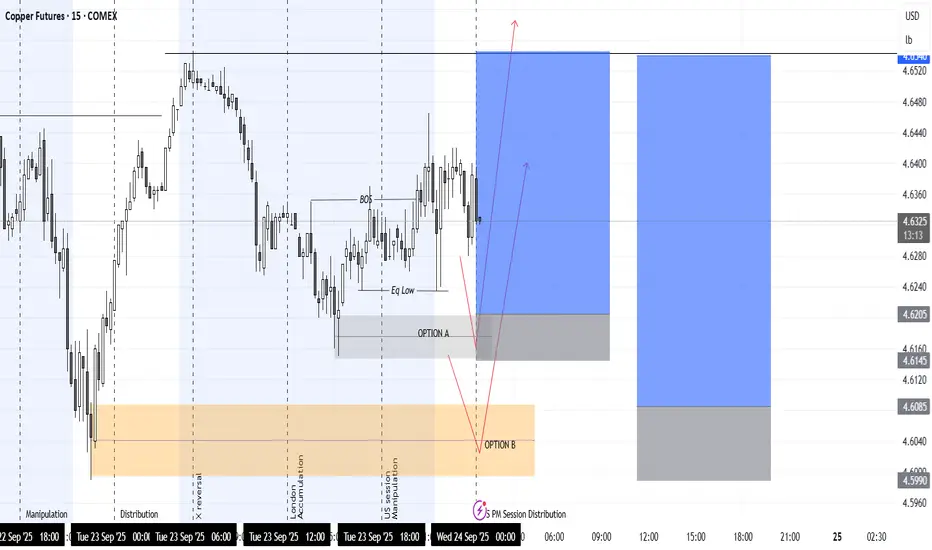

Market Context

Current price: 4.6320/lb

Recent BOS (break of structure) marked, suggesting prior bearish leg was countered.

Price consolidating around equilibrium after BOS.

Zones

Option A (grey box ~4.620–4.625)

→ A smaller demand/OB zone just below current price.

→ If respected, we could see a quick bullish continuation targeting the upper liquidity pools (blue boxes).

Option B (orange box ~4.600–4.608)

→ Deeper discount OB/demand zone.

→ If price sweeps liquidity through Option A, this zone could be the “true” accumulation point before reversal up.

Directional Bias

Chart marks liquidity run + expansion higher as primary scenario.

Arrows show:

Scenario 1: Price bounces off Option A → quick long.

Scenario 2: Price dips into Option B → deeper liquidity grab before reversal.

Bullish target zones (blue) extend 4.650–4.680.

Session Labels

London accumulation, US session manipulation, PM session distribution → classic ICT intraday model.

Suggests NY PM session might complete distribution cycle before expansion.

Current price: 4.6320/lb

Recent BOS (break of structure) marked, suggesting prior bearish leg was countered.

Price consolidating around equilibrium after BOS.

Zones

Option A (grey box ~4.620–4.625)

→ A smaller demand/OB zone just below current price.

→ If respected, we could see a quick bullish continuation targeting the upper liquidity pools (blue boxes).

Option B (orange box ~4.600–4.608)

→ Deeper discount OB/demand zone.

→ If price sweeps liquidity through Option A, this zone could be the “true” accumulation point before reversal up.

Directional Bias

Chart marks liquidity run + expansion higher as primary scenario.

Arrows show:

Scenario 1: Price bounces off Option A → quick long.

Scenario 2: Price dips into Option B → deeper liquidity grab before reversal.

Bullish target zones (blue) extend 4.650–4.680.

Session Labels

London accumulation, US session manipulation, PM session distribution → classic ICT intraday model.

Suggests NY PM session might complete distribution cycle before expansion.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.