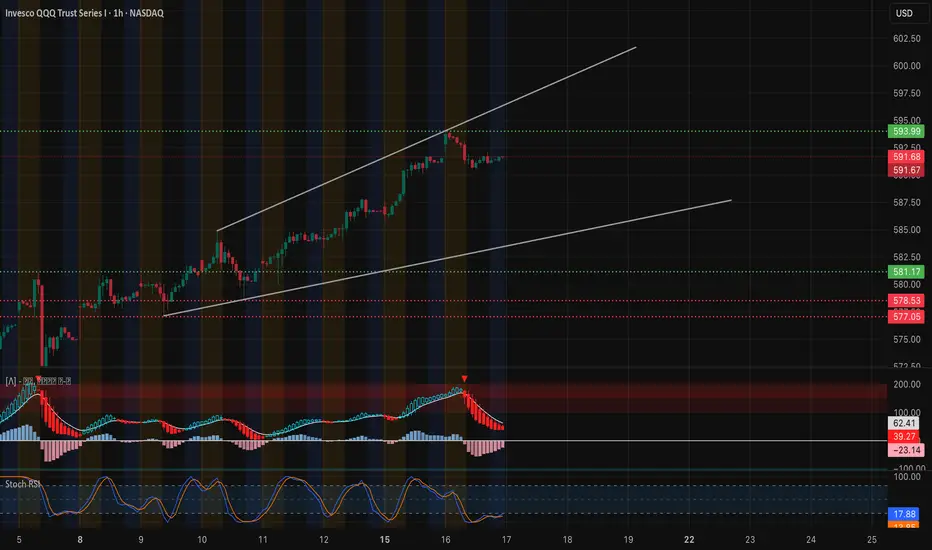

1-Hour Chart Technical View

QQQ’s 1-hour chart shows a steady uptrend within a rising channel. After a strong run from mid-week lows, price is consolidating near $591. MACD has cooled from earlier highs and Stoch RSI is in oversold territory, suggesting a pause rather than a reversal.

* Immediate Support: $590 (short-term breakout level)

* Major Support: $583 and $577 (key demand zones)

* Upside Zone: $594–$598 is the next resistance cluster; a breakout could carry to $600

The 9 EMA remains above the 21 EMA, supporting the current bullish bias as long as $590 holds.

GEX & Options Flow

Options positioning offers balanced but supportive cues:

* Call Walls: $594 (highest positive NET GEX / gamma resistance), $596, and $598.

* Put Walls: $583 and $575 (biggest downside defenses).

* GEX Bias: About 49.5% call exposure with IVR at 16.2 (IVx ~19.8). This shows healthy, moderate option interest with no sign of panic pricing.

Dealers remain positioned to hedge dips, favoring a controlled upward drift.

Trade Thoughts & Suggestions

* Swing Idea: Accumulate near $590 with a stop below $586, aiming for $594–$598 and a stretch to $600.

* Scalp Idea: Quick bounce plays off $590 or a breakout scalp if $594 is taken out with strong volume.

* Bearish Scenario: A decisive break under $586 could open $583 and $577 as targets.

Quick Take

QQQ is in a healthy consolidation inside a rising channel. For Sept 17, holding $590 keeps the door open for a move toward $594–$600.

Disclaimer: This analysis is for educational purposes only and does not constitute financial advice. Always do your own research and manage risk before trading.

QQQ’s 1-hour chart shows a steady uptrend within a rising channel. After a strong run from mid-week lows, price is consolidating near $591. MACD has cooled from earlier highs and Stoch RSI is in oversold territory, suggesting a pause rather than a reversal.

* Immediate Support: $590 (short-term breakout level)

* Major Support: $583 and $577 (key demand zones)

* Upside Zone: $594–$598 is the next resistance cluster; a breakout could carry to $600

The 9 EMA remains above the 21 EMA, supporting the current bullish bias as long as $590 holds.

GEX & Options Flow

Options positioning offers balanced but supportive cues:

* Call Walls: $594 (highest positive NET GEX / gamma resistance), $596, and $598.

* Put Walls: $583 and $575 (biggest downside defenses).

* GEX Bias: About 49.5% call exposure with IVR at 16.2 (IVx ~19.8). This shows healthy, moderate option interest with no sign of panic pricing.

Dealers remain positioned to hedge dips, favoring a controlled upward drift.

Trade Thoughts & Suggestions

* Swing Idea: Accumulate near $590 with a stop below $586, aiming for $594–$598 and a stretch to $600.

* Scalp Idea: Quick bounce plays off $590 or a breakout scalp if $594 is taken out with strong volume.

* Bearish Scenario: A decisive break under $586 could open $583 and $577 as targets.

Quick Take

QQQ is in a healthy consolidation inside a rising channel. For Sept 17, holding $590 keeps the door open for a move toward $594–$600.

Disclaimer: This analysis is for educational purposes only and does not constitute financial advice. Always do your own research and manage risk before trading.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.