Market Preview

* Macro backdrop: U.S. index futures are steady after a strong tech rally last week. Rates and the dollar remain stable, leaving room for growth stocks to extend gains.

* Sector tone: EV and AI-related momentum is strong, with Tesla leading on heavy volume and institutional call buying.

Technical Analysis – TSLA

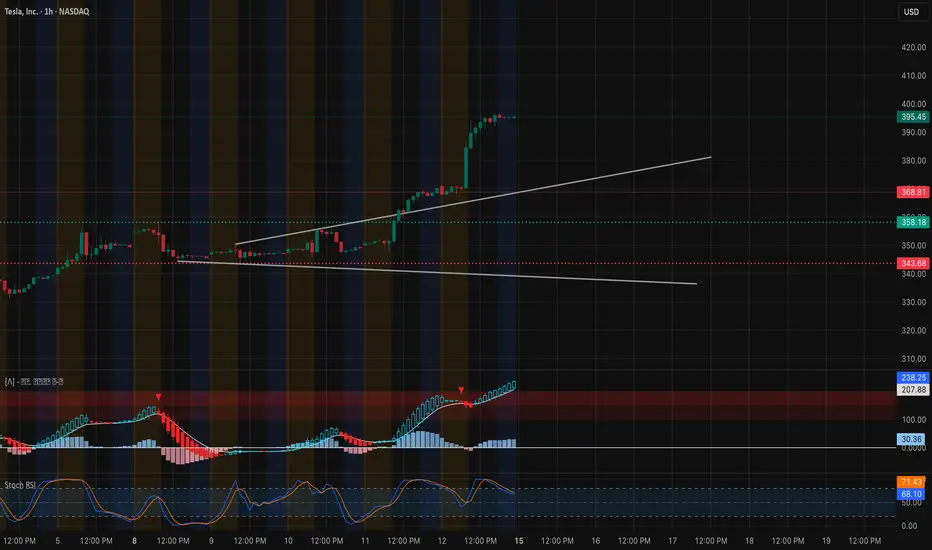

Trend & Structure (1-Hour Chart)

* Price surged to $395–396 and is consolidating near the highs.

* Structure remains firmly bullish with higher highs/lows and a well-defined rising channel.

Key Levels

* Resistance: $396.6 (highest positive NETGEX / CALL Resistance), $405, and $420 as next upside targets.

* Support: $389.9 (near-term pivot), $368.8 (major breakout base), $347.5 (HVL zone).

Momentum & Indicators

* MACD on 1H is bullish and expanding, supporting continuation.

* Stoch RSI is near overbought, signaling possible brief consolidation or a minor pullback before another leg higher.

* Volume remains strong, showing solid institutional demand.

Options/GEX Insight

* Massive call positioning (≈98% call bias) with positive GEX layers up to $420 suggests market makers may support higher prices.

* IVR 17.4 and IVx avg 61.5 indicate elevated but manageable volatility.

Trade Scenarios for Sept 15

* Bullish Plan:

* Entry: Break/hold above $396.6 with volume.

* Targets: $405 → $420.

* Stop: Below $389.9.

* Defensive Plan (if rejection occurs):

* Entry: Loss of $389.9 with momentum shift.

* Targets: $368.8 → $347.5.

* Stop: Above $396.6.

Summary

Tesla heads into Monday with a strong bullish setup. Holding above $389.9 keeps momentum intact, while a breakout over $396.6 could trigger a run toward $405–420.

Disclaimer: This analysis is for educational purposes only and does not constitute financial advice. Always do your own research and manage risk before trading.

* Macro backdrop: U.S. index futures are steady after a strong tech rally last week. Rates and the dollar remain stable, leaving room for growth stocks to extend gains.

* Sector tone: EV and AI-related momentum is strong, with Tesla leading on heavy volume and institutional call buying.

Technical Analysis – TSLA

Trend & Structure (1-Hour Chart)

* Price surged to $395–396 and is consolidating near the highs.

* Structure remains firmly bullish with higher highs/lows and a well-defined rising channel.

Key Levels

* Resistance: $396.6 (highest positive NETGEX / CALL Resistance), $405, and $420 as next upside targets.

* Support: $389.9 (near-term pivot), $368.8 (major breakout base), $347.5 (HVL zone).

Momentum & Indicators

* MACD on 1H is bullish and expanding, supporting continuation.

* Stoch RSI is near overbought, signaling possible brief consolidation or a minor pullback before another leg higher.

* Volume remains strong, showing solid institutional demand.

Options/GEX Insight

* Massive call positioning (≈98% call bias) with positive GEX layers up to $420 suggests market makers may support higher prices.

* IVR 17.4 and IVx avg 61.5 indicate elevated but manageable volatility.

Trade Scenarios for Sept 15

* Bullish Plan:

* Entry: Break/hold above $396.6 with volume.

* Targets: $405 → $420.

* Stop: Below $389.9.

* Defensive Plan (if rejection occurs):

* Entry: Loss of $389.9 with momentum shift.

* Targets: $368.8 → $347.5.

* Stop: Above $396.6.

Summary

Tesla heads into Monday with a strong bullish setup. Holding above $389.9 keeps momentum intact, while a breakout over $396.6 could trigger a run toward $405–420.

Disclaimer: This analysis is for educational purposes only and does not constitute financial advice. Always do your own research and manage risk before trading.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.