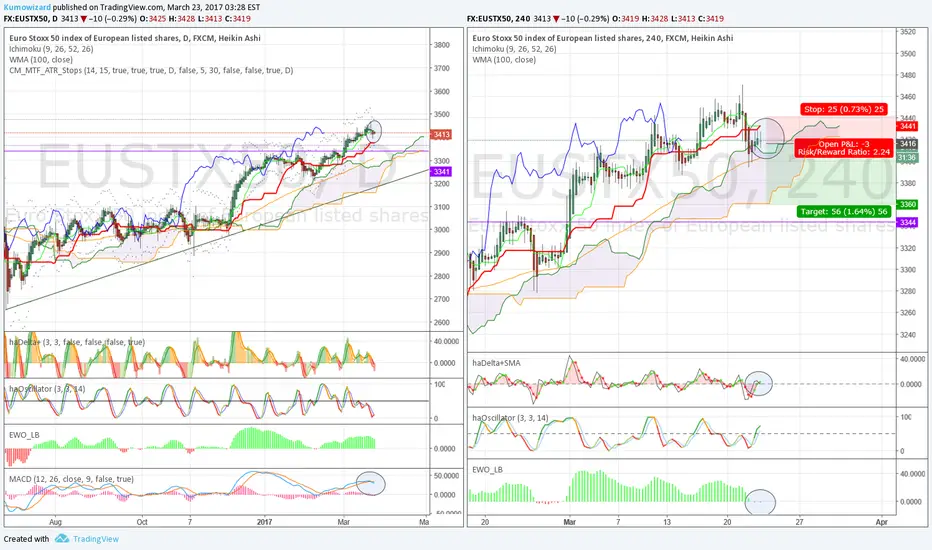

No doubt, the major strategic trend is bullish. However there are multiple signs for a local top, and possibility for more pull back towards daily support zone at 3344-3370:

- Daily Heikin-Ashi shows some weakness

- Daily MACD crossed down: sign of consolidation

- 4H weak bearish Tenkan/Kijun cross, within a neutral Ichimoku setup.

- 4H Heikin-Ashi weakness. Heikin-Ashi may give a sell signal below Kijun Sen.

- 4H EWO shows absolute loss of short temr bullish momentum.

Short term key support is 3400+.

I enterred half unit Short at 3416 with Stop at 3341, TP target at 3360. RR is 2,2.

- Daily Heikin-Ashi shows some weakness

- Daily MACD crossed down: sign of consolidation

- 4H weak bearish Tenkan/Kijun cross, within a neutral Ichimoku setup.

- 4H Heikin-Ashi weakness. Heikin-Ashi may give a sell signal below Kijun Sen.

- 4H EWO shows absolute loss of short temr bullish momentum.

Short term key support is 3400+.

I enterred half unit Short at 3416 with Stop at 3341, TP target at 3360. RR is 2,2.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.