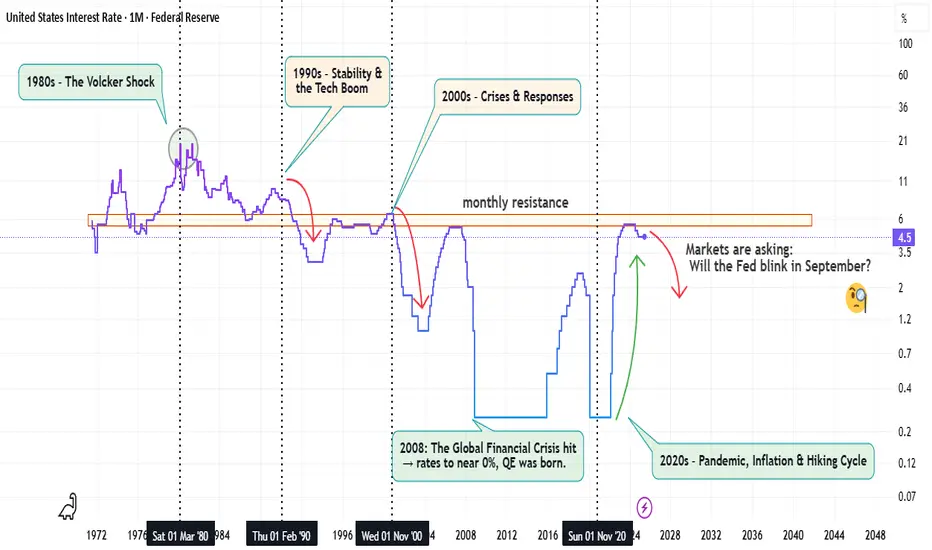

📈 U.S. Interest Rates: From the Volcker Era to Today & Why September Could Be a Turning Point

When people talk about “the Fed,” they often forget just how much its decisions shape every asset class — from stocks and bonds to real estate and crypto. To understand the setup for September 2025, we need to look back. Because history doesn’t repeat… but it sure does rhyme.

🔙 The Journey Since the 1980s

1980s – The Volcker Shock

Paul Volcker took interest rates above 20% to crush runaway inflation. Painful? Yes. But it restored credibility and anchored inflation expectations for decades.

1990s – Stability & the Tech Boom

Rates gradually declined. Cheap(er) credit fueled the U.S. expansion and helped ignite the dot-com bubble.

2000s – Crises & Responses

Early 2000s: Post-dot-com crash, the Fed cut rates sharply.

2008: The Global Financial Crisis hit → rates to near 0%, QE was born.

2010s – The Low-Rate Era

This was the decade of “easy money.” Stocks soared, housing recovered, and crypto emerged in a world shaped by monetary stimulus.

2020s – Pandemic, Inflation & Hiking Cycle

2020: Zero rates + record stimulus.

2022 onward: Inflation surged → the Fed started its most aggressive hiking cycle since the Volcker era.

📊 Where We Stand in 2025

Current rates: at multi-decade highs.

Inflation: cooled off, but still above the Fed’s 2% target.

Growth: showing cracks (manufacturing weakness, slowing jobs data).

Markets are asking: Will the Fed blink in September?

🌍 Why September Matters

Pause Scenario: The Fed holds steady. Markets breathe, risk assets stabilize.

Cut Scenario: If growth data worsens, even a small cut could spark rallies across risk-on assets.

Hike Scenario (unlikely): Would shock markets and hit crypto hardest.

💡 Impact by Asset Class

Stocks: Lower rates = higher valuations. Tech especially sensitive.

Bonds: A cut means yields fall, prices rise.

Dollar: A pause/cut could weaken the dollar → bullish for commodities & crypto.

Crypto: The big winner if liquidity returns. Historically, Bitcoin thrives when real rates fall. Altcoins even more so.

