the drop to the low and the accumulation there to the retest of the st. You can expect a break of the st. Meaning expect price to go above the resistance to grab the liquidity of the sellers that stopped the st from breaking the resistance!

6. It’s here at number 5 where we get the signal to trade. Remember from previous lessons. You must have 3 reasons to trade 1. Signal bars 2. Entry bar 3. Confirmation bars. The rejection above the st is a Utad soon as price dropped into the st cluster that’s was the short signal !

Understand labels mean nothing we don’t want you to focus on labels how they work or what they mean all this is irrelevant! What you need to do ONLY and I repeat ONLY .. the only thing you need to do is and this is one of those best trading advices anyone can give is understand when the market flavors buyers or sellers within any trend or correction. As the participants gauge market strengths vs weakness within any direction. So what we just explained we gauges the strengths and weakness and called buyers failure to break above their aggressive move up to the sc. remember the move up was aggressive because price didn’t retest the sc! Now if price wasn’t so aggressively push pass the sc we would need more indications to short here but a fail break above a previous aggressive more high is a signal to short bar!

Now this is the psychology now we keep these mentioning as we apply the strategy

The strategy

Our strategies are based off of feeding of manipulation!

We use the weekly chart for this. It’s the best chart for trading and with lil practice you can easily master it and be able to see what the 15min is doing on it.

Now so far we see price broken the low! And then retraced back n broke above the support at the micro accumulation area.

Now typical retail traders see this as a retest and in the lower time frames the market is selling down currently after this retest and many traders will enter short here hoping for a bearish continuation. But by looking at the weekly chart we see the buyers wicked the low (weekly low tail) so they are present as we seen their aggressions as mentioned above we don’t completely forget above these because signs of repeat strengths within a area or signs that buyers are taking back the market we need to keep mental track so we can see early signals of strengths and be a buyer while the others are sellers ! Cus the don’t know how to record keep market strengths ( or never taught)

So the strategies finally!

Since it’s Thursday with one day left of the week and fri the most volatile day. We don’t take this sell signal on the daily and lower! We let the week play out . As if the market continues to drop on fri after being within a narrow range all week the probability increase that the move will be a burn out move which buyers will take advantage.

What we want to see is the buyers failure to break back above the accumulation! Give them Friday to do so as the weekly outlook will tell us so. This will be as a narrow bull bar. As the mark manipulation retail traders to short only to hit their Sl. And then we can short next weeks weekly high tail as the buyers failure and exhausted themselves last week as the market manipulated the high and low. Giving the sellers a fresh week to sell down buy adding theirs orders within this narrow weekly range. Remember narrow ranges ultimately means order placement! Massive orders are placed with a market SLOWS DOWN.!!! thus a narrow candle this week and then a high tell next week is a good confirmation that sellers won

Redefine the move-

Sine we have a break low support and a immediately move back - this shows the market is manipulating buyers and sellers by the narrow weekly candle we have thus far! If the bears drive price aggressively lower on fri this increases the probabilities of an exhausted move lower! But to short the market we need to see the buyers! Get exhausted this can only be done by the seller stopping the buyers from breaking above the re accumulation zone here the weekly failure to do so will show that the market manipulation sellers who took the short signal rn but the buyers brought the market up as the fought to go higher but ultimately failing at the weekly close. In which next week we can short the next move down

This strategy plays out all the time. why? Cuz the markets greatest accomplishment is to convince traders to do the opposite. Traders are trend traders - the markets goals is to fake out as many early traders as possible cus we are not taught how to look within the background to see weakness or strengths. So ex a market can be in a downtrend and a pullback comes and traders take the short entry on the pullback betting a continuation but there are more signs of strengths then weakness. The market knows most traders are retest traders . So here we see the break below support but a immediate pullback to the support- this per say isn’t a retest! For a retest price must drift away from the area as we see from the st to the micro accumulation- price drifted away! So a move up afterward is a retest. What we have here is a fake break below the accumulation thus we give the buyers the rest of the week remember since it’s one day left to go high as Friday is the most volatile day and the market can be manipulated sellers to enter today only for their sl to get ran on fri! With the market ultimately dropping lower if the market drops Friday it’ll overextend sellers increasing a buy up next week. So we want to be sellers right now cus the trend hadn’t be changed but also we see buyers strengths so we need to see buyers get exhausted not seller !!

Re read this post and understand what is being presented as these nuggets are rare indeed and it took us years to understand many of these phenomenons we will present.. look at the graph for visual aid

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.