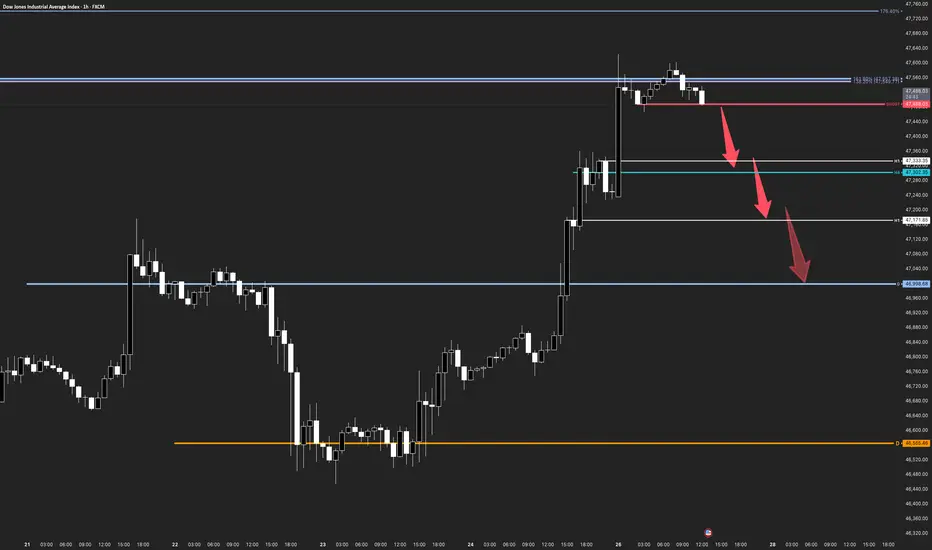

US30 | Countertrend Setup From Long-Term Fibonacci Target Zone

The Market Flow | Oct 27, 2025

Technical Overview

Weekly / Daily:

• Price has reached the 138.2% Fibonacci extension, aligning with the upper boundary of the long-term impulse zone.

• This region represents a potential profit-taking area within an extended expansion phase.

• The daily structure completed an impulse to the 161.8% Fibonacci target.

• Market currently trades inside a high-probability reaction zone, suggesting risk of corrective flow.

H4:

• Price action shows initial hesitation beneath the prior breakout.

• Intermediate structural support rests near 47,330–47,200, representing the first countertrend target.

H1:

• A defined trigger = 47,488 (red SHORT level) marks potential short confirmation if broken with a 1–2–3 sequence on M15.

• Below this level, the path → 47,333 → 47,171 → 46,998 aligns with visible breakout retests.

Trade Structure & Levels

• Bias: Bearish countertrend short below 47,488

• Trigger = 47,488

• Invalidation = 47,580 (H1 structure high)

• Path → 47,333 → 47,171 → 46,998

• Phase: Countertrend within extended impulse reaching long-term target zone

Risk & Event Context

• Long-term momentum remains bullish, but exhaustion signals at key Fibonacci confluence may induce a corrective phase.

• Watch for volatility spikes near macro releases or equity session opens that could accelerate profit-taking.

Conclusion

US30 sits within its long-term Fibonacci target zone. A confirmed lower-timeframe trigger below 47,488 would validate a short-term countertrend move toward daily breakout levels before broader structure reassessment.

Technical Overview

Weekly / Daily:

• Price has reached the 138.2% Fibonacci extension, aligning with the upper boundary of the long-term impulse zone.

• This region represents a potential profit-taking area within an extended expansion phase.

• The daily structure completed an impulse to the 161.8% Fibonacci target.

• Market currently trades inside a high-probability reaction zone, suggesting risk of corrective flow.

H4:

• Price action shows initial hesitation beneath the prior breakout.

• Intermediate structural support rests near 47,330–47,200, representing the first countertrend target.

H1:

• A defined trigger = 47,488 (red SHORT level) marks potential short confirmation if broken with a 1–2–3 sequence on M15.

• Below this level, the path → 47,333 → 47,171 → 46,998 aligns with visible breakout retests.

Trade Structure & Levels

• Bias: Bearish countertrend short below 47,488

• Trigger = 47,488

• Invalidation = 47,580 (H1 structure high)

• Path → 47,333 → 47,171 → 46,998

• Phase: Countertrend within extended impulse reaching long-term target zone

Risk & Event Context

• Long-term momentum remains bullish, but exhaustion signals at key Fibonacci confluence may induce a corrective phase.

• Watch for volatility spikes near macro releases or equity session opens that could accelerate profit-taking.

Conclusion

US30 sits within its long-term Fibonacci target zone. A confirmed lower-timeframe trigger below 47,488 would validate a short-term countertrend move toward daily breakout levels before broader structure reassessment.

Day trader capitalizing on the expansion phases of emerging trends.

MORE CHARTS & FREE EDUCATION

SUBSCRIBE 🚀 themarketflow.trading

MORE CHARTS & FREE EDUCATION

SUBSCRIBE 🚀 themarketflow.trading

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Day trader capitalizing on the expansion phases of emerging trends.

MORE CHARTS & FREE EDUCATION

SUBSCRIBE 🚀 themarketflow.trading

MORE CHARTS & FREE EDUCATION

SUBSCRIBE 🚀 themarketflow.trading

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.