Technical Analysis (TA) Overview:

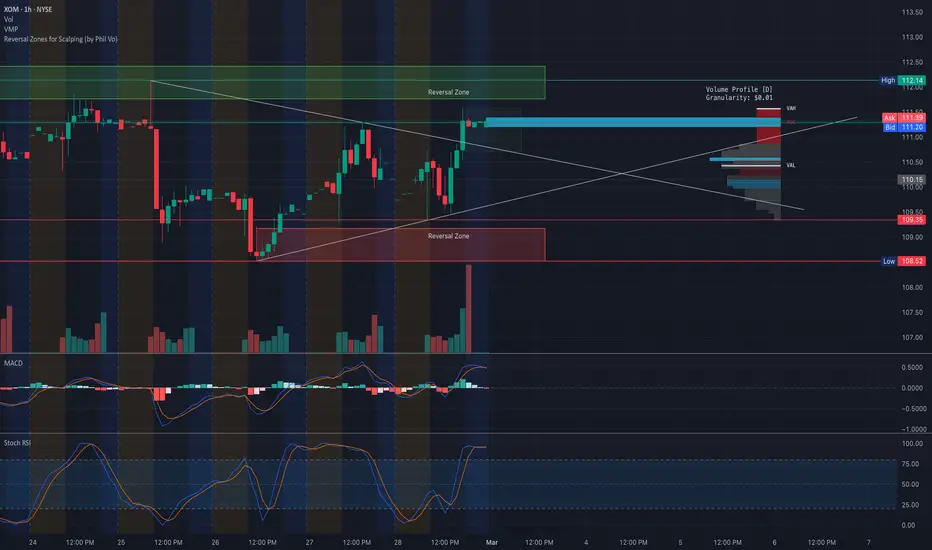

📌 Price Action: XOM is testing a key reversal zone, showing strong buying pressure after breaking out from a descending trendline. The price is now consolidating near resistance.

📌 Support & Resistance:

Resistance Levels: $112.87 (Major Resistance), $115 (Call Wall)

Support Levels: $109 (High Volume Node), $108 (Put Wall)

📌 Indicators:

MACD: Bullish momentum building, but still in a weak positive zone.

Stoch RSI: Overbought levels (95+), suggesting a potential short-term pullback before continuation.

📌 Volume Profile:

High liquidity around $111-$112, indicating a potential battle between buyers and sellers.

GEX (Options Analysis) - Key Insights:

📌 Gamma Exposure (GEX): Positive GEX at higher levels suggests dealers may hedge by selling, acting as resistance.

📌 Call Walls (Resistance Levels):

$112-$115 (Highest positive GEX zone) → Likely resistance, where price action might slow down.

$120 (Extreme Call Wall) → If momentum sustains, this could be a long-term target.

📌 Put Support Levels:

$109-$108 → Strong support, if broken, could trigger a sell-off to $105 (next put support).

📌 Options Sentiment:

IV Rank (IVR): 32.7 → Moderate implied volatility, options not overly expensive.

Calls 11.3% → Mild bullish positioning in the options market.

Potential Trade Setups:

✅ Bullish Scenario: If XOM holds above $111, a breakout toward $115+ is possible.

❌ Bearish Scenario: Failure to hold $109 could send XOM back to $105-$106.

💡 Suggestion: Watch for a retest of $109 as support before a breakout move!

📌 Final Thoughts:

Short-term traders: Look for confirmation above $111 for a quick move to $115.

Swing traders: Ideal entry on a pullback to $109-$110, targeting $115+.

Options traders: A breakout over $112 with rising call positioning could fuel momentum.

📢 This analysis is for educational purposes only and does not constitute financial advice. Always do your own research before making trading decisions! 🚀

📌 Price Action: XOM is testing a key reversal zone, showing strong buying pressure after breaking out from a descending trendline. The price is now consolidating near resistance.

📌 Support & Resistance:

Resistance Levels: $112.87 (Major Resistance), $115 (Call Wall)

Support Levels: $109 (High Volume Node), $108 (Put Wall)

📌 Indicators:

MACD: Bullish momentum building, but still in a weak positive zone.

Stoch RSI: Overbought levels (95+), suggesting a potential short-term pullback before continuation.

📌 Volume Profile:

High liquidity around $111-$112, indicating a potential battle between buyers and sellers.

GEX (Options Analysis) - Key Insights:

📌 Gamma Exposure (GEX): Positive GEX at higher levels suggests dealers may hedge by selling, acting as resistance.

📌 Call Walls (Resistance Levels):

$112-$115 (Highest positive GEX zone) → Likely resistance, where price action might slow down.

$120 (Extreme Call Wall) → If momentum sustains, this could be a long-term target.

📌 Put Support Levels:

$109-$108 → Strong support, if broken, could trigger a sell-off to $105 (next put support).

📌 Options Sentiment:

IV Rank (IVR): 32.7 → Moderate implied volatility, options not overly expensive.

Calls 11.3% → Mild bullish positioning in the options market.

Potential Trade Setups:

✅ Bullish Scenario: If XOM holds above $111, a breakout toward $115+ is possible.

❌ Bearish Scenario: Failure to hold $109 could send XOM back to $105-$106.

💡 Suggestion: Watch for a retest of $109 as support before a breakout move!

📌 Final Thoughts:

Short-term traders: Look for confirmation above $111 for a quick move to $115.

Swing traders: Ideal entry on a pullback to $109-$110, targeting $115+.

Options traders: A breakout over $112 with rising call positioning could fuel momentum.

📢 This analysis is for educational purposes only and does not constitute financial advice. Always do your own research before making trading decisions! 🚀

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.