BTC 65-70K IS VITAL FOR BULLSMorning folks,

So, as we suggested last time, we're at 70K. Today we talk about big picture. Recent action tells two things. First is - long-term upside reversal, whenever it will happen, it takes "W" shape, not "V" one. Because long-term volatility and oversold level is broken. DiNapoli calls it as VOB (Volatility Breakout) trade.

Second - market now stands at vital long-term area for bulls. This is 66K. Because this is Yearly Pivot Support 1. Downside breakout means that major upside trend is broken. Besides, this is previous top and consolidation level. Downside breakout leads BTC in area of 50's with 57K as the first target.

But everything is so bad. Chances exist, so let's just keep watching. First - on our H&S pattern on 4H chart.

Since market stands at the targets that we specified last time. I set "neutral" mark for this update. But, overall context is bearish of course.

Daily Charts

Odds suggest pullback out from 70-75KMorning folks,

So, we're here. As we said - BTC will drop and it has dropped. Now it is around 75K, but daily picture and some downside extensions suggest that it could reach ~70K area . If course it would be nice to catch it right at the bottom. But, generally speaking, we're in an area of 70-75K where odds on pullback are high.

If everything goes with our initial plan - we should get reverse H&S pattern with 100-105K target. But, this is next question.

Now, we just need to keep an eye on 1H chart trying to not miss potential bullish reversal patterns. That is what we're going to do now...

In the next 1-2 weeks, the price is between 4600-5200.In the next 1-2 weeks, the price is between 4600-5200.

Gold spot prices fluctuated wildly last week, falling from a high of $5,602 on Thursday, January 29th, to a low of $4,679 on Friday, January 30th, a difference of approximately $900, marking the largest price swing since 1983. Looking at the daily candlestick chart, Friday's candlestick has a long lower shadow, indicating strong buying support below $4,800. The key level to watch in the first week of February is the psychological support level of $4,800, while the resistance level of $5,000. In the next 1-2 weeks, prices are unlikely to reach new highs, and are expected to fluctuate between $4,600 and $5,200.

H4: As shown in the chart, the long lower shadow on the last candlestick of the H4 pattern indicates support at $4800. However, a sharp drop will likely create selling pressure above $5000 due to buying pressure from the previous 1-2 weeks. In the coming days, a long position can be considered primarily in the $4580-$4820 range. Short positions can be considered around the $5000 psychological level and the $5250 resistance zone. See the strategy below for details.

H4 Strategy:

