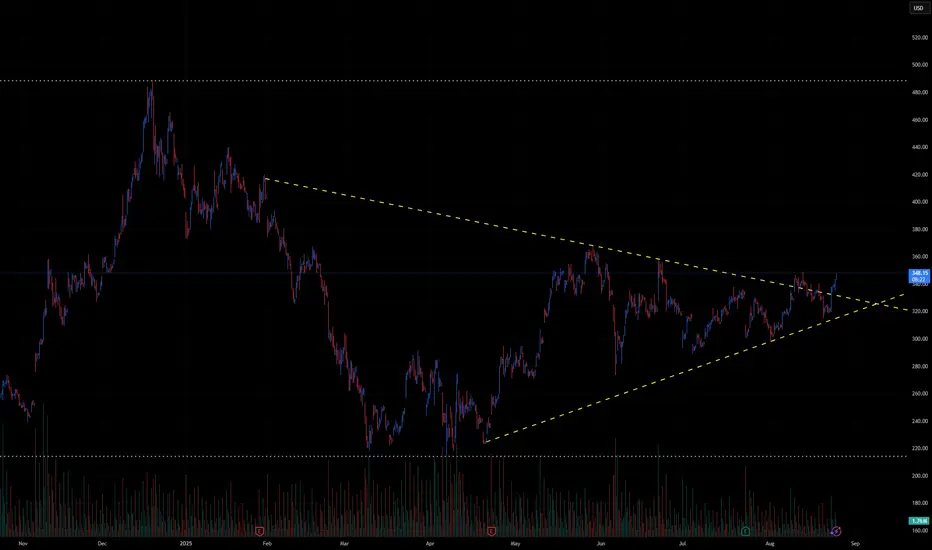

🚗 TSLA Technical Outlook – Symmetrical Triangle Breakout Watch

Ticker: TSLA (Tesla, Inc.)

Timeframe: 30-minute candles

🔍 Current Setup

TSLA has been consolidating for months inside a large symmetrical triangle, marked by:

Descending resistance: from ~380 down to ~347.

Ascending support: from April lows near ~240, now rising toward ~320.

Current price: ~348, testing the upper boundary of the triangle.

This structure signals compression after a major downtrend, and the breakout direction will likely define TSLA’s next big move.

📊 Breakout Levels

🚀 Upside (Bullish Scenario)

Trigger: Break and close above 350–355.

Intermediate Targets:

370–380 → First resistance zone.

400–420 → Extension levels.

Measured Move Target: ~450+ (based on the triangle height projection).

🔻 Downside (Bearish Scenario)

Trigger: Failure at resistance and break below 320, confirmation under 310.

Intermediate Supports:

300 → Psychological level.

280–260 → Stronger support zone.

Measured Move Target: ~250 (triangle projection downward).

📈 Volume Analysis

Volume has been contracting steadily during the triangle’s formation.

A major volume spike will be key to confirming whichever direction TSLA chooses.

⚖️ Probability Bias

TSLA is at the make-or-break resistance zone (~350).

A breakout above 355 would strongly favor bulls, targeting 380 → 400+.

But a rejection here and break below 320 would shift momentum bearish, sending TSLA back toward 280–260.

✅ Takeaway

TSLA is at a critical inflection point inside a long-term triangle:

Bullish Break > 355: Targets 370 → 400 → 450+

Bearish Break < 320: Targets 300 → 280 → 250

Watch for volume-backed confirmation, as this move could define Tesla’s next multi-week trend.

Ticker: TSLA (Tesla, Inc.)

Timeframe: 30-minute candles

🔍 Current Setup

TSLA has been consolidating for months inside a large symmetrical triangle, marked by:

Descending resistance: from ~380 down to ~347.

Ascending support: from April lows near ~240, now rising toward ~320.

Current price: ~348, testing the upper boundary of the triangle.

This structure signals compression after a major downtrend, and the breakout direction will likely define TSLA’s next big move.

📊 Breakout Levels

🚀 Upside (Bullish Scenario)

Trigger: Break and close above 350–355.

Intermediate Targets:

370–380 → First resistance zone.

400–420 → Extension levels.

Measured Move Target: ~450+ (based on the triangle height projection).

🔻 Downside (Bearish Scenario)

Trigger: Failure at resistance and break below 320, confirmation under 310.

Intermediate Supports:

300 → Psychological level.

280–260 → Stronger support zone.

Measured Move Target: ~250 (triangle projection downward).

📈 Volume Analysis

Volume has been contracting steadily during the triangle’s formation.

A major volume spike will be key to confirming whichever direction TSLA chooses.

⚖️ Probability Bias

TSLA is at the make-or-break resistance zone (~350).

A breakout above 355 would strongly favor bulls, targeting 380 → 400+.

But a rejection here and break below 320 would shift momentum bearish, sending TSLA back toward 280–260.

✅ Takeaway

TSLA is at a critical inflection point inside a long-term triangle:

Bullish Break > 355: Targets 370 → 400 → 450+

Bearish Break < 320: Targets 300 → 280 → 250

Watch for volume-backed confirmation, as this move could define Tesla’s next multi-week trend.

Trade active

MASSIVE WIN OVER $420 TODAYDisclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.