1INCH/USDT – Test Downtrend Resistance | Breakout or Rejection?1INCH/USDT remains in a medium to long-term downtrend, clearly characterized by a sequence of lower highs and lower lows since the previous peak. Price is currently experiencing a relief rally, moving upward toward a major descending trendline resistance that has historically capped bullish attempts.

This area represents a critical decision zone. Market participants are closely watching whether price will break the trendline or get rejected and continue the bearish structure.

---

Pattern Explanation

Descending Trendline (Bearish Market Structure)

The descending trendline has been respected multiple times, acting as a strong dynamic resistance.

Each previous touch of this trendline resulted in price rejection and continuation to the downside.

Price is now approaching the same trendline again, making this level technically significant.

Potential Bearish Continuation Structure

Overall structure still favors sellers unless a confirmed breakout occurs.

Failure to break above resistance may form a bearish continuation setup, leading to another impulsive drop.

---

Key Levels

Resistance Zones

0.1700 USDT – Minor resistance / reaction zone

0.2035 USDT – Key resistance & trendline breakout level

0.2245 USDT – Strong resistance / confirmation level

0.2700 – 0.2950 USDT – Upper supply zone

0.3540 USDT – Major resistance / previous range high

Support Zones

0.1635 USDT – Short-term support

0.1450 – 0.1330 USDT – Major demand zone

A breakdown below this zone would strengthen the bearish continuation scenario.

---

Bullish Scenario

Price breaks and closes above the descending trendline on the daily timeframe.

Strong confirmation occurs with a daily close above 0.2035 USDT.

This would invalidate the bearish structure and signal a potential trend reversal.

Bullish targets:

0.2245 USDT

0.2700 USDT

0.2950 USDT

Increasing volume during breakout would further support bullish momentum.

Bias: Trend reversal if breakout is confirmed.

---

Bearish Scenario

Price fails to break the trendline and shows rejection (bearish candle / long upper wick).

Rejection around 0.1700 – 0.2035 USDT confirms seller dominance.

Downside targets:

0.1635 USDT

0.1450 USDT

0.1330 USDT

A clean breakdown below support would confirm bearish continuation.

Bias: Bearish continuation if rejection occurs.

---

Conclusion

1INCH/USDT is currently trading at a major technical inflection point. The descending trendline acts as the key level determining the next major move.

Traders should wait for clear confirmation — either a breakout for bullish continuation or a rejection for bearish continuation.

This is a high-risk, high-impact zone, best traded with confirmation and proper risk management.

---

#1INCH #1INCHUSDT #CryptoAnalysis #TechnicalAnalysis #Altcoins #Downtrend #Trendline #SupportResistance #Breakout #Bearish #Bullish #PriceAction