Buy Zone @ 4580 - 4820

SL: 40-80, TP: 120-240

Sell Zone 1 @ 4960 - 5080

SL: 40-60, TP: 120-180

Sell Zone 2 @ 5200 - 5300

SL: 40-60, TP: 120-180

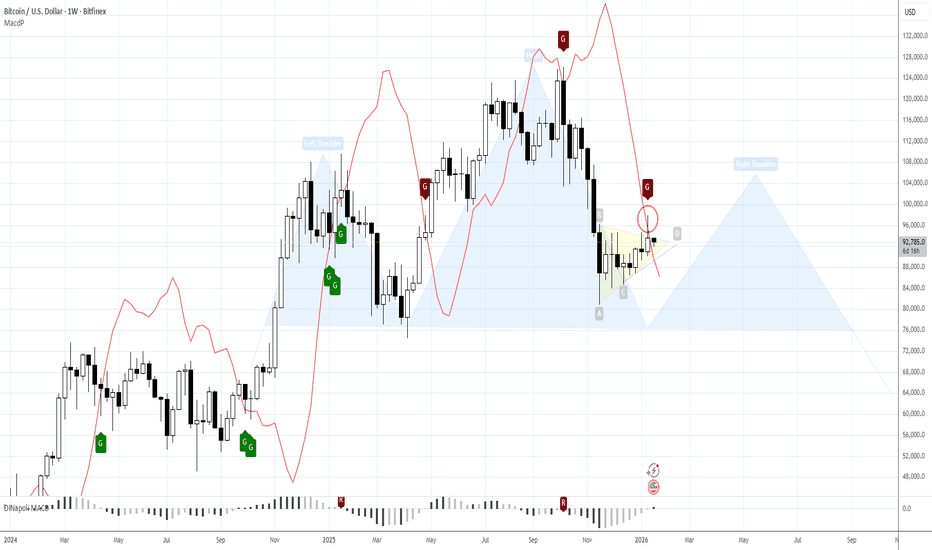

3-DRIVE SEEMS MORE PROBABLE NOWMorning folks,

So, everything goes with the plan. Congrats, this week we could get 3rd grabber in a row on weekly chart, that suppose downside acceleration. Everything mostly stands the same, but in the light of recent events, for me 3-Drive pattern down to 85K now looks more probable than reverse H&S, discussed last time.

EVen more, I'm not sure that market will reverse on 85K. Some reaction - maybe, but real reversal hardly likely...

BTC IS BEARISH UNTIL 100K WILL BE BROKEN UPMorning folks,

So, our plan is working perfect. Once we've got 1st weekly bearish grabber, last week we've got another one . As we explained last time, Japan is the major reason of BTC sell-off now. And there is not light out of the woods yet.

It means that currently bullish chances look phantom, only if US will make political decision to help Japan. Yes, we could get some intraday spikes, driven by BlackRock, Strategy and Co, but they will be short term, like last week.

To change the sentiment market has to erase grabbers, and move above 100K area. If we get something like H&S on the picture - this is quite another tune. Then, yes, bulls could return control over the market.

But for now, completion of downside XOP at 78K on daily chart looks more probable. So, we consider no longs by far. And watching for rallies for possible short entry.

EVERYTHING WITH THE PLANMorning folks,

Last time we in details explained why our view is bearish and that we should be prepared for collapse. But the recent leg is just a beginning. Although we keep mid term bearish context intact, in a nearest few sessions we count on upside bounce. Because it fits to our plan of 4H H&S Shape .

On 1H chart we see reversal pattern, that suggest reaching of 92.5-93K level. We doesn't call you to buy, although this is not forbidden. But our major context is bearish, so we mostly watch for this pattern as a chance to get good short entry later...

I mark this update as "bullish", since the next one comes on Monday. But you've got an idea...

SUI Daily OTE Rejection - Pin Bar Signal Toward SSL and FVGs📝 Description

SUI on Daily timeframe is trading inside a bearish HTF structure and has now retraced into the 0.618–0.786 OTE zone, where a clear FVG is present. Price reaction in this area suggests weakening upside momentum rather than acceptance above value.

________________________________________

📈 Analysis (Scenario-Based | Non-Signal)

If the latest daily candle closes as a pin bar within the 0.618–0.786 zone and inside the FVG, downside probability increases. This behavior would signal rejection from premium, favoring a bearish rotation toward lower liquidity.

Downside Expectation:

• Draw toward lower FVGs (1.780 and 1.535)

• Targeting Sell-Side Liquidity (SSL) below recent lows

• Move classified as liquidity-driven continuation, not a trend change

________________________________________

🎯 ICT & SMC Notes

• Confluence of OTE (0.618–0.786) with reversal FVG

• Pin bar close = premium rejection

• Bias shifts toward SSL draw

________________________________________

🧩 Summary

A pin bar close on D within the 0.618–0.786 OTE and reversal FVG strengthens the case for a bearish continuation. Under this condition, price is likely to rotate lower toward FVG inefficiencies and SSL, aligning with the dominant HTF bearish framework.

________________________________________

🌍 Fundamental Notes / Sentiment

SUI remains risk-sensitive. Any return of risk-off or USD strength can speed up the SSL draw after rejection from the 0.618–0.786 OTE. In a risk-on environment, downside may stay corrective, D close confirmation remains key.

________________________________________

⚠️ Risk Disclosure

Trading involves substantial risk and may result in capital loss. This analysis is for educational purposes only and does not constitute financial advice. Always apply proper risk management, predefined stop-loss levels, and disciplined position sizing aligned with your trading plan.

