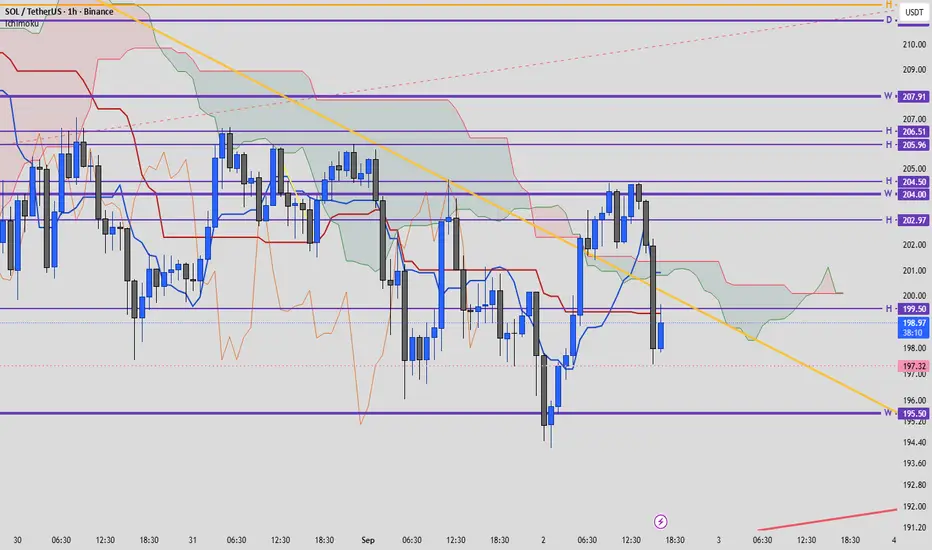

On the 1H chart, Solana is ranging between key support and resistance levels (marked in purple, derived from higher timeframe Ichimoku levels).

🔹Resistance Levels

207.91 (Weekly):** A major resistance zone. A breakout above could open the path toward 210.

206.51 – 205.96 (Daily/Hourly):** Strong resistance cluster that has repeatedly rejected bullish attempts.

204.50 – 204.00 (Weekly/Hourly):** First short-term barrier for buyers.

202.97 (Hourly):** Mid-level resistance, crucial for momentum continuation.

🔹Support Levels**

199.50 (Hourly):** Immediate support, currently being tested. Losing this level may trigger further selling.

197.32 (Hourly):** Next short-term support, likely to be retested.

195.50 (Weekly):** Key medium-term support. A breakdown here could extend the correction toward 192 and lower.

🔹Ichimoku Insights**

Price is trading **below Tenkan-sen (blue)** → showing short-term bearish pressure.

Kijun-sen (red)** around 200–201 acts as a dynamic resistance.

Kumo Cloud** ahead is thin and flat, signaling indecision. A breakout above 202 would bring price inside a bullish Kumo structure.

Chikou Span (orange)** is still below price, not confirming a bullish reversal yet.

---

## 📊 Conclusion

* **Bullish Scenario:** A confirmed breakout above **202.97** could target **204.5 → 206.5**.

* **Bearish Scenario:** Breaking below **197.3** opens the way to **195.5 → 192**.

👉 The **197–202 zone** remains the key battleground. A breakout on either side will likely define Solana’s next move. 🚀

🔹Resistance Levels

207.91 (Weekly):** A major resistance zone. A breakout above could open the path toward 210.

206.51 – 205.96 (Daily/Hourly):** Strong resistance cluster that has repeatedly rejected bullish attempts.

204.50 – 204.00 (Weekly/Hourly):** First short-term barrier for buyers.

202.97 (Hourly):** Mid-level resistance, crucial for momentum continuation.

🔹Support Levels**

199.50 (Hourly):** Immediate support, currently being tested. Losing this level may trigger further selling.

197.32 (Hourly):** Next short-term support, likely to be retested.

195.50 (Weekly):** Key medium-term support. A breakdown here could extend the correction toward 192 and lower.

🔹Ichimoku Insights**

Price is trading **below Tenkan-sen (blue)** → showing short-term bearish pressure.

Kijun-sen (red)** around 200–201 acts as a dynamic resistance.

Kumo Cloud** ahead is thin and flat, signaling indecision. A breakout above 202 would bring price inside a bullish Kumo structure.

Chikou Span (orange)** is still below price, not confirming a bullish reversal yet.

---

## 📊 Conclusion

* **Bullish Scenario:** A confirmed breakout above **202.97** could target **204.5 → 206.5**.

* **Bearish Scenario:** Breaking below **197.3** opens the way to **195.5 → 192**.

👉 The **197–202 zone** remains the key battleground. A breakout on either side will likely define Solana’s next move. 🚀

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.