1INCHUSDTPERP

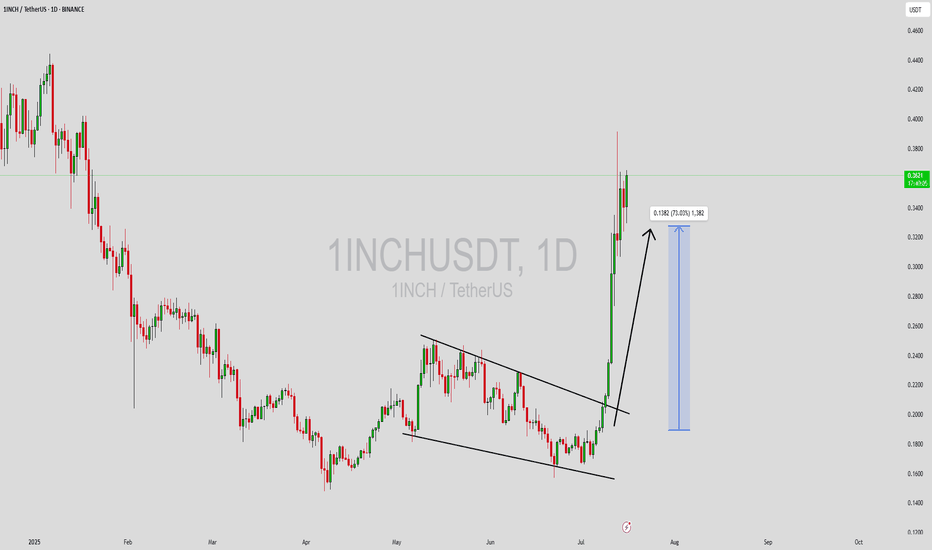

#1INCHUSDT — Accumulation or the Beginning of a Breakdown?#1INCH

The price is moving within an ascending channel on the 1-hour timeframe and is adhering to it well. It is poised to break out strongly and retest the channel.

We have a downtrend line on the RSI indicator that is about to break and retest, which supports the upward move.

There is a key support zone in green at 0.1770, representing a strong support point.

We have a trend of consolidation above the 100-period moving average.

Entry price: 0.1909

First target: 0.1954

Second target: 0.2010

Third target: 0.2080

Don't forget a simple money management rule:

Place your stop-loss order below the green support zone.

Once you reach the first target, save some money and then change your stop-loss order to an entry order.

For any questions, please leave a comment.

Thank you.

1INCH/USDT — Accumulation or the Beginning of a Breakdown?The price of 1INCH is currently trading within a major historical support zone between 0.175 – 0.155 USDT, a level that has repeatedly acted as a key turning point since mid-2024.

Recently, the market revisited this critical zone under strong selling pressure but showed a sharp liquidity wick down to 0.1036 USDT, followed by an immediate recovery — a classic signal of liquidity absorption or a potential accumulation event by larger players.

In other words, this zone represents the final line of defense for buyers — holding above it could trigger a major rebound, while a confirmed breakdown below may lead to deeper capitulation.

---

Structure and Pattern Overview

Overall trend: still bearish, forming a sequence of lower highs and lower lows.

Yellow zone (0.175 – 0.155): a strong demand area that has acted as a reliable support multiple times.

Long wick to 0.1036: a sign of extreme liquidation followed by potential smart money accumulation.

Potential formation: if the price holds this zone and forms a higher low, a double bottom pattern could emerge — a classic early reversal signal.

---

Bullish Scenario

If 1INCH holds above 0.175 – 0.155 and forms a strong bullish 3D candle with rising volume, a potential reversal could begin.

Main confirmation: 3D candle close above 0.19 USDT.

Bullish targets:

0.2346 → first resistance to reclaim.

0.2730 → breakout confirmation level.

0.3515 → primary swing target if structure shifts bullish.

Narrative: this area could serve as a major accumulation base before the next markup phase, signaling that institutional buyers are quietly positioning before a broader trend reversal.

---

Bearish Scenario

If 1INCH closes below 0.155 USDT with strong momentum, the support zone will fail, and sellers will regain full control.

First downside target: 0.1036 (previous wick low).

Below 0.1036: the next psychological area lies around 0.09 – 0.08 USDT.

Narrative: a breakdown here would indicate full bearish dominance and could trigger a capitulation phase before any potential recovery.

---

Market Psychology

The 0.175 – 0.155 USDT zone represents a psychological battleground between fear and opportunity.

Retail traders who panic-sold below 0.16 may have provided the liquidity needed for smart money to accumulate positions.

If volume confirms steady buying interest within this area, we could soon witness the beginning of the next bullish markup phase for 1INCH.

---

Conclusion

1INCH is now standing at one of its most critical levels of 2025.

This is more than just a technical support — it’s the decisive zone for the medium-term trend.

Holding above 0.155 = possible start of a major reversal.

Breaking below 0.155 = potential continuation to 0.1036 or lower.

From this point, the market will decide whether 1INCH enters a strong accumulation phase or dives into its final capitulation stage.

