Top-Down Analysis Strategy: How I Open and Manage TradesLearn how I use top-down analysis from senior to junior timeframes to find high-probability entry points and confidently follow through on trades.

On the weekly chart, I identify point A and the presumed point B — this is my idea. Then, gradually shifting through the timeframes, I need to confirm this idea. I get confirmation when volume appears on the chart.

On the daily chart, I note the formation of a new trading range, which arises as a result of the interaction of the price with the key level. I determine the POI in the form of a daily FVG — my idea is confirmed, and the price is ready to move towards point B.

I also note the daily SNR as a potential zone of interest. If the price reacts to the SNR, it will mean that I am working in a strong trend. If the reaction occurs on the FVG, the movement simply continues along the trend.

If you are interested in the topic of working in ranges, write in the comments — I will definitely cover it.

As a result of the daily SNR test, the price confirms the presence of volume through the formation of a 4-hour True SNR. You can open a position from it with a limit order with a target beyond point B and fix the risk/profit ratio at 1:2.

If you found this article interesting and my method useful, I would appreciate your support — please like, share, and help promote this article so that it reaches more traders.

SNR

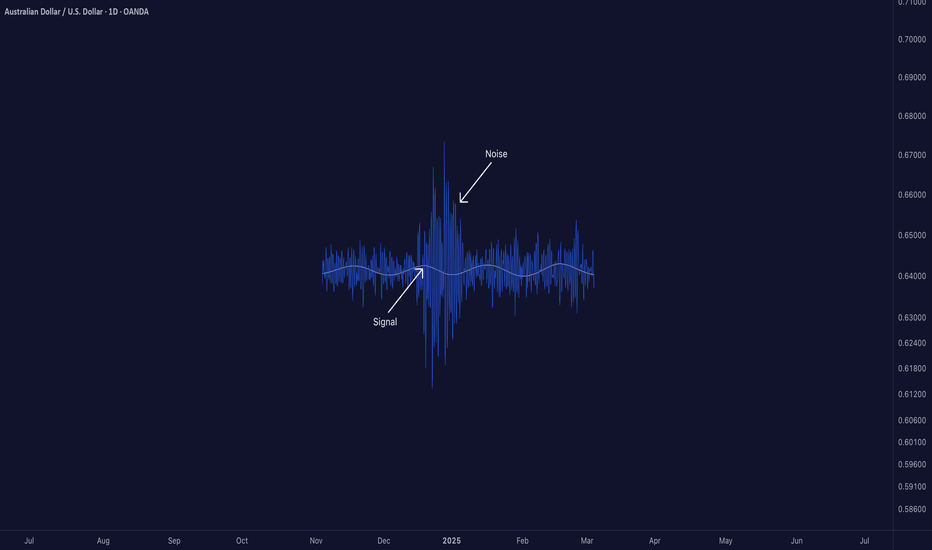

Signal-to-Noise Ratio: The Most Misunderstood Truth in Trading█ Signal-to-Noise Ratio: The Most Misunderstood Truth in Quant Trading

Most traders obsess over indicators, signals, models, and strategies.

But few ask the one question that defines whether any of it actually works:

❝ How strong is the signal — compared to the noise? ❞

Welcome to the concept of Signal-to-Noise Ratio (SNR) — the invisible force behind why some strategies succeed and most fail.

█ What Is Signal-to-Noise Ratio (SNR)?

⚪ In simple terms:

Signal = the real, meaningful, repeatable part of a price move

Noise = random fluctuations, market chaos, irrelevant variation

SNR = Signal Strength / Noise Level

If your signal is weak and noise is high, your edge gets buried.

If your signal is strong and noise is low, you can extract alpha with confidence.

In trading, SNR is like trying to hear a whisper in a hurricane. The whisper is your alpha. The hurricane is the market.

█ Why SNR Matters (More Than Sharpe, More Than Accuracy)

Most strategies die not because they’re logically flawed — but because they’re trying to extract signal in a low SNR environment.

Financial markets are dominated by noise.

The real edge (if it exists) is usually tiny and fleeting.

Even strong-looking backtests can be false positives created by fitting noise.

Every quant failure story you’ve ever heard — overfitting, false discoveries, bad AI models — starts with misunderstanding the signal-to-noise ratio.

█ SNR in the Age of AI

Machine learning struggles in markets because:

Most market data has very low SNR

The signal changes over time (nonstationarity)

AI is powerful enough to learn anything — including pure noise

This means unless you’re careful, your AI will confidently “discover” patterns that have no predictive value whatsoever.

Smart quants don’t just train models. They fight for SNR — every input, feature, and label is scrutinized through this lens.

