"Good news" for non-technical buyers as "Elliott takes aim at PepsiCo with $4 billion stake; shares rise."

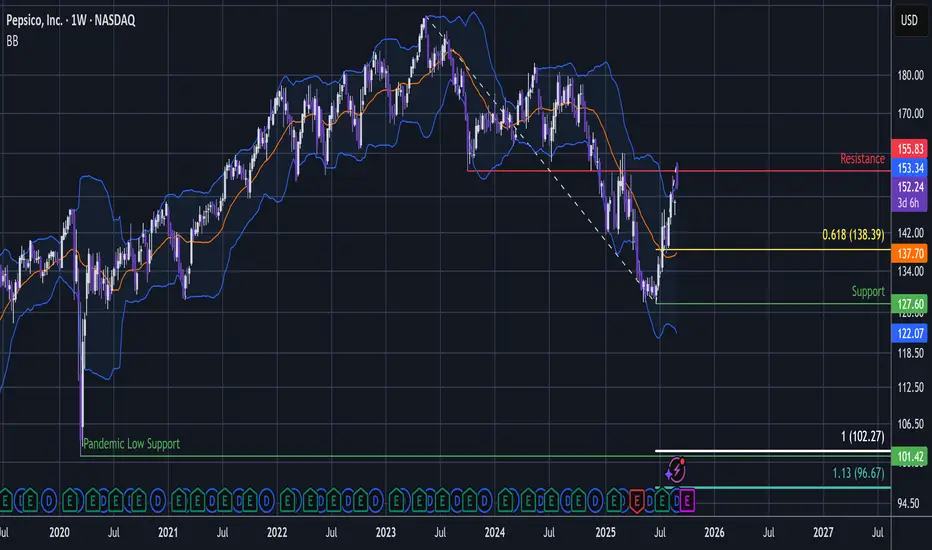

But PepsiCo is printing a nasty Gap-up-dump-down shakeout pattern above resistance as September opens.

This appears to be a terminal shakeout that can send PEP tumbling.

Up on the week chart, the shakeout has pierced into higher liquidity zone above October 2023 resistance.

So with that "hi 5" done and traders shaken out, this can no begin the next wave down.

Also notice how it pops above the Bollinger Bands - signalling a relative trend extremity.

...

This shakeout looks like it may be signalling a major top here.

So this might just be a HTF retracement peak leading to another major wave down.

If it is then a 1:1 Golden Window extension (1 - 1.13) could see PEP get all the way back to 2020 lows to potentially complete a 3 wave correction.

From there might be a great buy.

So I will give 3 targets for this trade.

1) At or slightly above the 0.618 @ $138.39 for shorter term trade

2) At or slightly above the support low @ $127.6 for mid term trade.

3) At or slightly above the Pandemic Low support @ $101.42.

Invalidation: above today's high @ $154.53.

News from REuters:

"Elliott Management on Tuesday disclosed a $4 billion stake in PepsiCo (PEP.O), opens new tab, launching a campaign to restore growth and boost the beverage maker's share price.

The stake in PepsiCo, one of Elliott's biggest holdings, comes as the company tackles choppy demand for its snacks business and pursues a shift to healthier drinks and sodas to address changing consumer preferences."

This analysis is shared for educational purposes only and does not constitute financial advice. Please conduct your own research before making any trading decisions.

But PepsiCo is printing a nasty Gap-up-dump-down shakeout pattern above resistance as September opens.

This appears to be a terminal shakeout that can send PEP tumbling.

Up on the week chart, the shakeout has pierced into higher liquidity zone above October 2023 resistance.

So with that "hi 5" done and traders shaken out, this can no begin the next wave down.

Also notice how it pops above the Bollinger Bands - signalling a relative trend extremity.

...

This shakeout looks like it may be signalling a major top here.

So this might just be a HTF retracement peak leading to another major wave down.

If it is then a 1:1 Golden Window extension (1 - 1.13) could see PEP get all the way back to 2020 lows to potentially complete a 3 wave correction.

From there might be a great buy.

So I will give 3 targets for this trade.

1) At or slightly above the 0.618 @ $138.39 for shorter term trade

2) At or slightly above the support low @ $127.6 for mid term trade.

3) At or slightly above the Pandemic Low support @ $101.42.

Invalidation: above today's high @ $154.53.

News from REuters:

"Elliott Management on Tuesday disclosed a $4 billion stake in PepsiCo (PEP.O), opens new tab, launching a campaign to restore growth and boost the beverage maker's share price.

The stake in PepsiCo, one of Elliott's biggest holdings, comes as the company tackles choppy demand for its snacks business and pursues a shift to healthier drinks and sodas to address changing consumer preferences."

This analysis is shared for educational purposes only and does not constitute financial advice. Please conduct your own research before making any trading decisions.

Note

Winner winner chicken dinner.Your FA guru can't read a chart💭

I run a technical group with lots of content every day + regular videos, 1:1, chatroom 🚀.

Better than all the rest? My record speaks for itself 💡.

Telegram Group: $50 per month✨.

Contact: t.me/dRends35

I run a technical group with lots of content every day + regular videos, 1:1, chatroom 🚀.

Better than all the rest? My record speaks for itself 💡.

Telegram Group: $50 per month✨.

Contact: t.me/dRends35

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Your FA guru can't read a chart💭

I run a technical group with lots of content every day + regular videos, 1:1, chatroom 🚀.

Better than all the rest? My record speaks for itself 💡.

Telegram Group: $50 per month✨.

Contact: t.me/dRends35

I run a technical group with lots of content every day + regular videos, 1:1, chatroom 🚀.

Better than all the rest? My record speaks for itself 💡.

Telegram Group: $50 per month✨.

Contact: t.me/dRends35

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.