Hello I am the Cafe Trader.

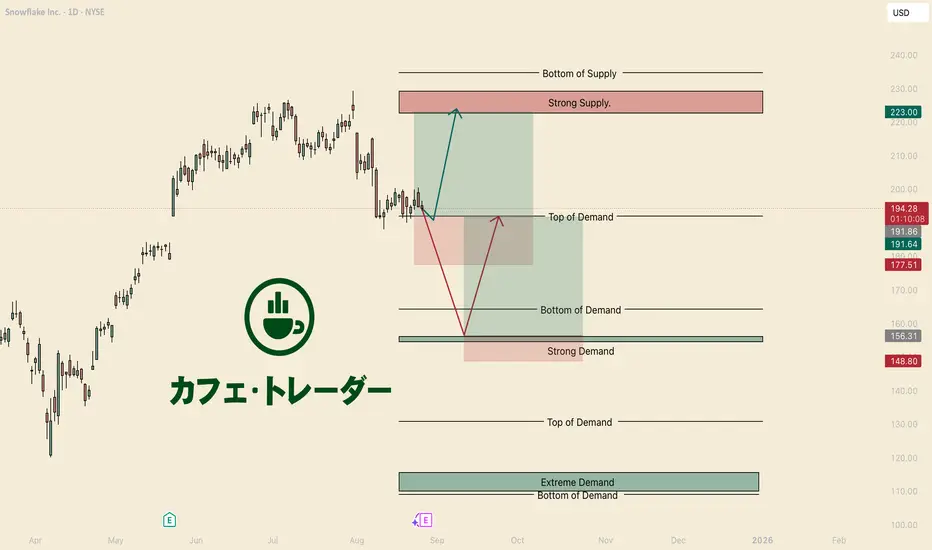

Today we’re looking at Snowflake (SNOW).

Price has broken into the Top of Demand, pushing back buyers while bears are making a case for this to go lower.

From a shorter term perspective, bears are in control of this one, making the Red scenario the most likely to happen in my book.

But if you are strongly convicted in SNOW, I have give you two trades, and some long term ideas to get some exposure on SNOW.

Green Scenario

If buyers defend the Top of Demand [/I] here, we can see a quick move higher back into Strong Supply. This would be the aggressive play, taking the immediate bounce.

2RR Setup

Entry: 192 (Top of Demand)

Stop: 177.5 (below Bottom of Demand)

TP: 223 (Strong Supply)

Notes: Top of Demand needs to hold, Personally you could even tighten the stop as this is a bit loose.

Red Scenario

If buyers fail at the Top of Demand, we’ll likely see price flush into the Strong Demand zone . That’s where I’d expect More conentrated buyers to step in.

Entry: 156 (Strong Demand)

Stop: 148.8 (below Strong Demand)

TP: 192–194 (Top of Demand flip)

Notes: This is the more conservative path, but also the higher conviction zone for a rebound.

Long Term

If you were looking to get some good pricing with SNOW, these should match your conviction.

Aggressive: 192–194 (Top of Demand)

Value: 156 (Strong Demand)

Extreme Value: 112–115 (Extreme Demand)

This is a layered setup. If aggressive buyers show up now, great — but if not, let the market come to you at the better value zones. Either way, SNOW offers multiple opportunities depending on your conviction and patience.

Happy Trading,

thecafetrader

Today we’re looking at Snowflake (SNOW).

Price has broken into the Top of Demand, pushing back buyers while bears are making a case for this to go lower.

From a shorter term perspective, bears are in control of this one, making the Red scenario the most likely to happen in my book.

But if you are strongly convicted in SNOW, I have give you two trades, and some long term ideas to get some exposure on SNOW.

Green Scenario

If buyers defend the Top of Demand [/I] here, we can see a quick move higher back into Strong Supply. This would be the aggressive play, taking the immediate bounce.

2RR Setup

Entry: 192 (Top of Demand)

Stop: 177.5 (below Bottom of Demand)

TP: 223 (Strong Supply)

Notes: Top of Demand needs to hold, Personally you could even tighten the stop as this is a bit loose.

Red Scenario

If buyers fail at the Top of Demand, we’ll likely see price flush into the Strong Demand zone . That’s where I’d expect More conentrated buyers to step in.

Entry: 156 (Strong Demand)

Stop: 148.8 (below Strong Demand)

TP: 192–194 (Top of Demand flip)

Notes: This is the more conservative path, but also the higher conviction zone for a rebound.

Long Term

If you were looking to get some good pricing with SNOW, these should match your conviction.

Aggressive: 192–194 (Top of Demand)

Value: 156 (Strong Demand)

Extreme Value: 112–115 (Extreme Demand)

This is a layered setup. If aggressive buyers show up now, great — but if not, let the market come to you at the better value zones. Either way, SNOW offers multiple opportunities depending on your conviction and patience.

Happy Trading,

thecafetrader

Trade closed: target reached

This happened too fast...Happy trading, follow and boost for more!

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.