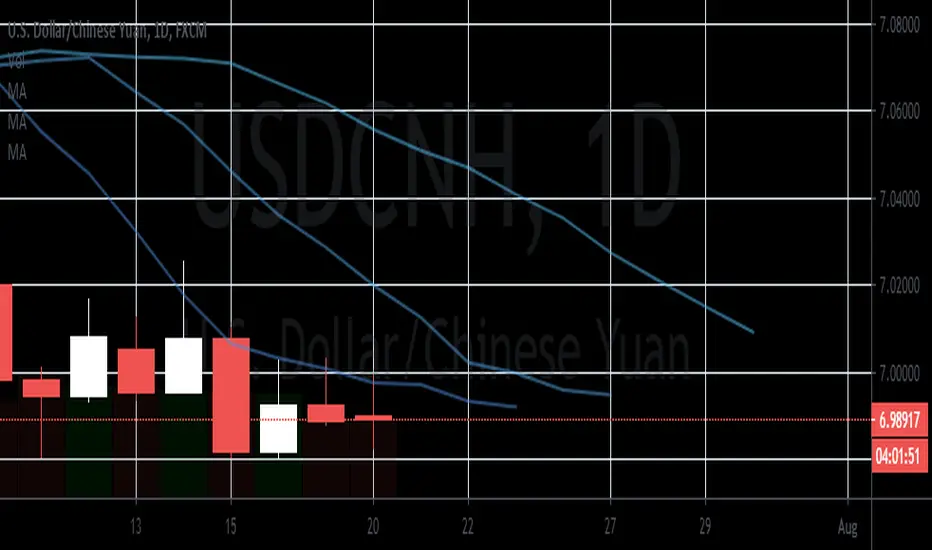

The Chinese yuan continues to advance against the US dollar as the Chinese economy gradually recovers. The USD/CNH trading pair’s prices are widely predicted to remain bearish and possibly reach its support level in the first week of August. Bears are hoping to force prices to the range last seen in early March before the pandemic worsened around the world. The main strength of the Chinese yuan comes from the recent reports that Goldman Sachs says that it sees the currency reinforcing itself against the US dollar in the next 12 months. However, the Chinese yuan’s strength suddenly felt a sudden stop this Monday after the People’s Bank of China announced its official interest rates this morning. Earlier this Monday, the PBoC announced that it has set its 5-year loan prime rate at about 4.65%, leaving it unchanged from a month earlier. Aside from that, the Chinese central bank also left its 1-year loan prime rate unmoved at about 3.85%.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.