📈Technical:

MARKET BIAS: Neutral (consolidating at HVN pivot, high-rate sensitivity)

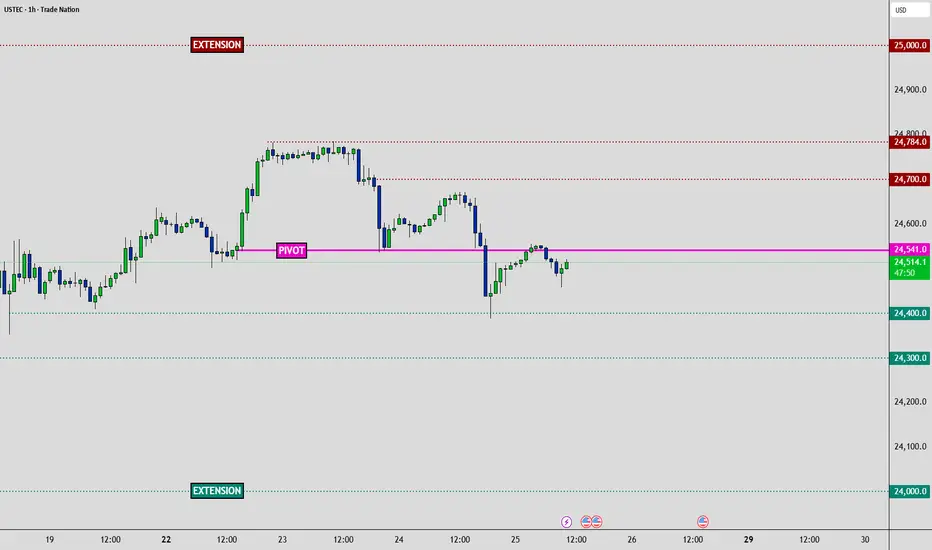

PIVOT ZONE: 24,541 (Exact HVN level)

🥇 Traders Edge - Actionable & Tactical

TRADE SETUPS:

🟧 Risk Warning: Core PCE surprise = 200+ point moves

🟧 Special Risk: High beta to rate moves via PCE

↕️ Bias Flip: Break below 24,400 (bearish) | above 24,700 (bullish)

🟢Long Setup:

• Entry above Pivot | Stop 24,450 | TP: 24,650 | 24,750 | 24,850 - Extended Breakout

🔴Short Setup:

• Entry below 24,400| Stop Above Pivot | TP: 24,300 | 24,000 - Extended Breakdown

🎯KEY LEVELS:

• Strong Resistance: 24,700 | 24,784

• Strong Support: 24,400 | 24,300 | 24,100 | 24,000

🎯PRICE TARGETS:

• Bullish Path: 24,700 → 24,784 → 25,000 (Extended breakout)

• Bearish Path: 24,400 → 24,300 → 24,000 (Extended breakdown)

🚨HIGH-IMPACT EVENTS (48H): (NY Time Zone)

• Sep 25 | 08:30 GDP Q2 Final: 3.3% vs -0.5% → Growth supports tech multiples

• Sep 26 | 08:30 Core PCE MoM: 0.2% vs 0.3% → TECH RATE SENSITIVITY

• Sep 26 | 08:30 Personal Spending: 0.5% vs 0.5% → Tech demand proxy

• Sep 26 | 10:00 Michigan Sentiment: 55.4 → Growth stock appetite

🛑 MASTER RISK EVENT

🟧Friday September 26 | 08:30 (NY Time Zone)

🟧 Core PCE Price Index (MoM) - Forecast: 0.2% vs Previous: 0.3%

🟧 Critical Impact: Fed's preferred inflation gauge determines rate path and USD strength

• Gold: Collapse risk if hot print

• Equities: Rate repricing volatility

• Sectors: Tech rotation sensitivity

⚠️ RISK MANAGEMENT PROTOCOL

• Reduce position sizes before Friday 08:30 EDT

• USD strength reversals impact Gold heavily

• Tech high beta to rate repricing

• Month-end flows amplify volatility

________________________________________

Analysis based on Session Volume POC clusters and HVN methodology

MARKET BIAS: Neutral (consolidating at HVN pivot, high-rate sensitivity)

PIVOT ZONE: 24,541 (Exact HVN level)

🥇 Traders Edge - Actionable & Tactical

TRADE SETUPS:

🟧 Risk Warning: Core PCE surprise = 200+ point moves

🟧 Special Risk: High beta to rate moves via PCE

↕️ Bias Flip: Break below 24,400 (bearish) | above 24,700 (bullish)

🟢Long Setup:

• Entry above Pivot | Stop 24,450 | TP: 24,650 | 24,750 | 24,850 - Extended Breakout

🔴Short Setup:

• Entry below 24,400| Stop Above Pivot | TP: 24,300 | 24,000 - Extended Breakdown

🎯KEY LEVELS:

• Strong Resistance: 24,700 | 24,784

• Strong Support: 24,400 | 24,300 | 24,100 | 24,000

🎯PRICE TARGETS:

• Bullish Path: 24,700 → 24,784 → 25,000 (Extended breakout)

• Bearish Path: 24,400 → 24,300 → 24,000 (Extended breakdown)

🚨HIGH-IMPACT EVENTS (48H): (NY Time Zone)

• Sep 25 | 08:30 GDP Q2 Final: 3.3% vs -0.5% → Growth supports tech multiples

• Sep 26 | 08:30 Core PCE MoM: 0.2% vs 0.3% → TECH RATE SENSITIVITY

• Sep 26 | 08:30 Personal Spending: 0.5% vs 0.5% → Tech demand proxy

• Sep 26 | 10:00 Michigan Sentiment: 55.4 → Growth stock appetite

🛑 MASTER RISK EVENT

🟧Friday September 26 | 08:30 (NY Time Zone)

🟧 Core PCE Price Index (MoM) - Forecast: 0.2% vs Previous: 0.3%

🟧 Critical Impact: Fed's preferred inflation gauge determines rate path and USD strength

• Gold: Collapse risk if hot print

• Equities: Rate repricing volatility

• Sectors: Tech rotation sensitivity

⚠️ RISK MANAGEMENT PROTOCOL

• Reduce position sizes before Friday 08:30 EDT

• USD strength reversals impact Gold heavily

• Tech high beta to rate repricing

• Month-end flows amplify volatility

________________________________________

Analysis based on Session Volume POC clusters and HVN methodology

Note

📌NASDAQ Trading Plan - Updated parameter calibration from yesterdayTrader’s Edge:

🎯Nasdaq sits on a critical decision point – breakout or rejection here will drive the next directional wave.

USTEC (Nasdaq 100)

Pivot Zone:

24,300 – 24,400

Bias Flip:

Bullish above 24,400 / Bearish below 24,300

Bearish Targets: 24,000 → 23,800 → 23,600

Bullish Targets: 24,600 → 24,800 → 25,200+

Invalidation: Re-entry back into pivot zone negates bias flip

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.