Natural Gas – Trend Shift in Progress?After being bearish bearish for a while, Natural Gas has broken out of the descending red trendline, signaling a clear shift in momentum from bearish to bullish.

What stands out here is how price reacted after the breakout. Instead of selling off again, it held above the recent support zone and started building higher structure.

As long as this new bullish structure holds, the bias remains to the upside, with room for continuation toward higher levels. Any pullbacks that stay above support are, for me, opportunities to watch.

⚠️ Disclaimer: This is not financial advice. Always do your own research and manage risk properly.

📚 Stick to your trading plan regarding entries, risk, and management.

Good luck! 🍀

All Strategies Are Good; If Managed Properly!

~Richard Nasr

BTC WEEKLY BEARISH GRABBER IS SETMorning folks,

Today a short update, as last time we explained our position in details. So, the clarity has come, we've got our bearish grabber on weekly chart. This pattern suggests drop back to 76-80$ K lows within a few weeks.

Now we consider no longs. From fundamental point of view, appearing of this pattern is quite logical now. Geopolitical tensions are raising and demand for high risk assets is dropping. BTC is one of the most risky assets with questionable potential return. So, it is not a surprise that it is under pressure. Clarity Act has not passed the Senate and postponed...

So, right now we rather watch for chances to sell, at least until this pattern holds.

98K IS DONE. BUT IT IS NOT SIMPLE PICTUREMorning folks,

BTC market now is becoming not suitable for intraday trading, especially with the high leverage level. By our opinion it is not a "free" market any more. Recent rally is a clear example of market makers manipulation, as you do not see this type of action on any other market. Besides, dollar even raised in those moment. Hardly BTC was so excited by CPI numbers. So the rally was without any reasons at all. Only if sudden liquidity injection happened and everybody run to buy crypto...

Anyway we suggest that BTC looks more or less natural only on long-term charts and call to not use a big leverage on this market.

Now BTC has completed AB=CD target on daily chart. But it doesn't mean yet that we're in upside reversal. We have very tricky combination, when BTC stands at strong resistance and if it closes the week under 95K area, we will get bearish grabber on weekly chart .

Thus, we do not exclude yet the action back to 75-76K lows. It means that right now we see nothing to do. For bulls it is late already as price stands at resistance and target is done. While for bears it is a bit early as need to see the market reaction first.

Tron continuing to climb the measured move lineUsually when you see a measured move line treated like a staircase by price action and by this many consecutive daily candles probability is good that the breakout will be validated. If so, the target for this one is around 43-44 cents. *not financial advice*

BTC LOOKS WEAKMorning folks,

So, as we suggested, the pullback from 90K area has happened. At the same time, our base case position is deeper action. Even upward bounce to 95-96K resistance will be still an AB=CD pullback shape. Besides, now we're not sure that we will get it at all.

As we said last time, we still keep on the table scenario with drop back to 75-78K lows before real upside reaction could start. Aggressive US administration rhetoric about Venezuela, Cuba, Iran, Greenland etc makes investors nervous and keep demand for safe haven. This makes additional pressure on BTC.

So, currently action around 90K support looks more like upside AB-CD bounce rather than real upside reversal. In current circumstances we do not want to buy.

NZDUSD - Bears Brewing at a Critical Intersection!!!📉NZDUSD has been moving inside a clear bearish structure , with lower highs forming along the orange descending trendline.

⚔️Price is now approaching a major confluence area where the upper orange trendline meets the green resistance zone, a level that has repeatedly acted as a ceiling.

As price retests this intersection, we will be looking for trend-following short setups, expecting sellers to defend this area and potentially drive price back downward within the bearish cycle.

A strong breakout above the trendline would invalidate the short bias, but unless that happens, the bears remain in control.

Are you seeing the same reaction zone on your charts? Let me know 👇

⚠️ Disclaimer: This is not financial advice. Always do your own research and manage risk properly.