█ How to Measure It (Sharpe, t-stat, IC)

You can estimate a strategy’s SNR with:

Sharpe Ratio: Signal = mean return, Noise = volatility

t-Statistic: Measures how confident you are that signal ≠ 0

Information Coefficient (IC): Correlation between forecast and realized return

👉 A high Sharpe or t-stat suggests strong signal vs noise

👉 A low value means your “edge” might just be noise in disguise

█ Real-World SNR: Why It's So Low in Markets

The average daily return of SPX is ~0.03%

The daily standard deviation is ~1%

That's signal-to-noise of 1:30 — and that's for the entire market, not a niche alpha.

Now imagine what it looks like for your scalping strategy, your RSI tweak, or your AI momentum model.

This is why most trading signals don’t survive live markets — the noise is just too loud.

█ How to Build Strategies With Higher SNR

To survive as a trader, you must engineer around low SNR. Here's how:

1. Combine signals

One weak signal = low SNR

100 uncorrelated weak signals = high aggregate SNR

2. Filter noise before acting

Use volatility filters, regime detection, thresholds

Trade only when signal strength exceeds noise level

3. Test over longer horizons

Short-term = more noise

Long-term = signal has more time to emerge

4. Avoid excessive optimization

Every parameter you tweak risks modeling noise

Simpler systems = less overfit = better SNR integrity

5. Validate rigorously

Walk-forward, OOS testing, bootstrapping — treat your model like it’s guilty until proven innocent

█ Low SNR = High Uncertainty

In low-SNR environments:

Alpha takes years to confirm (t-stat grows slowly)

Backtests are unreliable (lucky noise often looks like skill)

Drawdowns happen randomly (even good strategies get wrecked short-term)

This is why experience, skepticism, and humility matter more than flashy charts.

If your signal isn’t strong enough to consistently rise above noise, it doesn’t matter how elegant it looks.

█ Overfitting Is What Happens When You Fit the Noise

If you’ve read Why Your Backtest Lies , you already know the dangers of overfitting — when a strategy is tuned too perfectly to historical data and fails the moment it meets reality.

⚪ Here’s the deeper truth:

Overfitting is the natural consequence of working in a low signal-to-noise environment.

When markets are 95% noise and you optimize until everything looks perfect?

You're not discovering a signal. You're just fitting past randomness — noise that will never repeat the same way again.

❝ The more you optimize in a low-SNR environment, the more confident you become in something that isn’t real. ❞

This is why so many “flawless” backtests collapse in live trading. Because they never captured signal — they captured noise.

█ Final Word

Quant trading isn’t about who can code the most indicators or build the deepest neural nets.

It’s about who truly understands this:

❝ In a world full of noise, only the most disciplined signal survives. ❞

Before you build your next model, launch your next strategy, or chase your next setup…

Ask this:

❝ Am I trading signal — or am I trading noise? ❞

If you don’t know the answer, you're probably doing the latter.

-----------------

Disclaimer

The content provided in my scripts, indicators, ideas, algorithms, and systems is for educational and informational purposes only. It does not constitute financial advice, investment recommendations, or a solicitation to buy or sell any financial instruments. I will not accept liability for any loss or damage, including without limitation any loss of profit, which may arise directly or indirectly from the use of or reliance on such information.

All investments involve risk, and the past performance of a security, industry, sector, market, financial product, trading strategy, backtest, or individual's trading does not guarantee future results or returns. Investors are fully responsible for any investment decisions they make. Such decisions should be based solely on an evaluation of their financial circumstances, investment objectives, risk tolerance, and liquidity needs.

KOG - Identify your zones!Identifying the correct zones and regions for your trading:

Many of our followers will know that not only do we have Excalibur targets, we give the exact levels and price points that we want the price to achieve. What we also do, is show you the boxes (zones) on the chart for the wider community, to help steer you in the right direction. Price action plays a huge part in this and it’s something all traders should learn, however, zones are effective, not only in trading the right way, but knowing when you’re in the wrong way!

Price is a series of test on levels. It creates trends or ranges but will always do the same thing. Once we understand this, we know it's not the market that is the problem, it’s us, the trader. If we learn it's behaviour all we then need to do is make sure our money and risk management is up to scratch. It's never 100%, but if we test a level, it breaks, structure suggests it's going against us, don't hold on to hope, or add more in the direction you intended. Cut the damn thing like it's a poison to your account.

You need to treat this as a business, no matter what your account size. Every day there are large institutions who want to take your money away from you, you’re in this market to take from them and give them as little as possible. You should have a risk model in place, am I going to risk a certain percentage of my account? Am I going to stick to a stop loss of a certain number of pips? Am I going to have a risk reward that makes sense? Your stop loss and risk management plan are your best friend in this market, it allows you to limit the losses and live to trade another day.