---

#1INCH #CryptoAnalysis #1INCHUSDT #CryptoTrading #AltcoinWatch #ReversalZone #SupportZone #BearishVsBullish #PriceAction #MarketStructure #SwingTrade #LiquiditySweep

1INCH/USDT (3D) — at Demand Zone: Accumulation or Breakdown?Analysis:

The 3-day chart shows 1INCH consolidating tightly within the 0.23–0.25 demand zone, an area that has acted as a critical base since mid-2024.

Every touch of this zone has triggered a strong bullish reaction, proving it’s a key defense area for buyers. However, repeated retests also weaken its strength — making this retest a make-or-break moment for the mid-term trend.

Price is currently moving sideways with declining volatility, suggesting the market is in a final consolidation phase before a major directional move.

This zone will decide whether we see a strong reversal rally or a structural breakdown into new lows.

---

Key Technical Structure

Demand Zone (Major Support): 0.23 – 0.25

Nearest Resistance: 0.27 – 0.30

Higher Resistances: 0.354 → 0.436 → 0.533 → 0.659

Major Support Below: 0.148

---

Price Structure & Pattern

1INCH has been forming a broad horizontal range with multiple retests at 0.23–0.25, signaling potential base accumulation.

However, the macro structure still shows a series of lower highs, keeping the overall trend bearish-to-neutral until a confirmed breakout occurs.

Long downside wicks around 0.23 indicate liquidity sweeps — a common sign of institutional accumulation before a major move.

---

Bullish Scenario

Confirmation:

A strong 3D candle close above 0.30 — confirming breakout from the range.

Implication:

Marks the end of accumulation and the beginning of a potential mid-term reversal structure.

Upside Targets:

TP1 → 0.354 (mid-range top)

TP2 → 0.436 (major supply)

TP3 → 0.533 (trend reversal confirmation)

TP4 → 0.659–0.703 (extended target)

Entry Strategy:

Conservative: wait for a 3D close above 0.30 and enter on retest.

Aggressive: enter near 0.23–0.25 upon bullish rejection, with a tight stop below 0.23.

Stop Loss: below 0.23 (breakdown invalidates setup).

---

Bearish Scenario

Confirmation:

A 3D close below 0.23 confirms structural breakdown from the base range.

Implication:

Signals a shift from accumulation to redistribution, resuming the broader downtrend.

Downside Targets:

0.20 → 0.18 (intermediate)

0.15 (major psychological and technical support)

Strategy:

Look for bearish rejection around 0.27–0.30 for short setups, or enter breakdown continuation trades below 0.23 with confirmation.

---

Conclusion

The 0.23–0.25 zone stands as the final equilibrium point between buyers and sellers — the golden demand zone that will dictate 1INCH’s next major trend.

A confirmed breakout above 0.30 could trigger a strong reversal toward 0.53–0.70, while a breakdown below 0.23 opens the door for a drop toward 0.15.

The market is silent — and this calmness often precedes a massive move.

---

#1INCH #CryptoAnalysis #TechnicalAnalysis #Altcoin #Breakout #PriceAction #CryptoTrading #SwingTrade #SupportResistance #MarketStructure #ReversalZone #CryptoMarket #ChartAnalysis

1INCH/USDT — Critical Accumulation Zone?🔎 Overview

Currently, 1INCH/USDT is trading around $0.2449, sitting right above the key demand zone at $0.21–$0.25 (yellow box). This level has repeatedly acted as a major support, preventing further downside.

On the 3D timeframe, price action shows extended corrective structure after a strong downtrend. This zone is now a make-or-break area: will it turn into an accumulation base for a new bullish cycle, or become a distribution zone before further decline?

---

📌 Market Structure & Price Action

Mid-term trend: still forming lower highs → bias remains neutral-to-bearish until reversal signs appear.

Yellow zone ($0.21–$0.25): major demand zone, repeatedly tested with strong rebounds.

Deep wick spikes → liquidity grabs / stop-hunts before price recovery.

Currently consolidating sideways above demand → market waiting for the next decisive move.

