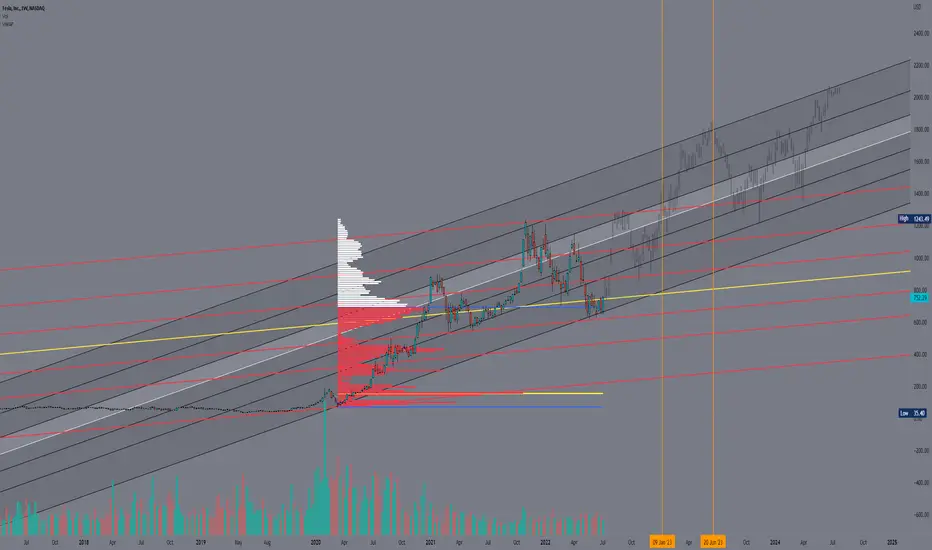

TSLA is an interesting story. And in any story, the only thing that matters, is data. As you can see on the all time volume profile on the left, we are currently building volume interest at a higher point. There is no interest in taking tesla all the way back to the yellow line, which is the original point of control (POC) based on volume interest. We also see that there has been a competing narrative of which fib channel it is in. Is the red channel in control or the black? I would argue that we are creating an 8 week bottom on the black channel before a really steady up hill climb into next year. I would like to see volume at this level spike to the point that the yellow line suddenly shifts up to our current price range. That would give it very strong support indeed to continue up. However, because the shorts will give up in large amount, I expect the entire market to have an insane July into August because of the counter reaction. I also expect most of that profit to be lost as we find balance over next year. Should this play out, we would target the top of the black channel before any major drops or selloffs.

I expect ARKK, TSLA, APPLE and the indexes in general to all mirror this exact pattern. I I will repost my long term fib channels for SPX, but this was the exact bottom I expected... so .. I'm a Genie in a bottle, you gotta rub me the right way. :)

I expect ARKK, TSLA, APPLE and the indexes in general to all mirror this exact pattern. I I will repost my long term fib channels for SPX, but this was the exact bottom I expected... so .. I'm a Genie in a bottle, you gotta rub me the right way. :)

Note

The next two three weeks are everything. If we don't hold this short squeeze, TSLA goes to 200. I'll tell ya though, being stuck under the 50% of the red channel is a dangerous place to spend all that time. Makes me think Monday is going to gap down and screw everyone. Or gap above that yellow 50 line and go for it. Next week is scary.Note

Okay, I think we do gap above and open on top of that line. Because if my ghost bars are right, second week is a heavy contest to get lower again, and that will induce lots of volume interest and be the thing that pulls the point of control to the 700 area.Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.