⚡ My Personal View

I don’t see the Fed risking a fresh hike here. Inflation’s not dead, but neither is growth. My base case:

September pause with dovish signals.

First rate cut possible late 2025 if data keeps softening.

For crypto, that means:

Neutral short-term.

Bullish medium-term if liquidity trickles back into the system.

🚀 Every market cycle is shaped by rates. From the Volcker shock to the birth of Bitcoin, the Fed has always been in the driver’s seat. September might not be “the” moment, but it could be the beginning of a major narrative shift.

❓What’s your call — pause, cut, or surprise hike? And how do you see crypto reacting? Drop your thoughts

When people talk about “the Fed,” they often forget just how much its decisions shape every asset class — from stocks and bonds to real estate and crypto. To understand the setup for September 2025, we need to look back. Because history doesn’t repeat… but it sure does rhyme.

🔙 The Journey Since the 1980s

1980s – The Volcker Shock

Paul Volcker took interest rates above 20% to crush runaway inflation. Painful? Yes. But it restored credibility and anchored inflation expectations for decades.

1990s – Stability & the Tech Boom

Rates gradually declined. Cheap(er) credit fueled the U.S. expansion and helped ignite the dot-com bubble.

2000s – Crises & Responses

Early 2000s: Post-dot-com crash, the Fed cut rates sharply.

2008: The Global Financial Crisis hit → rates to near 0%, QE was born.

2010s – The Low-Rate Era

This was the decade of “easy money.” Stocks soared, housing recovered, and crypto emerged in a world shaped by monetary stimulus.

2020s – Pandemic, Inflation & Hiking Cycle

2020: Zero rates + record stimulus.

2022 onward: Inflation surged → the Fed started its most aggressive hiking cycle since the Volcker era.

📊 Where We Stand in 2025

Current rates: at multi-decade highs.

Inflation: cooled off, but still above the Fed’s 2% target.

Growth: showing cracks (manufacturing weakness, slowing jobs data).

Markets are asking: Will the Fed blink in September?

🌍 Why September Matters

Pause Scenario: The Fed holds steady. Markets breathe, risk assets stabilize.

Cut Scenario: If growth data worsens, even a small cut could spark rallies across risk-on assets.

Hike Scenario (unlikely): Would shock markets and hit crypto hardest.

💡 Impact by Asset Class

Stocks: Lower rates = higher valuations. Tech especially sensitive.

Bonds: A cut means yields fall, prices rise.

Dollar: A pause/cut could weaken the dollar → bullish for commodities & crypto.

Crypto: The big winner if liquidity returns. Historically, Bitcoin thrives when real rates fall. Altcoins even more so.

⚡ My Personal View

I don’t see the Fed risking a fresh hike here. Inflation’s not dead, but neither is growth. My base case:

September pause with dovish signals.

First rate cut possible late 2025 if data keeps softening.

For crypto, that means:

Neutral short-term.

Bullish medium-term if liquidity trickles back into the system.

🚀 Every market cycle is shaped by rates. From the Volcker shock to the birth of Bitcoin, the Fed has always been in the driver’s seat. September might not be “the” moment, but it could be the beginning of a major narrative shift.

❓What’s your call — pause, cut, or surprise hike? And how do you see crypto reacting? Drop your thoughts

_____________________________________

🐺 Discipline is rarely enjoyable ,

But almost always profitable 🐺

TElEGRAM CHANNEL : t.me/KIU_COIN

_____________________________________

🐺 Discipline is rarely enjoyable ,

But almost always profitable 🐺

TElEGRAM CHANNEL : t.me/KIU_COIN

_____________________________________

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

_____________________________________

🐺 Discipline is rarely enjoyable ,

But almost always profitable 🐺

TElEGRAM CHANNEL : t.me/KIU_COIN

_____________________________________

🐺 Discipline is rarely enjoyable ,

But almost always profitable 🐺

TElEGRAM CHANNEL : t.me/KIU_COIN

_____________________________________

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.