---

🟢 Bullish Scenario

For bullish confirmation, price needs:

1. Hold above $0.21–$0.25 zone.

2. Break & close 3D above $0.30 → early reversal confirmation.

3. Establish higher highs & higher lows → sign of trend shift.

📈 Upside targets:

R1: $0.300

R2: $0.354

R3: $0.436

R4: $0.532

R5: $0.659 – $0.703

With strong momentum, the $0.65–$0.70 zone could act as a mid-term price magnet.

---

🔴 Bearish Scenario

For bearish continuation, price needs:

1. 3D close below $0.21 with volume.

2. Failed retest (previous support flips into resistance).

📉 Downside targets:

S1: $0.190

S2: $0.165

S3: $0.148 (major low on chart)

Breaking below $0.148 would heavily weaken long-term structure for buyers.

---

🎯 Trading Approach & Risk Management

Swing setup: Long from $0.22–$0.24 with stop below $0.195 → target $0.30+.

Breakout setup: Wait for 3D close > $0.305, enter on retest → target $0.354+.

Short setup: Only valid if 3D close < $0.205 with failed retest → targets $0.165–$0.148.

⚠️ Risk note: Keep per-trade risk under 1–3% of capital. Always use stop losses.

---

📊 Key Levels

Main demand/support: $0.21–$0.25

Major resistances: $0.30 → $0.35 → $0.43 → $0.53 → $0.65–0.70

Critical low: $0.148

---

✨ Conclusion

1INCH/USDT is at a decisive crossroads.

Holding the $0.21–$0.25 zone could trigger a bounce toward $0.30 and potentially higher. However, a confirmed breakdown below $0.21 exposes the market to deeper correction toward $0.19–$0.148.

Traders should carefully watch the 3D candle close and volume confirmation before committing to directional trades.

---

#1INCH #1INCHUSDT #CryptoAnalysis #Altcoin #TechnicalAnalysis #CryptoTrading #PriceAction #SwingTrading #BreakoutSetup

1INCH/USDT — Golden Pocket Re-Test at a Critical Zone!Currently, 1INCH/USDT is trading around $0.2568, sitting right at the Golden Pocket (Fibonacci 0.5–0.618) between $0.242–$0.263. This area is highly significant because:

It has acted as a historical demand zone since 2023, often serving as both support and resistance.

It will determine whether buyers can defend this level for a recovery, or if a breakdown towards lower support levels will occur.

---

🔎 Market Structure & Pattern

Macro trend: Since topping near $0.70, the market has been printing lower highs & lower lows → bearish bias still present.

Golden Pocket zone: Represents a potential accumulation area, where smart money often positions for a reversal.

Recent price action: A sharp retracement occurred after rejection at higher levels, and price is now testing this crucial zone again.

---

🚀 Bullish Scenario

If 1INCH manages to hold above $0.242 and closes the 3D candle strong:

1. This will confirm a successful retest at the golden pocket → strong signal for a rebound.

2. Further confirmation if price breaks & closes above $0.300 with volume.

🎯 Upside Targets:

TP1: $0.300 (+16.9%)

TP2: $0.354 (+38%)

TP3: $0.436 (+70%)

Extended targets if momentum continues: $0.532 – $0.658

📌 Bullish Invalidation: 3D close below $0.242 → bullish thesis fails.

---

🐻 Bearish Scenario

If the golden pocket fails to hold and price closes below $0.242:

1. Support flips to resistance → opening the path for deeper downside.

2. Price may revisit $0.19, with extended risk toward the swing low at $0.148.

🎯 Downside Targets:

TP1: $0.190 (–26%)

TP2: $0.148 (–42%)

📌 Bearish Invalidation: A strong reclaim and close above $0.300 would cancel the bearish outlook.

---

📌 Conclusion & Strategy

$0.242–$0.263 = Decision Zone.

Bullish case: A rebound from this zone could fuel a swing rally toward $0.354 – $0.436.

Bearish case: A breakdown below $0.242 targets $0.19 – $0.148.

Watch for 3D candle close & volume confirmation → critical for the next major move.

