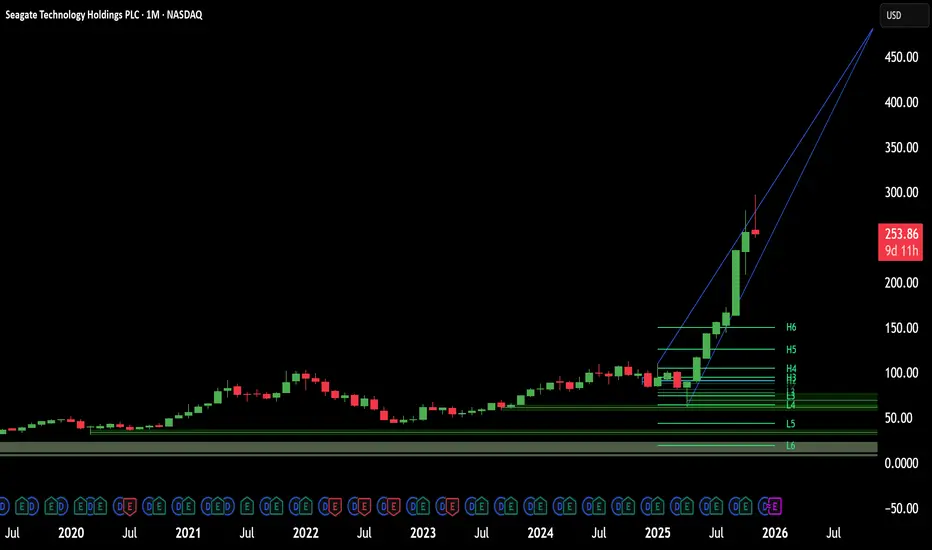

Seagate Technologies (NASDAQ: STX) exhibits powerful technical and fundamental momentum. Its stock has doubled over the last year, driven by its unique positioning in the surging Artificial Intelligence (AI) infrastructure buildout. Seagate can deliver AI-capable hard drives (HDDs) at scale for the data center industry like no other competitor. The company's future success depends on its massive capacity storage solutions, which are critical for training AI models and inference processes. This robust outlook propels strong support from major institutional investors and a bullish analyst consensus.

Technology, High-Tech, and Patent Analysis

Seagate's competitive edge rests on its Heat-Assisted Magnetic Recording (HAMR) technology. This innovation, branded as the Mozaic 3+ platform, dramatically increases areal density, enabling massive capacity gains and superior cost-per-terabyte efficiency compared to older technologies.

Seagate's foresight places it ahead of its primary competitor, Western Digital, in this generational technology transition. The company's patent strength in this domain ensures a sustained technological advantage, crucial as high-density HDDs remain the cost-effective backbone for the majority of exabyte-scale AI data storage.

Industry Trends and Business Models

The AI boom fundamentally reshapes the data storage industry. AI models require enormous, cost-effective storage for training datasets, making high-capacity HDDs indispensable. Seagate's business model focuses intensely on mass-capacity, nearline drives for hyperscale cloud providers (Amazon, Microsoft, Alphabet, etc.) and AI innovators like NVIDIA and OpenAI. Build-to-order (BTO) contracts with these major customers secure revenue streams and provide demand visibility well into 2026, mitigating cyclical risks previously inherent in the storage market.

Management & Leadership in Strategic Growth

Management demonstrates effective strategic pivoting, focusing on value capture and improved operational leverage. The successful and rapid commercialization of the Mozaic 3+ HAMR drives confirms strong execution in the product roadmap. Leadership forecasts management-defined gross margins to increase to nearly 40% in 2026. These margin improvements, driven by the higher profitability of next-generation drives, highlight a commitment to disciplined growth and improved operational efficiency.

