🛑 “Why My Stop Loss Didn’t Trigger?”

Let’s talk about Stop Orders, Stop Limits, Spreads, and the Outside-RTH trap.

Before we blame the broker, it’s crucial to understand how each order type actually works:

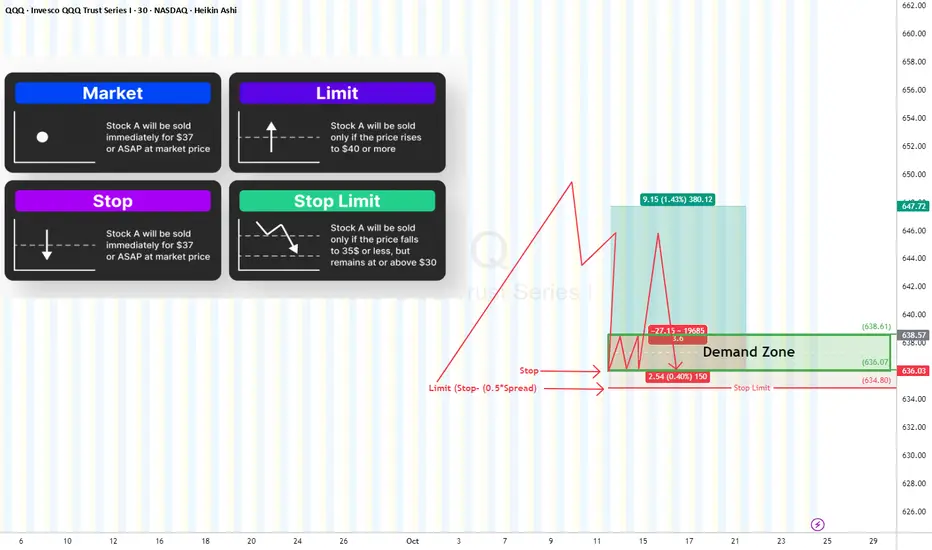

🔹 Market Order

Executes immediately at the best available price.

✅ Guarantees execution

⚠️ Doesn’t guarantee price (can slip during volatility).

🔹 Limit Order

Executes only at your specified price or better.

✅ Price control

⚠️ Might never fill if market doesn’t reach your limit or gap down.

🔹 Stop Order (Is a Stop “Market” Order)

Activates when price hits your stop level, then converts into a market order.

✅ Great for stop-loss protection

⚠️ May fill at much lower price than your stop due to slippage.

🔹 Stop Limit Order

Activates at the stop trigger, then becomes a limit order — meaning it only executes if the market trades at your limit price or better.

✅ Full control over fill price

⚠️ Risk of not executing at all if price moves away quickly.

Regular Trading Hours (RTH):

Market orders are supported → Stop Market

Outside RTH (Pre/Post-market):

Market orders are not supported therefore, only Stop Limit works.

Now, Why Your Stop Might Not Trigger?

1- You used a Stop-Limit (not Stop Market)

If the market gaps beyond your limit, there’s no fill (Buyer) at this price.

Price “touched” your stop — but never traded through your limit price.

2- You traded Outside RTH

During pre-market or after-hours, If you didn’t enable “Outside RTH” trading, your stop simply didn’t activate.

3- Thin Liquidity

Low volume = fewer buyers/sellers near your stop → delayed or partial fills.

This is especially true Outside RTH, where spreads widen and depth disappears. Or you are trading an equity or ETFs with slim volume (check the volume first before trading any asset)

✅ Recommendation:

Use Stop-Limit + “Allow Outside RTH+GTC” and make your limit “marketable” to ensure execution.

Offset guide for Stop-Limits (Δ):

• At least 0.5× spread

• Or ¼ to ½ ATR(5) for your timeframe

Example for a long position:

• You bought at $100, want to exit if it breaks $99.80.

• Pre-market spread = $0.12

• Set: Stop = 99.80, Limit = 99.68 (≈0.12 below stop)

→ Gives room for spread expansion and slippage so the stop fills quickly.