👉 Aggressive traders may position within the golden pocket with tight risk management, while conservative traders should wait for 3D confirmation before committing.

#1INCH #1INCHUSDT #CryptoAnalysis #Altcoins #SwingTrade #Fibonacci #SupportResistance #DeFi

1INCHUSDT Forming Falling Wedge1INCHUSDT is setting up for what could be a significant bullish reversal as it breaks out from a classic falling wedge pattern. This well-known technical setup typically signals a trend reversal with a strong probability of a sharp upside move once resistance is breached. Over recent sessions, 1INCH has demonstrated strong buying interest with an uptick in volume, indicating that investors and traders alike are beginning to take positions ahead of a possible rally.

The increase in trading volume is an encouraging sign that accumulation is underway. This means that both institutional players and retail investors see value at these levels and are positioning themselves for a potential 60% to 70% gain in the coming weeks. With key resistance levels getting cleared and the falling wedge breakout confirmed, momentum could build quickly, driving price action toward higher targets.

Sentiment surrounding 1INCH is also benefiting from its strong fundamentals as a leading decentralized exchange aggregator. The project’s ability to find the best token swap rates across multiple DEXs has kept it relevant in the DeFi space, attracting new users and liquidity. Combined with improving on-chain metrics and renewed interest in the DeFi sector as a whole, the setup looks increasingly favorable for bulls.

✅ Show your support by hitting the like button and

✅ Leaving a comment below! (What is You opinion about this Coin)

Your feedback and engagement keep me inspired to share more insightful market analysis with you!

1INCHUSDT Forming Bullish Wave1INCHUSDT is showing signs of a promising bullish wave pattern that could deliver solid gains for traders who position themselves early. The 1INCH token, which powers the popular decentralized exchange aggregator 1inch Network, has seen a consistent uptick in trading activity and on-chain volume recently. This uptick in volume indicates that investors and whales are quietly accumulating positions, setting the stage for a possible breakout move. If this momentum continues, the price action could produce an impressive 60% to 70% upside from current levels.

The project’s fundamentals remain strong as the 1inch Network continues to expand its reach in the DeFi space, offering some of the best rates and routing for decentralized trades. This network effect, combined with increased protocol usage, provides additional fuel for a sustained uptrend. The bullish wave pattern developing on the chart suggests that the price could test key resistance levels soon, and a breakout above these levels may trigger a strong upward rally supported by healthy liquidity.

Technically, 1INCHUSDT has formed a clear accumulation zone with higher lows indicating growing buyer confidence. As traders look for altcoins with solid use cases and liquidity, 1INCH is positioning itself as a standout candidate. The alignment of strong technicals with a robust DeFi narrative makes this pair one to watch closely in the coming weeks. Smart investors will be paying attention to volume spikes and breakout confirmations to catch the wave early.

✅ Show your support by hitting the like button and

✅ Leaving a comment below! (What is You opinion about this Coin)

Your feedback and engagement keep me inspired to share more insightful market analysis with you!

1inch - Long Priority BINANCE:1INCHUSDT

✅Before we start to discuss, I would be glad if you share your opinion on this post's comment section and hit the like button if you enjoyed it.

Thank you.

Possible Targets and explanation idea

➡️We bounced from fundamental price value. Usually after that we follow to liquidity like magnet to "Exit line" by Take Profit indicator

➡️We probably will test with break out 1st resistance zone soon

➡️Already retested on D1 timeframe downtrend line since April

➡️Targets for November is 2nd resistance zone and test of global downtrend line

➡️Signal to Buy appeared on "Direction" indicator 20 September. No signal to sell or open short. Long priority

Hope you enjoyed the content I created, You can support with your likes and comments this idea so more people can watch!

✅Disclaimer: Please be aware of the risks involved in trading. This idea was made for educational purposes only not for financial Investment Purposes.

* Look at my ideas about interesting altcoins in the related section down below ↓

* For more ideas please hit "Like" and "Follow"!