Macroeconomics and Balance Sheet Inflection

The global macroeconomic environment for data center expansion remains robust, fueled by the multi-trillion-dollar AI Supercycle. This secular tailwind significantly boosts demand for Seagate's mass-capacity products. Seagate's balance sheet quality is improving after past challenges with debt and losses. Strong cash flow, driven by surging AI demand, enables debt reduction and improved financial health. This pivot is expected to increase shareholder value by improving financial flexibility and supporting future dividend increases.

Corporate Culture, Innovation, and Shareholder Value

The company culture prioritizes innovation through long-term investment in core storage science, evidenced by the 20-year development of HAMR. Beyond stock appreciation, the company's *b]$2.96 annualized dividend acts as a catalyst for long-term shareholders. Seagate currently pays less than 35% of its earnings, providing ample room to increase the distribution pace, offering both growth and income potential as earnings surge.

Market Sentiment and Institutional Support

Market sentiment strongly favors the stock, marked by a Moderate Buy consensus from a growing number of analysts. Key technical indicators, including high trading volume and MACD convergence, signal strengthening market momentum. Furthermore, institutions own over 90% of the stock and have been consistent net buyers throughout 2025. This institutional support provides a rock-solid base and sets the stage for a potential year-end rally to new all-time highs.

Technology, High-Tech, and Patent Analysis

Seagate's competitive edge rests on its Heat-Assisted Magnetic Recording (HAMR) technology. This innovation, branded as the Mozaic 3+ platform, dramatically increases areal density, enabling massive capacity gains and superior cost-per-terabyte efficiency compared to older technologies.

Seagate's foresight places it ahead of its primary competitor, Western Digital, in this generational technology transition. The company's patent strength in this domain ensures a sustained technological advantage, crucial as high-density HDDs remain the cost-effective backbone for the majority of exabyte-scale AI data storage.

Industry Trends and Business Models

The AI boom fundamentally reshapes the data storage industry. AI models require enormous, cost-effective storage for training datasets, making high-capacity HDDs indispensable. Seagate's business model focuses intensely on mass-capacity, nearline drives for hyperscale cloud providers (Amazon, Microsoft, Alphabet, etc.) and AI innovators like NVIDIA and OpenAI. Build-to-order (BTO) contracts with these major customers secure revenue streams and provide demand visibility well into 2026, mitigating cyclical risks previously inherent in the storage market.

Management & Leadership in Strategic Growth

Management demonstrates effective strategic pivoting, focusing on value capture and improved operational leverage. The successful and rapid commercialization of the Mozaic 3+ HAMR drives confirms strong execution in the product roadmap. Leadership forecasts management-defined gross margins to increase to nearly 40% in 2026. These margin improvements, driven by the higher profitability of next-generation drives, highlight a commitment to disciplined growth and improved operational efficiency.

Macroeconomics and Balance Sheet Inflection

The global macroeconomic environment for data center expansion remains robust, fueled by the multi-trillion-dollar AI Supercycle. This secular tailwind significantly boosts demand for Seagate's mass-capacity products. Seagate's balance sheet quality is improving after past challenges with debt and losses. Strong cash flow, driven by surging AI demand, enables debt reduction and improved financial health. This pivot is expected to increase shareholder value by improving financial flexibility and supporting future dividend increases.

Corporate Culture, Innovation, and Shareholder Value

The company culture prioritizes innovation through long-term investment in core storage science, evidenced by the 20-year development of HAMR. Beyond stock appreciation, the company's *b]$2.96 annualized dividend acts as a catalyst for long-term shareholders. Seagate currently pays less than 35% of its earnings, providing ample room to increase the distribution pace, offering both growth and income potential as earnings surge.

Market Sentiment and Institutional Support

Market sentiment strongly favors the stock, marked by a Moderate Buy consensus from a growing number of analysts. Key technical indicators, including high trading volume and MACD convergence, signal strengthening market momentum. Furthermore, institutions own over 90% of the stock and have been consistent net buyers throughout 2025. This institutional support provides a rock-solid base and sets the stage for a potential year-end rally to new all-time highs.

Stock N Roll!

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Stock N Roll!

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.