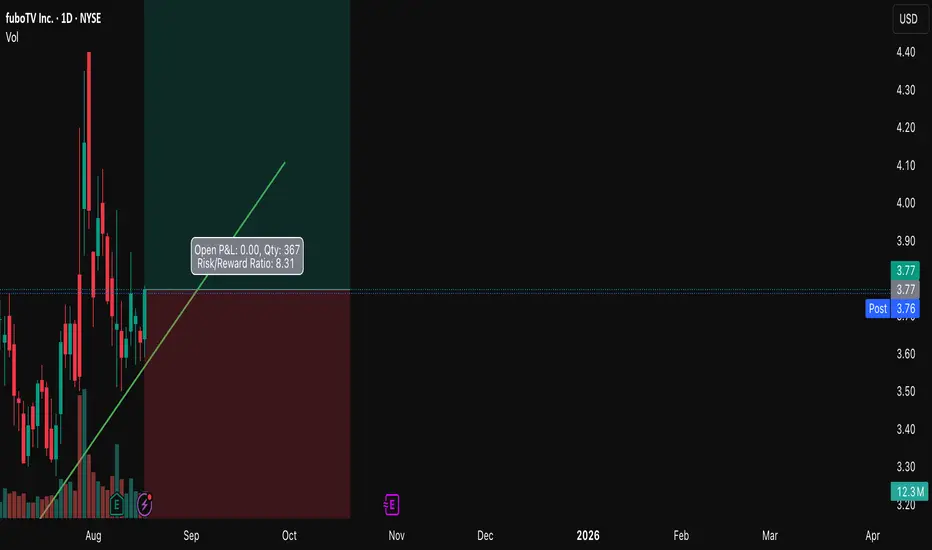

Ticker: FuboTV (NYSE: FUBO)

Timeframe: 1D

⸻

🟢 Bullish Scenario — “Respect the Channel”

• Trigger: Hold and bounce from channel support (~$3.70–$3.80).

• Entry Idea: Long near support zone.

• Stop Loss: Below $3.40 (invalidate channel).

• Targets:

• TP1 = $4.50

• TP2 = $5.20 (channel resistance)

• Breakout above $5.20 opens path toward $6.00+

⸻

🔴 Bearish Scenario — “Break & Dump”

• Trigger: Daily close below $3.40.

• Entry Idea: Short on breakdown, or wait for retest rejection.

• Stop Loss: Above $3.75 (back inside channel).

• Targets:

• TP1 = $3.00

• TP2 = $2.50 (demand zone)

• If demand fails, next leg could revisit $2.00

⸻

⚖️ Summary

FUBO is at a make-or-break spot:

• Hold channel = long opportunity toward $5+

• Lose $3.40 = bearish breakdown back into the $2.50 demand box

This is a clear risk/reward setup — tight invalidation, big potential upside.

Timeframe: 1D

⸻

🟢 Bullish Scenario — “Respect the Channel”

• Trigger: Hold and bounce from channel support (~$3.70–$3.80).

• Entry Idea: Long near support zone.

• Stop Loss: Below $3.40 (invalidate channel).

• Targets:

• TP1 = $4.50

• TP2 = $5.20 (channel resistance)

• Breakout above $5.20 opens path toward $6.00+

⸻

🔴 Bearish Scenario — “Break & Dump”

• Trigger: Daily close below $3.40.

• Entry Idea: Short on breakdown, or wait for retest rejection.

• Stop Loss: Above $3.75 (back inside channel).

• Targets:

• TP1 = $3.00

• TP2 = $2.50 (demand zone)

• If demand fails, next leg could revisit $2.00

⸻

⚖️ Summary

FUBO is at a make-or-break spot:

• Hold channel = long opportunity toward $5+

• Lose $3.40 = bearish breakdown back into the $2.50 demand box

This is a clear risk/reward setup — tight invalidation, big potential upside.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.