#1INCH/USDT Ready to go higher#1INCH

The price is moving in a descending channel on the 1-hour frame and sticking to it well

We have a bounce from the lower limit of the descending channel, this support is at 0.3950

We have a downtrend on the RSI indicator that is about to be broken, which supports the rise

We have a trend to stabilize above the moving average 100

Entry price 0.5000

First target 0.5586

Second target 0.6014

Third target 0.6555

1INCHUSDT Set for Bullish ReversalBINANCE:1INCHUSDT Technical analysis update

- LSE:INCH 's price is approaching the double bottom neckline resistance.

-A breakout from a 300-day descending channel formation has been confirmed on the daily chart.

-The price has crossed the 100 EMA on the daily chart.

-The price is nearing the 200 EMA on the daily chart; once it crosses this level, we can confirm another bullish signal.

-The price is rebounding from the August 2023 support level.

These technical developments highlight a strong potential for a bullish reversal in 1INCH. If the price breaks above the 200 EMA and maintains upward momentum, it could lead to a significant rally. Traders should watch for increased volume and sustained price action to validate further upside potential.

1INCH USDT formed a triangleThe price is consolidating within a symmetrical triangle, a common continuation pattern. The triangle is formed by two converging trendlines—one descending from the highs and one ascending from the lows

if the price broke the trendline it might give us a good move

guys this is not a financial advice you make your own choice

1inch targets for this year

Possible Targets and explanation idea

➡️Fib relevant. We are now in -0.27 zone (accumulation stage) on Weekly timeframe

➡️0.13$ is a last target what we can reach if market collapse at -0.27 level

➡️Trade now under fundamental price (real value of coin) last green line

➡️Take profit now at 2.36$ around 0.23 level by fib and main Weekly IMB.

➡️Between 2.36 and 3.20 will be massive rejection if we will see altseason.

➡️On Crypto4light Market Mood you can see white zones. Its always great time for accumulation if you use DCA strategy for long term

Hope you enjoyed the content I created, You can support with your likes and comments this idea so more people can watch!

✅Disclaimer: Please be aware of the risks involved in trading. This idea was made for educational purposes only not for financial Investment Purposes.

---

• Look at my ideas about interesting altcoins in the related section down below ↓

• For more ideas please hit "Like" and "Follow"!

1Inch targets for May 2023BINANCE:1INCHUSDT

✅Before we start to discuss, I would be glad if you share your opinion on this post's comment section and hit the like button if you enjoyed it.

Thank you.

Possible Targets and explanation idea

➡️Middle term fib. Trade in -0.27 zone

➡️Reject at downtrend line

➡️Reject at volume sellers level

➡️Would be good to see retest 0.45$ and one more retest around March

➡️0.23lvl fib we got Monthly FVG Will be first massive resistance

➡️ Same level will be psychological price target 1$

Hope you enjoyed the content I created, You can support with your likes and comments this idea so more people can watch!

✅Disclaimer: Please be aware of the risks involved in trading. This idea was made for educational purposes only not for financial Investment Purposes.

---

• Look at my ideas about interesting altcoins in the related section down below ↓

• For more ideas please hit "Like" and "Follow"!

1inch is setting up for upto 14% pumpHi dear friends, hope you are well and welcome to the new trade setup of 1inch token with US Dollar pair.

Recently we caught almost 44% pump of 1INCH as below:

Now on a 4-hr time frame, 1inch is about to complete a bullish Shark move for the next pump.

Note: Above idea is for educational purpose only. It is advised to diversify and strictly follow the stop loss, and don't get stuck with trade.

#1INCH/USDT#1INCH

The price is moving within a 4-hour downtrend channel that it is closely committed to, and has just broken through

We have a support area at 0.3400 and we bounced from it at the lower border of the channel

We have a tendency to stabilize above the Moving Average 100

We have an uptrend on the RSI indicator and it has been broken higher

Entry price is 0.3860

The first target is 0.4658

The second target is 0.5160

The third goal is 0.5760