The market will give you clues as to what it’s going to do, breaks, tests, and retests. We can plan the move before it happens this way, we know if it breaks a level, that level turns into support or resistance then it’s going to go and test the next level.

Remember:

The market will always give you a chance to get out of a trade if it’s going against you, as traders our ego's take over and we hold on to hope. If you're in a whipsaw and choppy market and in the wrong direction, your safest option, even if it ends up going your way in the end is to get out of it and limit your losses. You can always find another entry point for a better risk reward.

Ego is one of the biggest killers of accounts and works both ways. Hold on to a failing plan it will humble you. Show the market you’re too confident, it will humble you! Know when to trade, know when not to trade, know when you’re in the wrong way and accept defeat!

The example on the chart is showing you a simple 4H timeframe, with the zones in place. We know price will play zones and levels, it has to test these almost to see if it likes that price point or not. It will either break or reject the level.

If it breaks, you will usually see a forceful break, then the retest of the level which turns previous support/resistance into new support/resistance, or it will reject, in which case you will usually find the reversal. When trading with a bias or a target in mind, the market will use these zones (levels) to work within and as traders, we should know that if a level is hit, that’s our target reached, or, if it’s broken, that’s sign that we should either start thinking about managing the trade or getting out of it. In order to plot the levels, you will need to zoom out of the chart. Similar to the ‘Simple trading strategy’ we have shared in the past, you will use the peaks and troughs dragged across to present day, to identify your zones. Why? You may ask! Because the market is historical, the levels are the levels, and “levels don’t lie”.

Concern:

What many traders do, and it’s not their fault, it’s just a lack of education and trading experience, is hold on to trades with huge drawdown. They will place a trade in one direction, price goes against them, instead of implementing a stop loss, they will convince themselves the market will come back to this price, so instead “I’ll turn that into a swing trade”. This is the wrong way to think about the market, especially if you’re an intra-day trader, which most of us are. Shown on the chart, you can see, the level breaks, the level is retested, the retest in confirmed and the price moves away from the level. Once, the retest if confirmed, that’s the market telling you the trader, listen, you’re potentially in the wrong way, and we’re going to test another level higher/lower, so prepare yourself.

This is a really simple way, together with a risk model in place, to limit losses and maintain a healthy account.

Please try it and let us know!

As always, trade safe.

KOG

Synchronicity Of Effort and Result:Synchronicity Of Effort and Result: The one of the supply and demand rule of Wyckoff Trading Method. Analyse the Market Correctly to get an idea about reversals from a level. this Concept Works 95% - 100% If Analysed Correctly.

Note: This is not an investment Advice. Trading Involves High Risk!

Support And Resistance ( How it works ? )Today I decided to make a post on Support And Resistance Levels.. Many New Traders are not Aware of How to Draw Them Accurately .Because U can Draw Unlimited SNR levels Based On Your Physcology

So if You are Interested to Learn about SNR ,, This Post is For you.

Support is As the name suggests,The Area or Line where market drops to certain Level and Take a pause Before Deciding either it should Bounce from there or Keep falling

And Resistance is where market bulls up to certain level where the market resists to go above it..

To classify a Certain Level to Be Support or Resistance, You need to check the level about how many times market stayed to that level and bounced back from it,,

For Us If a market Reacted 2 times Support and 1 times Resistance or Vice Versa and bounced back from there,, That level can be classified as SNR level.

Now you may be thinking Ok thats fine Its easy to locate them on Any chart But how do we trade them?

First of all To enter any trade based on SNR level ,, You need Confirmations on DIfferent Time Frames .. Like if you classify your SNR levels on Daily Chart,

You need to confirm you entry on Shorter TIme frames on H4 or H1,

Lets say You Did analysis : Drawing important SNR levels on Your Favourite Pairs ( Obviously High Vol Pairs , Low Spread ) on Weekend And now you are ready to make some profits out of the market

Now To Enter a trade on those levels.

You look for these kind of Confirmations..

DOuble top on H1 or H4

Harmonic Pattern , H&S

flag , triangle, Wedge patterns etc.

Now the final part is Candlestick Conifrmation

The Most Accurate ones are Hammer , Engulfing candles ( on H4 or H1)

With this kind of analysis You can be Among the Winners ,,

I Know this Post is quite Long Now ,, Still there is lot to discuss,, There is no end of Knowledge , Learning.

IF you like our work and find it helpful in your trading , Please SUpport us with a Thumbs up