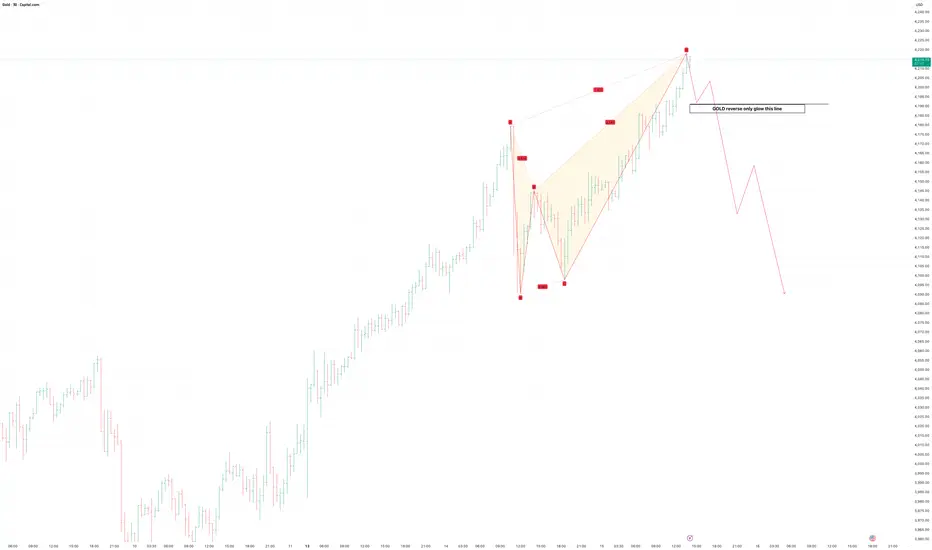

📊 Pattern Overview

The chart shows a Bearish Harmonic Pattern – likely a Bearish Gartley / Bat completion near the top zone.

You’ve marked the key structure points X–A–B–C–D, and the final leg D has completed near a precise Fibonacci confluence, indicating potential reversal.

🔍 Momentum & Confirmation

Expect bearish divergence on RSI/MACD near point D.

Watch for reversal candles — like bearish engulfing or shooting star — for entry confirmation.

A break and retest below the $4,210 line adds conviction for a short setup.

✅ Summary

Parameter Observation

Pattern Bearish Harmonic (Gartley/Bat)

Current Bias Bearish Reversal Likely

Reversal Zone $4,210–$4,225

Confirmation Line $4,210 (as labeled)

Targets $4,170 → $4,110 → $4,060

Stop-loss Above $4,235 (swing high)

Conclusion

Gold’s 1H chart is signaling a potential reversal from harmonic completion.

Only if the price closes below $4,210 with momentum confirmation, we can expect a correction toward $4,100–$4,060 levels.

Until then, the structure remains in a potential reversal zone, not yet active.

Disclaimer:

This analysis is for educational and technical research purposes only and does not constitute financial advice. Always confirm trade entries using volume, price action, and your personal risk parameters.

The chart shows a Bearish Harmonic Pattern – likely a Bearish Gartley / Bat completion near the top zone.

You’ve marked the key structure points X–A–B–C–D, and the final leg D has completed near a precise Fibonacci confluence, indicating potential reversal.

🔍 Momentum & Confirmation

Expect bearish divergence on RSI/MACD near point D.

Watch for reversal candles — like bearish engulfing or shooting star — for entry confirmation.

A break and retest below the $4,210 line adds conviction for a short setup.

✅ Summary

Parameter Observation

Pattern Bearish Harmonic (Gartley/Bat)

Current Bias Bearish Reversal Likely

Reversal Zone $4,210–$4,225

Confirmation Line $4,210 (as labeled)

Targets $4,170 → $4,110 → $4,060

Stop-loss Above $4,235 (swing high)

Conclusion

Gold’s 1H chart is signaling a potential reversal from harmonic completion.

Only if the price closes below $4,210 with momentum confirmation, we can expect a correction toward $4,100–$4,060 levels.

Until then, the structure remains in a potential reversal zone, not yet active.

Disclaimer:

This analysis is for educational and technical research purposes only and does not constitute financial advice. Always confirm trade entries using volume, price action, and your personal risk parameters.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.