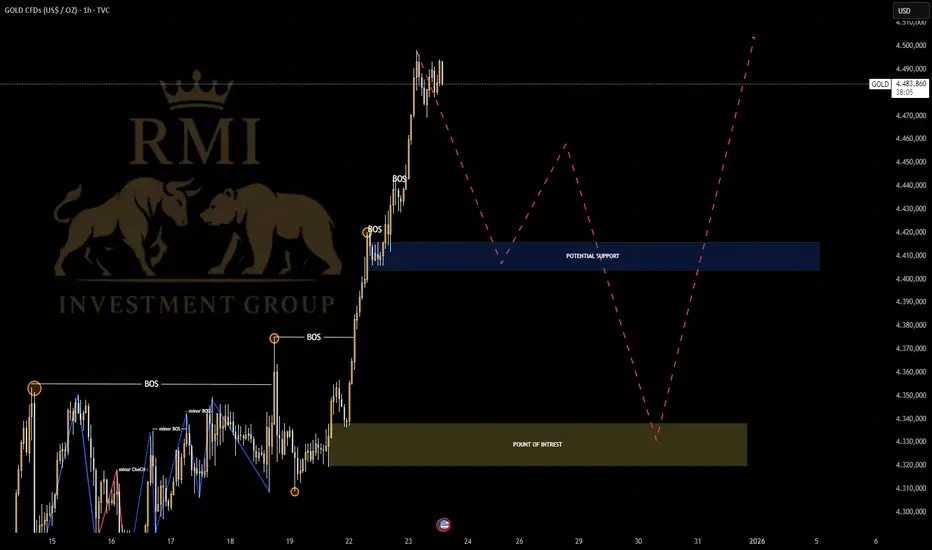

GOLD (XAU/USD) – All-Time High Price Discovery & Liquidity Reset Outlook

by RMI Invest

Market Context (All-Time High)

Gold is trading in price discovery at new all-time highs. Above current price there is no historical resistance, meaning the market is driven purely by liquidity, structure, and acceptance, not by fixed levels.

In this environment, prediction is irrelevant. The only edge comes from reading intent after expansion.

Market Structure

Multiple clean Breaks of Structure (BOS) confirm a strong bullish trend

The latest leg shows aggressive displacement, typical for initiative buying

No structural bearish break is present

Higher-timeframe bias remains bullish.

However, the market is now highly extended, increasing the probability of a structural reset rather than immediate continuation.

Current Market Condition

Price expanded vertically with little consolidation

Acceptance at the highs is not yet confirmed

Late buyers are increasingly exposed to drawdown risk

This is a typical zone where markets either:

accelerate briefly due to FOMO

or force a liquidity-driven pullback to rebalance positioning

Liquidity Perspective (Key Driver at ATH)

Buy-side liquidity above prior highs has been taken

The next meaningful liquidity rests below current price

The marked Point of Interest (POI) represents the last bullish consolidation before expansion

A pullback into this POI would be technically healthy, not bearish.

Scenario Framework

🟢 Scenario 1 – Pullback - ReAccumulation - Continuation (Preferred)

Short-term consolidation or minor fakeout at highs

Pullback toward the POI (sell-side liquidity draw)

Reaccumulation and structural confirmation

Continuation into new all-time highs

This scenario aligns with institutional positioning behavior.

🟡 Scenario 2 – Volatility Expansion

Sharp wicks above and below current price

Liquidity taken on both sides

Direction delayed until balance is restored

🔴 Scenario 3 – Bullish Invalidation (Low Probability)

Only valid if:

Price closes decisively below the POI

Follow-through confirms acceptance lower

At present, this scenario is not confirmed.

Invalidation

A sustained close and acceptance below the POI would invalidate the bullish continuation thesis and signal a deeper corrective phase.

RMI Invest Conclusion

All-time highs are not selling signals.

They are liquidity environments.

by RMI Invest

Market Context (All-Time High)

Gold is trading in price discovery at new all-time highs. Above current price there is no historical resistance, meaning the market is driven purely by liquidity, structure, and acceptance, not by fixed levels.

In this environment, prediction is irrelevant. The only edge comes from reading intent after expansion.

Market Structure

Multiple clean Breaks of Structure (BOS) confirm a strong bullish trend

The latest leg shows aggressive displacement, typical for initiative buying

No structural bearish break is present

Higher-timeframe bias remains bullish.

However, the market is now highly extended, increasing the probability of a structural reset rather than immediate continuation.

Current Market Condition

Price expanded vertically with little consolidation

Acceptance at the highs is not yet confirmed

Late buyers are increasingly exposed to drawdown risk

This is a typical zone where markets either:

accelerate briefly due to FOMO

or force a liquidity-driven pullback to rebalance positioning

Liquidity Perspective (Key Driver at ATH)

Buy-side liquidity above prior highs has been taken

The next meaningful liquidity rests below current price

The marked Point of Interest (POI) represents the last bullish consolidation before expansion

A pullback into this POI would be technically healthy, not bearish.

Scenario Framework

🟢 Scenario 1 – Pullback - ReAccumulation - Continuation (Preferred)

Short-term consolidation or minor fakeout at highs

Pullback toward the POI (sell-side liquidity draw)

Reaccumulation and structural confirmation

Continuation into new all-time highs

This scenario aligns with institutional positioning behavior.

🟡 Scenario 2 – Volatility Expansion

Sharp wicks above and below current price

Liquidity taken on both sides

Direction delayed until balance is restored

🔴 Scenario 3 – Bullish Invalidation (Low Probability)

Only valid if:

Price closes decisively below the POI

Follow-through confirms acceptance lower

At present, this scenario is not confirmed.

Invalidation

A sustained close and acceptance below the POI would invalidate the bullish continuation thesis and signal a deeper corrective phase.

RMI Invest Conclusion

All-time highs are not selling signals.

They are liquidity environments.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.