🚀 NASDAQ Weekly & Daily Update 🚀

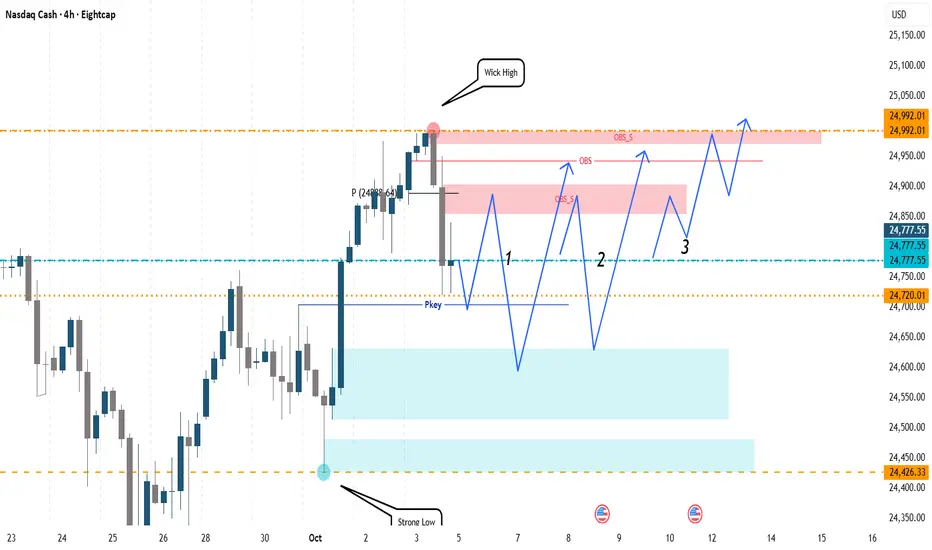

Nasdaq is currently in a strongly bullish trend, and this week marks a significant historic high. Most likely, we’ll see the index touch 25,500. Both the weekly and daily round levels are perfectly aligned, as it has just broken its previous high.

For the upcoming trading day, I’m considering 3 potential scenarios:

1️⃣ Scenario 1: Price may initially move downwards, gathering liquidity at the New York session low, then correct, and after touching the Pro Key level, rebound upwards.

2️⃣ Scenario 2: Price might move upwards first, hit the order block that aligns with the daily pivot, then retrace downwards to collect liquidity, and finally, after touching the Pro Key level, move upwards.

3️⃣ Scenario 3: Price might not reach the Pro Key level directly, react at the upper order block, break it, and continue strongly upwards.

💡 Key Points:

Each scenario’s price reaction depends heavily on the session.

Using the AMD concept, positions can be taken once confirmation is received.

This analysis is valid until the end of the trading day, so always wait for confirmation before entering trades and manage your capital.

⚠️ Disclaimer: All trading decisions are your responsibility.

I’d love to hear your thoughts and see your analysis! Let’s grow and learn together! 🙌

#NASDAQ #TradingView

Nasdaq is currently in a strongly bullish trend, and this week marks a significant historic high. Most likely, we’ll see the index touch 25,500. Both the weekly and daily round levels are perfectly aligned, as it has just broken its previous high.

For the upcoming trading day, I’m considering 3 potential scenarios:

1️⃣ Scenario 1: Price may initially move downwards, gathering liquidity at the New York session low, then correct, and after touching the Pro Key level, rebound upwards.

2️⃣ Scenario 2: Price might move upwards first, hit the order block that aligns with the daily pivot, then retrace downwards to collect liquidity, and finally, after touching the Pro Key level, move upwards.

3️⃣ Scenario 3: Price might not reach the Pro Key level directly, react at the upper order block, break it, and continue strongly upwards.

💡 Key Points:

Each scenario’s price reaction depends heavily on the session.

Using the AMD concept, positions can be taken once confirmation is received.

This analysis is valid until the end of the trading day, so always wait for confirmation before entering trades and manage your capital.

⚠️ Disclaimer: All trading decisions are your responsibility.

I’d love to hear your thoughts and see your analysis! Let’s grow and learn together! 🙌

#NASDAQ #TradingView

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.