REGN | Regeneron Pharmaceuticals – Macro Reaccumulation Setup

Published by WaverVanir International LLC | 06/12/2025

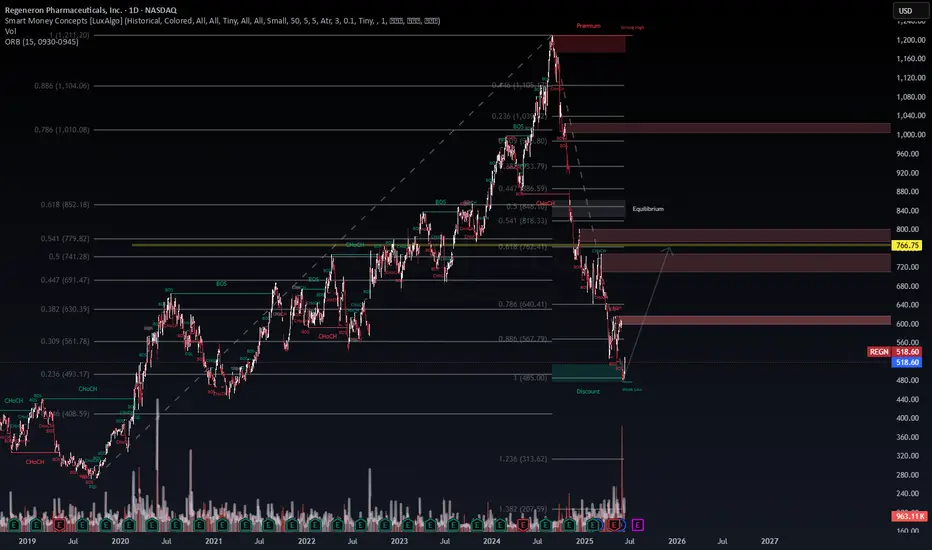

Regeneron has completed a deep retracement, touching the 0.886 Fibonacci level (~$567) and entering a strong discount zone, coinciding with a weak low sweep and increasing volume — suggesting potential accumulation by institutions.

🔍 Key Confluences:

🔄 Internal CHoCH and BOS structure shift indicates short-term reversal

🔵 Entered macro discount territory with a clean sweep of liquidity below $485

🟡 Targeting major inefficiency and liquidity void around $766.75, aligning with 0.5 retracement and prior equilibrium

🟥 Supply zones between $640–$720 may offer resistance/partial profit-taking zones

📉 Risk Framework:

Entry consideration: $500–$520

Stop loss idea: Below $475 (invalidate weak low sweep)

Primary Target: $766.75

Secondary Target (Extended): $818–$852

🧠 Fundamental & Macro Watch:

Upcoming trial results or FDA action could act as a key catalyst

Biotech sector sentiment tied to macro healthcare policy and AI-integration for drug discovery

Recent earnings showed strong forward guidance – potential re-rating ahead

📈 Probabilistic Outlook:

Bullish retracement toward $766.75: 70%

Extended bearish continuation (below $485): 15%

Sideways chop: 15%

🧭 Smart money often reacts to extreme fear – REGN may be entering a mark-up phase if confirmed with institutional follow-through.

#REGN REGN #SmartMoneyConcepts #FibConfluence #WaverVanir #BiotechStocks #SwingTrading #TechnicalAnalysis #InstitutionalOrderFlow

REGN #SmartMoneyConcepts #FibConfluence #WaverVanir #BiotechStocks #SwingTrading #TechnicalAnalysis #InstitutionalOrderFlow

Regeneron has completed a deep retracement, touching the 0.886 Fibonacci level (~$567) and entering a strong discount zone, coinciding with a weak low sweep and increasing volume — suggesting potential accumulation by institutions.

🔍 Key Confluences:

🔄 Internal CHoCH and BOS structure shift indicates short-term reversal

🔵 Entered macro discount territory with a clean sweep of liquidity below $485

🟡 Targeting major inefficiency and liquidity void around $766.75, aligning with 0.5 retracement and prior equilibrium

🟥 Supply zones between $640–$720 may offer resistance/partial profit-taking zones

📉 Risk Framework:

Entry consideration: $500–$520

Stop loss idea: Below $475 (invalidate weak low sweep)

Primary Target: $766.75

Secondary Target (Extended): $818–$852

🧠 Fundamental & Macro Watch:

Upcoming trial results or FDA action could act as a key catalyst

Biotech sector sentiment tied to macro healthcare policy and AI-integration for drug discovery

Recent earnings showed strong forward guidance – potential re-rating ahead

📈 Probabilistic Outlook:

Bullish retracement toward $766.75: 70%

Extended bearish continuation (below $485): 15%

Sideways chop: 15%

🧭 Smart money often reacts to extreme fear – REGN may be entering a mark-up phase if confirmed with institutional follow-through.

#REGN

Trade active

Note

Regeneron Pharmaceuticals (Ticker: REGN)Linvoseltamab for relapsed or refractory multiple myeloma (PDUFA by July 10, 2025)

Odronextamab for relapsed/refractory follicular lymphoma (PDUFA by July 30, 2025)

WaverVanir ⚡ To grow and conquer

stocktwits.com/WaverVanir | wavervanir.com | buymeacoffee.com/wavervanir

Not Investment Advice

stocktwits.com/WaverVanir | wavervanir.com | buymeacoffee.com/wavervanir

Not Investment Advice

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

WaverVanir ⚡ To grow and conquer

stocktwits.com/WaverVanir | wavervanir.com | buymeacoffee.com/wavervanir

Not Investment Advice

stocktwits.com/WaverVanir | wavervanir.com | buymeacoffee.com/wavervanir

Not Investment Advice

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.