This idea is based upon successful Breakout Retest scenario near a High-Volume Node (HVN).

Let's first get to the basics:

A successful Breakout Retest-

A breakout retest scenario occurs when the price breaks through a key level of support or resistance and then returns to test that same level before continuing in the breakout direction.

For example, if the price breaks above a resistance zone, traders wait to see if the price comes back down to that zone. If it holds as new support and shows rejection candles or strong buying, that’s called a successful retest.

At a successful retest, several things typically happen:

➡The old resistance acts as new support (or vice versa in case of breakdown).

➡Traders who missed the initial breakout enter the trade, adding momentum.

➡Weak hands or short-term traders exit, cleaning up the order flow.

➡The price often accelerates in the direction of the breakout with stronger conviction and volume.

In simple terms, a successful retest confirms that the breakout was genuine and not a false move.

High Volume Node-

HVN is a price level or zone on a volume profile where a large amount of trading activity has occurred. It represents an area where buyers and sellers actively agreed on price, leading to high transaction volume.

These zones usually act as balance areas- price tends to pause, consolidate, or even reverse near them because many traders have open positions there. When price revisits an HVN, it often encounters strong support or resistance, as market participants react to protect or exit their earlier trades.

In short, an HVN marks a fair value area on the chart where market consensus was strongest.

NASDAQ Analysis-

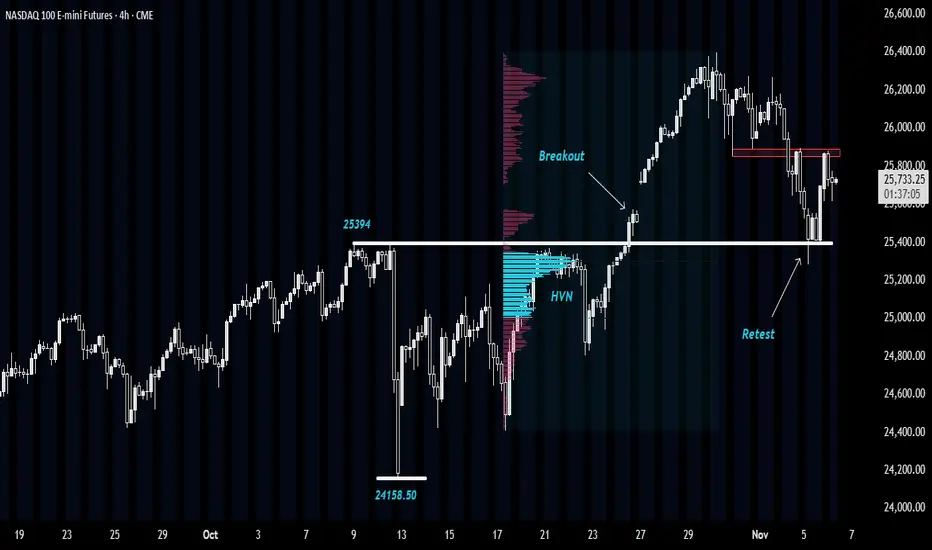

In the Nasdaq E-mini chart, we can observe a sharp decline from 25,394 to 24,158, but without any meaningful follow-through on the downside.

Subsequently, the price reacted once again from this same zone on 21st and 22nd October, before eventually breaking above 25,394 with strong momentum to form new highs.

At present, the market has pulled back to the 25,394 level, which previously acted as resistance. This area is now holding as support, suggesting a successful retest and presenting a potential buying opportunity.

Moreover, this retest is aligning with a HVN around 25,300, further reinforcing the support zone.

In the short term, the price is facing resistance near 25,900. A conservative long entry could be considered after a sustained move above 25,900, while an aggressive low-risk entry could be initiated around 25,500, closer to support.

📣Disclaimer:

Everything shared here is meant for education and general awareness only. It’s not financial advice, nor a recommendation to buy, sell, or hold any asset. Do your own research, manage your risk, and make sure you understand what you’re getting into.

Let's first get to the basics:

A successful Breakout Retest-

A breakout retest scenario occurs when the price breaks through a key level of support or resistance and then returns to test that same level before continuing in the breakout direction.

For example, if the price breaks above a resistance zone, traders wait to see if the price comes back down to that zone. If it holds as new support and shows rejection candles or strong buying, that’s called a successful retest.

At a successful retest, several things typically happen:

➡The old resistance acts as new support (or vice versa in case of breakdown).

➡Traders who missed the initial breakout enter the trade, adding momentum.

➡Weak hands or short-term traders exit, cleaning up the order flow.

➡The price often accelerates in the direction of the breakout with stronger conviction and volume.

In simple terms, a successful retest confirms that the breakout was genuine and not a false move.

High Volume Node-

HVN is a price level or zone on a volume profile where a large amount of trading activity has occurred. It represents an area where buyers and sellers actively agreed on price, leading to high transaction volume.

These zones usually act as balance areas- price tends to pause, consolidate, or even reverse near them because many traders have open positions there. When price revisits an HVN, it often encounters strong support or resistance, as market participants react to protect or exit their earlier trades.

In short, an HVN marks a fair value area on the chart where market consensus was strongest.

NASDAQ Analysis-

In the Nasdaq E-mini chart, we can observe a sharp decline from 25,394 to 24,158, but without any meaningful follow-through on the downside.

Subsequently, the price reacted once again from this same zone on 21st and 22nd October, before eventually breaking above 25,394 with strong momentum to form new highs.

At present, the market has pulled back to the 25,394 level, which previously acted as resistance. This area is now holding as support, suggesting a successful retest and presenting a potential buying opportunity.

Moreover, this retest is aligning with a HVN around 25,300, further reinforcing the support zone.

In the short term, the price is facing resistance near 25,900. A conservative long entry could be considered after a sustained move above 25,900, while an aggressive low-risk entry could be initiated around 25,500, closer to support.

📣Disclaimer:

Everything shared here is meant for education and general awareness only. It’s not financial advice, nor a recommendation to buy, sell, or hold any asset. Do your own research, manage your risk, and make sure you understand what you’re getting into.

JJ Singh

Trader/Investor

Moderator, TradingView

🚀Join t.me/jjsingh_2020 ,

A Free Education channel

🚀Tweet at twitter.com/JaySingh_2020

Trader/Investor

Moderator, TradingView

🚀Join t.me/jjsingh_2020 ,

A Free Education channel

🚀Tweet at twitter.com/JaySingh_2020

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

JJ Singh

Trader/Investor

Moderator, TradingView

🚀Join t.me/jjsingh_2020 ,

A Free Education channel

🚀Tweet at twitter.com/JaySingh_2020

Trader/Investor

Moderator, TradingView

🚀Join t.me/jjsingh_2020 ,

A Free Education channel

🚀Tweet at twitter.com/JaySingh_2020

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.