📚 Stick to your trading plan regarding entries, risk, and management.

Good luck! 🍀

All Strategies Are Good; If Managed Properly!

~Richard Nasr

BTC KEY TO DIRECTIONMorning folks,

As we said last time, the bearish scenario is not off the table. In fact, market now stands in a big triangle which is the key. BTC now is challenging 90K support. If it will be broken, the next is the last one around 88K. Downside breakout will open road to 75-78K lows again.

Now I do not see any good buying opportunities and prefer to watch for market reaction on major support levels.

BTC 97-98K is possibleMorning folks,

Just we talked about bearish signs last time, BTC immediately has shown upside bounce. But I'm hurry up to disappoint you that bearish context is not off the table yet, say on weekly chart.

BTC shows splashes every time when some liquidity is injected. We know what has happened on 31 December and 2nd of January. RRP activity by US Banks and 75+Bln from the Fed. Obviously some part appears on crypto market.

This makes us consider upside AB=CD and "222" Sell pattern with possible target around 97-98K area. At the same time, AB-CD shape doesn't let us to say that bearish tendency is broken. It might be just a local retracement.

For position taking I would keep an eye on 90K support area. If BTC will reach 98K - we will think what to do next. But, as it can collapse at any moment as it has shown previously, let's just see what will happen

XRP makes big moves -LONG-DAILY-VIEW-Hello all 🌍😀🙋♂️🙋♀️

Thank you so much for coming today 🌞

Let's dive right in 🏄♂️🏄🌊⏬👇🐼

I am and have been extremely bullish on XRP

🐮🙋♀️🙋♂️WHY?☮️💡🤯

FUNDAMENTALLY:

💠Deflationary in nature🍃 the more XRP that is burned (every transaction, results in a very small fraction of burned token) the more it pushes price of XRP up naturally -supply and demand-

💠XRP is ranked top 5 fastest transaction times of all cryptocurrencies (3-5 seconds)

💠The SEC tried to sue XRP's creator Ripple in 2020 for selling XRP to institutional investors, the lawsuit ended in a 'permanent' injunction against XRP selling to institutions. This could be considered good and bad

💠August 2025 SEC dropped the case and both parties dismissed their appeals

💠 The lawsuit of 2020 didn't stop XRP from outperforming, XRP is currently top 5 cryptocurrencies market cap rating, sitting at 💲130 Billion total (not circulating)

Let's dive in, to the next look 🔍🤸🤸♂️💭⏬🐼

TECHNICALLY:

NOVEMBER 3rd 2023 , XRP price went from .48 cents to 2.9 on DECEMBER 3rd

a 490 percent 💲price increase in just 1 month 🤯 That's a bullish and QUICK🏃♀️🏃♂️💨 jump ⏬⏬🔽👇

⭐👀📍

We have currently made a break from a bearish🐻 descending triangle📐 and it is a strong break at that 💥

If we can continue to gain support 💪 and turn these resistances into fuel ⛽ without getting rejected, XRP price could see some of our bullish 🐂🎯 targets, listed above 📈📉

Let's see!

⌚⌛👀🐶📌😀

Thank you for stopping by and always remember 👇👇

🫡🐴🐲🐸🤖👻👽🙍♂️🙍♀️🫡

🛑🛑🛑This is not financial advice🛑🛑🛑 Above are approximate targets based on fibs and major trend lines etc. I always recommend looking at multiple charts when making a big investment. Always have a stop loss ✋🛑💲 set🆗

Any thoughts 💭💡, questions 🙋♀️🙋♂️❓, good 👍, bad👎, happy 😄 or sad 😥, in the comments always welcome.

Jazerbay 🌠

Does it have any energy left?BTL sending out mixed signals on the daily chart. Looks like a bullish channel but its starting to look like a possible death cross within the next 2 weeks. Expecting a bounce back to the 50ema, then it could be time to flip the coin and enter the market. Time will tell, but not financial advise, so its not.

