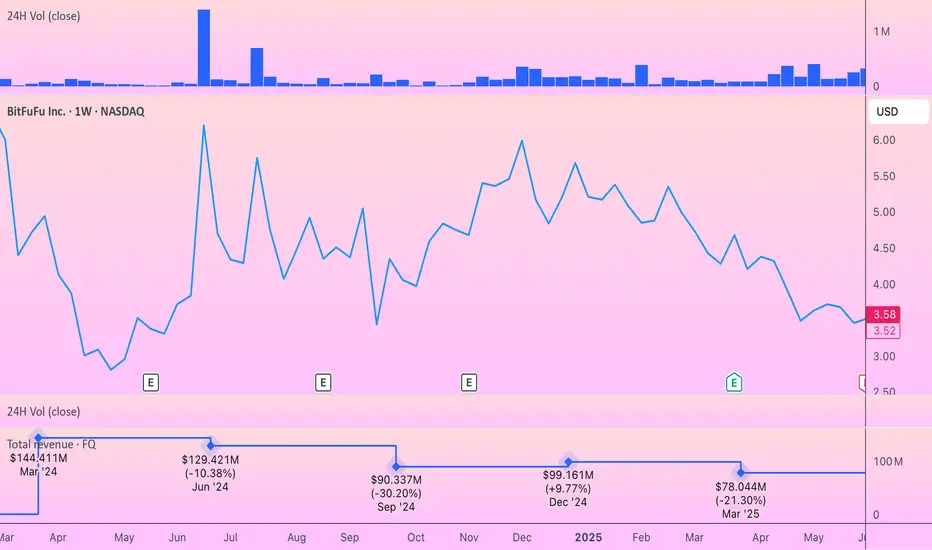

BitFuFu just dropped solid July metrics. Total hashrate under management hit a record 38.6 EH/s (+6.6% MoM), now ranked #5 among public Bitcoin miners, with power capacity expanding to 752 MW. Self-mining production surging 43.1% to 83 BTC - this shows they're getting real operational leverage from their infrastructure investments.

The dual approach is working: they're scaling both proprietary mining and their cloud platform (now 629k+ users). With the recent crypto-friendly policy shifts in the U.S., including the GENIUS Act, FUFU is positioned to benefit from the regulatory tailwinds.

I'm watching this as a leveraged infrastructure play on crypto. The operational momentum is clear, but it's still tied to BTC price action. Looking for volume confirmation and any breaks above key resistance if Bitcoin stays strong. The mining gains suggest they're building real competitive advantages here.

The dual approach is working: they're scaling both proprietary mining and their cloud platform (now 629k+ users). With the recent crypto-friendly policy shifts in the U.S., including the GENIUS Act, FUFU is positioned to benefit from the regulatory tailwinds.

I'm watching this as a leveraged infrastructure play on crypto. The operational momentum is clear, but it's still tied to BTC price action. Looking for volume confirmation and any breaks above key resistance if Bitcoin stays strong. The mining gains suggest they're building real competitive advantages here.

I am a research analyst specializing in Bitcoin mining and blockchain infrastructure. With a focus on mining economics, energy efficiency, and the evolving regulatory landscape, I provide data-driven insights into global mining trends.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

I am a research analyst specializing in Bitcoin mining and blockchain infrastructure. With a focus on mining economics, energy efficiency, and the evolving regulatory landscape, I provide data-driven insights into global mining trends.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.