How to Set a Reliable Stop-Limit

Market Order Type Settings Notes

Equities & ETFS (RTH) Stop Market Standard stop Fastest execution

Equities & ETFS (Outside RTH) Stop Limit + GTC Limit offset = Spread Needed for after-hours fills

Futures / FX / Crypto Stop Market 24h trading Market fills OK

The Best Setup

✅ Inside RTH → Stop Market (guaranteed execution)

✅ Outside RTH → Stop Limit + GTC enabled with marketable offset

✅ Always give buffer beyond supply/demand levels (0.1–0.3%)

✅ Watch spread and volume before placing stops

Final Takeaway

Your stop loss isn’t just a line on the chart — it’s an engineered safety net.

Use the right order type for the session, give it breathing room, and understand how spread, liquidity, and RTH rules impact execution.

Because a stop loss that doesn’t trigger… isn’t a stop loss at all. 🛑

Let’s talk about Stop Orders, Stop Limits, Spreads, and the Outside-RTH trap.

Before we blame the broker, it’s crucial to understand how each order type actually works:

🔹 Market Order

Executes immediately at the best available price.

✅ Guarantees execution

⚠️ Doesn’t guarantee price (can slip during volatility).

🔹 Limit Order

Executes only at your specified price or better.

✅ Price control

⚠️ Might never fill if market doesn’t reach your limit or gap down.

🔹 Stop Order (Is a Stop “Market” Order)

Activates when price hits your stop level, then converts into a market order.

✅ Great for stop-loss protection

⚠️ May fill at much lower price than your stop due to slippage.

🔹 Stop Limit Order

Activates at the stop trigger, then becomes a limit order — meaning it only executes if the market trades at your limit price or better.

✅ Full control over fill price

⚠️ Risk of not executing at all if price moves away quickly.

Regular Trading Hours (RTH):

Market orders are supported → Stop Market

Outside RTH (Pre/Post-market):

Market orders are not supported therefore, only Stop Limit works.

Now, Why Your Stop Might Not Trigger?

1- You used a Stop-Limit (not Stop Market)

If the market gaps beyond your limit, there’s no fill (Buyer) at this price.

Price “touched” your stop — but never traded through your limit price.

2- You traded Outside RTH

During pre-market or after-hours, If you didn’t enable “Outside RTH” trading, your stop simply didn’t activate.

3- Thin Liquidity

Low volume = fewer buyers/sellers near your stop → delayed or partial fills.

This is especially true Outside RTH, where spreads widen and depth disappears. Or you are trading an equity or ETFs with slim volume (check the volume first before trading any asset)

✅ Recommendation:

Use Stop-Limit + “Allow Outside RTH+GTC” and make your limit “marketable” to ensure execution.

Offset guide for Stop-Limits (Δ):

• At least 0.5× spread

• Or ¼ to ½ ATR(5) for your timeframe

Example for a long position:

• You bought at $100, want to exit if it breaks $99.80.

• Pre-market spread = $0.12

• Set: Stop = 99.80, Limit = 99.68 (≈0.12 below stop)

→ Gives room for spread expansion and slippage so the stop fills quickly.

How to Set a Reliable Stop-Limit

Market Order Type Settings Notes

Equities & ETFS (RTH) Stop Market Standard stop Fastest execution

Equities & ETFS (Outside RTH) Stop Limit + GTC Limit offset = Spread Needed for after-hours fills

Futures / FX / Crypto Stop Market 24h trading Market fills OK

The Best Setup

✅ Inside RTH → Stop Market (guaranteed execution)

✅ Outside RTH → Stop Limit + GTC enabled with marketable offset

✅ Always give buffer beyond supply/demand levels (0.1–0.3%)

✅ Watch spread and volume before placing stops

Final Takeaway

Your stop loss isn’t just a line on the chart — it’s an engineered safety net.

Use the right order type for the session, give it breathing room, and understand how spread, liquidity, and RTH rules impact execution.

Because a stop loss that doesn’t trigger… isn’t a stop loss at all. 🛑

By Dubai Traders Hub

Follow us on X , YouTube, and Join our Telegram Channel

Follow us on X , YouTube, and Join our Telegram Channel

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

By Dubai Traders Hub

Follow us on X , YouTube, and Join our Telegram Channel

Follow us on X , YouTube, and Join our Telegram Channel

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.