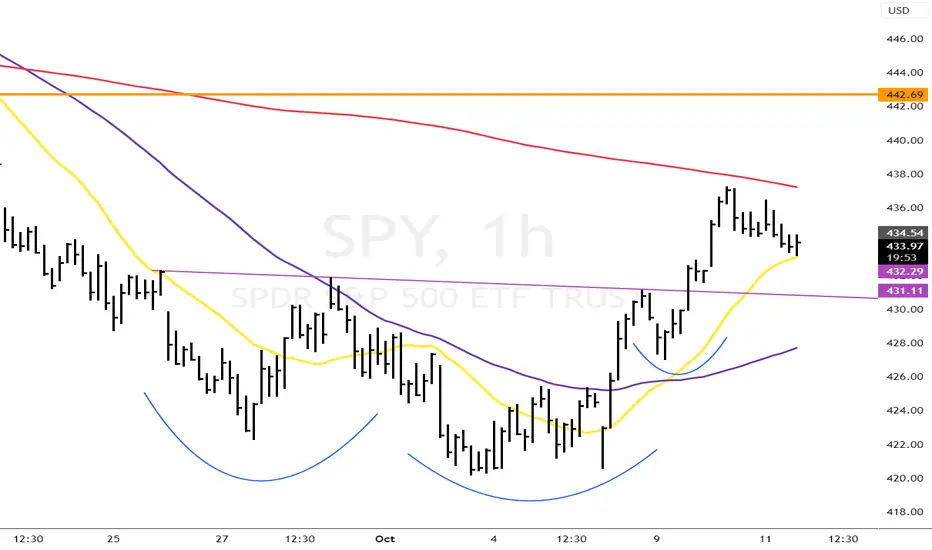

The structure of the Inverse Head & Shoulders consists of three main troughs. The middle trough (the 'head') is the lowest, flanked by two higher troughs (the 'shoulders'). The pattern is confirmed when the asset's price moves above the 'neckline,' a resistance level connecting the two shoulders.

Investors should remain vigilant for a decisive close above this neckline, as it would confirm the completion of the pattern and potentially signal the commencement of a new bullish cycle for the SPY index.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.