TESLA Always Pay YOURSELF! Tsla Stock were you PAID? GOLD Lesson

⭐️I want to go into depth regarding the this topic but it is a long one with PROS & CONS for doing and not doing it.

Every trader must choose what's best for them but you will SEE when I finally get to the write up that MANY OF THE PROS are NOT FINANCIAL but PSYCHOLOGICAL❗️

Another of 🟢SeekingPips🟢 KEY RULES!

⚠️ Always Pay YOURSELF.⚠️

I know some of you chose to HOLD ONTO EVERYTHING and place your STOP at the base of the WEEKLY CANDLE we entered on or the week priors base.

If you did that and it was in your plan GREAT but... if it was NOT that is a TRADING MISTAKE and You need to UPDATE YOUR JOURNAL NOW.

You need to note EVERYTHING. What you wanted to see before your exit, explain why not taking anything was justified to you, were there EARLY exit signals that you did not act on. EVERYTHING.

🟢SeekingPips🟢 ALWAYS SAYS THE BEST TRADING BOOK YOU WILL EVER READ WILL BE YOUR COMPLETE & HONEST TRADING JOURNAL ⚠️

📉When you read it in black amd white you will have YOUR OWN RECORD of your BEST trades and TRADING TRIUMPHS and your WORST TRADES and TRADING ERRORS.📈

✅️ KEEPING an UPTO DATE JOURNAL is STEP ONE.

STUDYING IT IS JUST AS IMPORTANT👍

⭐️🌟⭐️🌟⭐️A sneak peek of the LESSON after will be HOW & WHEN TO ENTER WHEN THE OPEN BAR IS GOING THE OPPOSITE WAY OF YOUR IDEA.👌

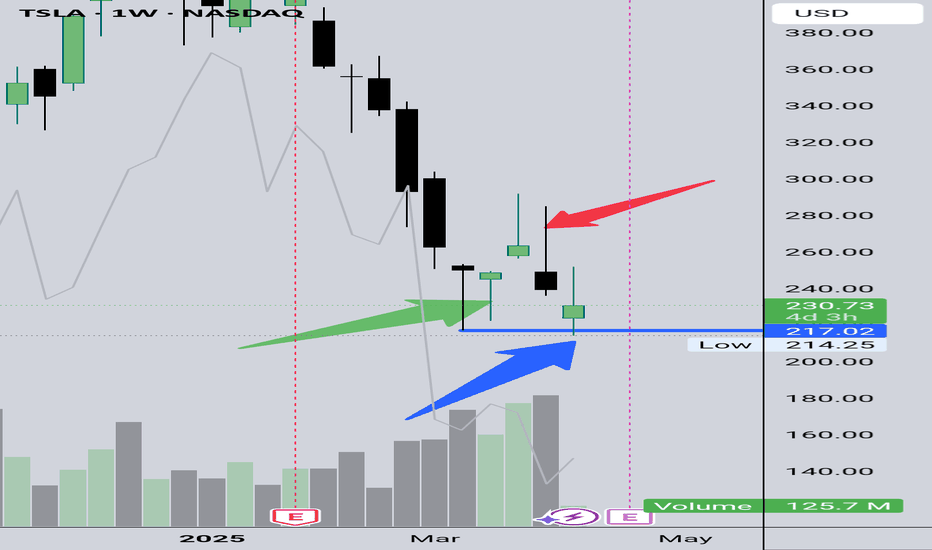

🚥Looking at the TESLA CHART ABOVE you will see that we were interested in being a BUYER when the weekly bar was BEARISH (GREEN ARROW) and we started to consider TAKE PROFITS and EXITS when the (RED ARROW) Weekly bar was still BULLISH.🚥

Tslaanalysis

Ultimate Winrate KDJ Strategy by reset parameter!(best tutorial)You've ever had this happen?

Bought a stock at rock bottom, and it starts to rise a bit, and then the J line turns down on the KDJ indicator, telling you to sell. So, you sell, but then it quickly shoots up, leaving you pretty blue. like you missed out on a fortune. Was the KDJ indicator down?

