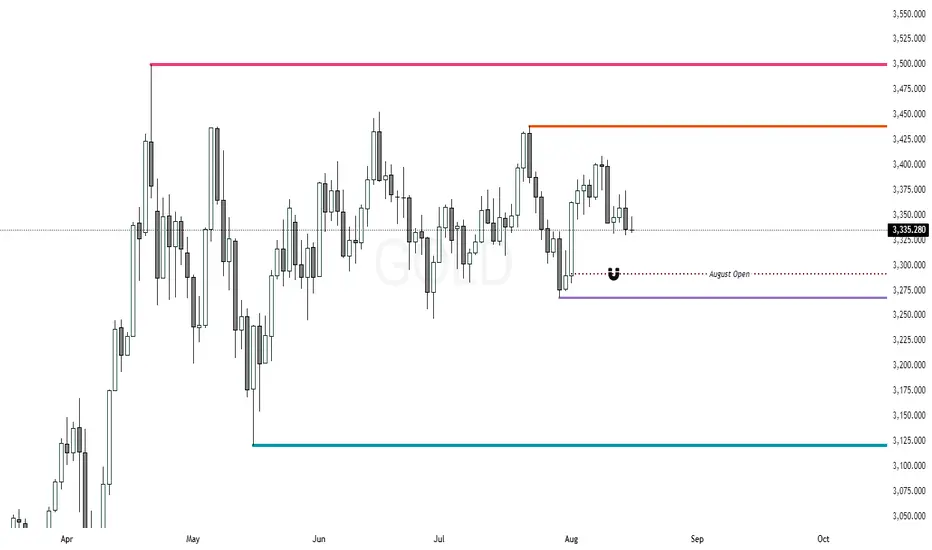

The Shiny Metal has been in a heavy mood swing this month as we may had expected. The current price action is now resting between the two highlighted lines which signify the higher time frame levels of July's High and Low. So, basically the price hasn't been able to breakout from the large range. An important note of this POV is the price action failed to push buyside against the August 11th bearish candle. It succeeded to rebalance midway of the aforementioned candle, which accordingly makes it a confirmed for sellside delivery where the NFP candle (August 1st) has left a wide imbalance area for price to mitigate into.

Another confluence that support my bearish thesis is that both Friday and Weekly candles' closed in a convincingly bearish tone. Given this scenario, I'd like to be a seller or do nothing is the likely theme for the upcoming week. Ideally, I'd like to see the August Open level to be tapped into and perhaps go lower to purge the July's low to close this month. We'll maybe a have a higher probability to see price reverse buyside in September.

Intermarket analysis side note:

1. US Treasury Yields are strong

2. US Government Bonds are weak

3. DXY remains subdued

Good luck and safe trading.....

Another confluence that support my bearish thesis is that both Friday and Weekly candles' closed in a convincingly bearish tone. Given this scenario, I'd like to be a seller or do nothing is the likely theme for the upcoming week. Ideally, I'd like to see the August Open level to be tapped into and perhaps go lower to purge the July's low to close this month. We'll maybe a have a higher probability to see price reverse buyside in September.

Intermarket analysis side note:

1. US Treasury Yields are strong

2. US Government Bonds are weak

3. DXY remains subdued

Good luck and safe trading.....

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.