BTC Looks Heavy...Happy New Year, Folks!

I hope you have a good time... so, BTC... looks heavy by my mind. Following to the swings structure it shows inability to return back to 94K area. First it was not able to proceed higher, showing too deep retracement. Now it stands flat under 90K.

On daily chart, with bullish MACD direction it starts reminding a bearish dynamic pressure, suggesting downside breakout. Besides, on weekly chart, consolidation is taking the shape of the pennant, which is also bearish.

Situation could change if BTC somehow will break above 91-92K area. In this case bearish pressure pattern will be cancelled. But right now, it seems that chances on re-testing of 80K lows look better. We do not consider any new longs by far.

Finger crossed for BTC 92.5K targetMorning folks, hopefully you've rest well.

Ok, BTC is started upward action, as we discussed, although not without adventures. Price action was very choppy on a think market. Now it seems, we have some impulse and hope that it will be enough at least until 92.5K target...

If you're interested with this setup, watch for 89.20K and 88.50K support levels to make a decision on entry. If BTC drops under 87.4K lows and erases the rally - deeper bearish action will happen. So, this fast short-term setup will be totally destroyed.

Take care,

S.

86-87K is still a BTC Red lineMerry Xmas, folks!

So, last time we said that signals are mixed but we could keep an eye on 86-87K support area. BTC will keep chances on upward action until it holds. And... it still holds.

Maybe this is just a result of a thin Xmas market, but BTC tries to form a reversal pattern here. Overall setup doesn't look fascinating, context is weak. But, at the same time, the cash risk is very small, dealing with this H&S pattern here. So, that's the only stuff that I want to share with you today.

EURAUD - Rally Into Resistance or Setup for Continuation?📉EURAUD remains structurally bearish , with price still respecting the broader descending trendline.

The recent bounce is corrective in nature and has brought price back into a key supply zone, right at the intersection with the upper trendline.

This area is critical.

⚔️As long as price remains capped below this confluence , the higher-timeframe bias stays bearish. This is exactly the type of zone where trend-following shorts become attractive — not blindly, but through confirmation on lower timeframes.

What matters here is not the level alone, but the reaction:

rejections, momentum loss, and lower-timeframe bearish structure will be the trigger.

If sellers defend this intersection, continuation to the downside remains the higher-probability scenario.

Will sellers step in again at the trendline, or will buyers surprise? 🤔

⚠️ Disclaimer: This is not financial advice. Always do your own research and manage risk properly.

📚 Stick to your trading plan regarding entries, risk, and management.

Good luck! 🍀

All Strategies Are Good; If Managed Properly!

~Richard Nasr

BTC IS BALANCING. 91K Bounce is possible.Morning folks,

Last time we decided to stay aside until some signs of stabilization will appear. Now I can't say, that BTC picture looks inspiring but, with coming the new Fed QE tranche this week for ~7 Bln and thin pre-Xmas market, it quite possible to show the minor bounce at least.

I would consider ~91K as the target point against "C" point lows. If C point will be broken we get strong downside action. In some degree, BTC has no option but to start upside action to keep intraday bullish context.

"Wild card" BTC SignalsMorning folks,

So BTC collapsed as we suggested last week. Just based on its performance and inability to break 94K resistance. On weekly chart it looks like re-testing of 78-80K is on the table still. Downside triangle breakout is also not a best sign, including recent spike after market manipulations...

Now price remains at 5/8 FIb support and even small bullish grabbers are forming around. Personally I do not want to buy with such a background.

But, if you're ready to take this risk (which I'm not), this setup has some attractive moments. First is - close stop placement, low cash risk, just under the bottom. Second - a lot of uncertainty, with BoE, ECB and especially BoJ later, and yes, CPI... so, maybe somebody will tell or do something that push BTC higher. THat's why I call it as "Wild card" scenario. Do we have bullish background? No. Could BTC still jump occasionally? Yes. So, this is a headache for you today ;)

TAke care. S.