Nope

Hold tight, cause we're about to see a miracle. By just tweaking a bit the KDJ indicator's parameters, you can nail those short-term highs and be on your way to the success.

So, how do you find the right KDJ indicator parameters?

Stick around, and I'll spill the beans!

First off, why do we need to optimize this lil' parameter?

Well, every stock moves differently cause the folks trading it are different. So, a one-size-fits-all KDJ indicator won’t always work well on every stock at every stage. To up our chances, we gotta tweak those parameters to find the best fit for our stock.

Now, onto the second question: how do you find the right ones?

Let’s go back to the Tesla stock chart.

After changing the KDJ indicator parameters to 74, the sell point lines up perfectly with the peak.

Why 74?

Well, from point A to point B, there’s exactly 74 candles. Why use the number of candles between those two points as the KDJ parameter?

Here’s the crux of it.

The KDJ indicator is a momentum oscillator, calculating the close price at latest candle with the highest and lowest prices of the previous nine candles since the default KDJ parameter is 9.

so If the price breaks above the highest price of those nine candles, it will be constantly giving false sell signals.

So, we need to set the KDJ parameter to the number of candles from the previous high to the low. This way, the highest price and lowest price are not broken.

Then, the KDJ works accurately.

Still lost? Let’s look at another example. Here’s an Apple stock chart.

With the default parameter of 9, we bought after the golden cross, but few days later, it prompt to sell signal, and then the price soared. Feeling furious yet?

But if we set the KDJ parameter to 95, we’d have sold right near the top, securing a nice profit!

Why 95?

Same method: from the highest point A to the lowest point B, there’s 95 candles.

Got it? Ain’t it something?

Check your stocks with this method. Got questions? Leave a comment, and I’ll get back to ya ASAP! Today we focused on using KDJ to find sell points. It’s just as magical for buy points, which I’ll cover in future videos.

So, please follow me and hit that boost bell so you don’t miss out!

Box Trading MasteryBox Trading Mastery. Simply utilize the average movement over a specific period to establish a trading range. Focus on the most recent range. Every time this range is breached, anticipate an equivalent movement in the next range. This is the essence of the 'Box Breakout Strategy,' enabling seamless trading without reliance on external indicators.

You Choose To Make Trading Complicated... Why?You will never control where the market goes next... unless you are a market maker with very deep pockets.

Stop trying to predict where something will be in 6 months and focus on what's happening now.

Your objective as a trader is to manage risk at Distribution/Accumulation points in the markets.

Here we have a chart of tesla.

Custom Candles, Ema Dots Indicator and The Custom RSI

We leverage the candles as confirmation of what price action wants to do as of right now.

If we have strong engulfing candles we NEVER chase.

You need to manage your risk on these compression points.

What we do is focus on the compression points of doji candles as they can shift signs of indecision and potential market exhaustion.

Then we align with the ema dots and rsi for correlation to leave overbought/oversold territory to identify the next major trend.

If you can manage a tight risk on capital on the trend turning points, that is how you win.

You have to risk a little to win big.

If you enter a trend shift and don't set a stoploss and the trend goes against you... that is how a large amount of traders blow their accounts.

You need to understand to manage risk and have the correct setup to identify the best trends in the markets.

It is inevitable that you will catch the next big trend if you play the trends correctly.

Filter out most of the noise and utilize a larger timeframe. Smart money let's their assets work for them over time.

Tesla analysis example of news powerJust sharing here my thoughts on recent news about Tesla and their presentation for a new Cybertruck. Have you noticed when there was all the bad news how windows of Cybertruck was broken and it has looked like Tesla is gonna have a very bad end of the year?

My question is: if you are selling based on news.. whos buying?

Well. Even though news presented it as catastrophic even for Tesla, it has reached just two weeks later its all-time high.

Focus more on technical analysis instead of panic and sell with the crowd based on news.