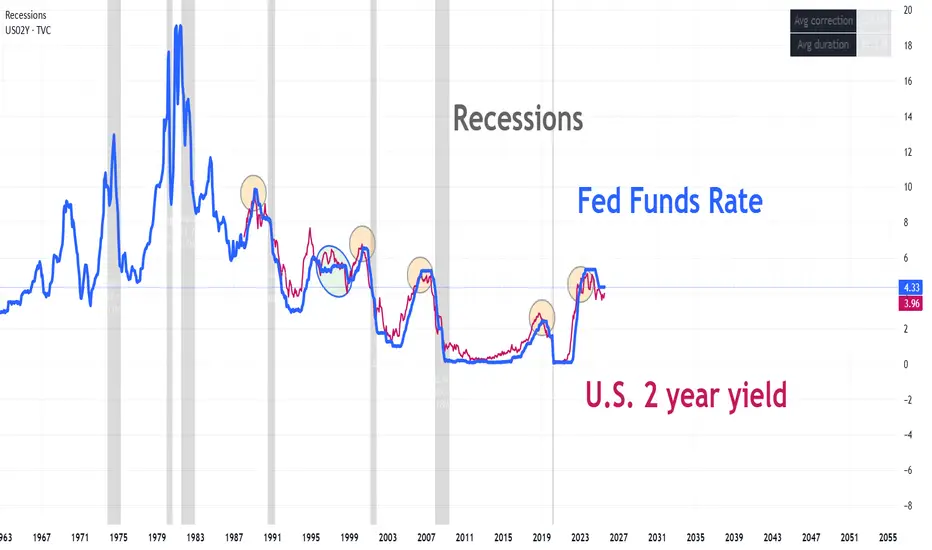

On August 4, we published a report analyzing the relationship between the 2-year yield and the Fed rate. At first glance, it looks like a technical oscillator, except in this case it represents market expectations for the 2-year rate. It embeds the expected real rate, expected inflation, and the term premium. Every time it gave a short signal, a recession followed shortly after. It generated one false signal and correctly anticipated the last four recessions. Two weeks after the report, Jackson Hole brought the pseudo-confirmation of the rate cut.

@intermarketflow

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

@intermarketflow

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.