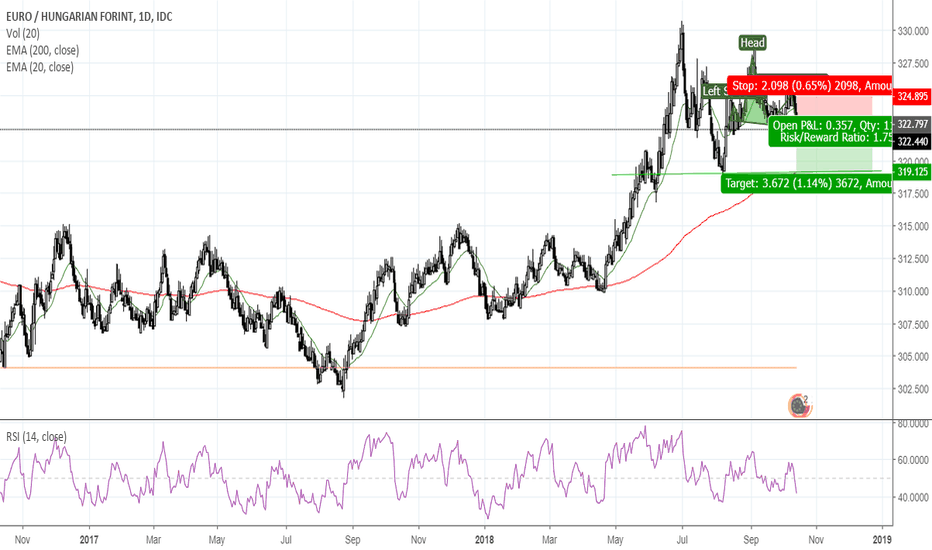

LAKE Inv. H&S on 200 MADaily:

-Consolidation supported by 200 day EMA (also seen on 200 SMA)

-VWAP from peak has been consistent resistance

1HR:

-Easily seen symmetry playing out in Inv. H&S/Rounding bottom bullish reversal

-Wedge forming above gap filled area of support

-Price finding support on 1HR atop converging EMAs. 50 EMA soon to cross 200 EMA, price is likely to be pushed higher, specifically given prior price action on 5/29 and 6/2 where the 50 EMA acted as strong and rising support level

Bullish as long as price remains above the gap area (>$14). I am looking for breakout of wedge/pennant on 1HR to enter this trade, I will place sell order for 1/2 position at the VWAP level.

200ema-pullback

USDJPY Will price retest the trend line and 200 EMA? This is a full breakdown of my perception of price action on higher time frames! I take my entries using smaller time frame confirmation and you should, too. If you have any questions about this trade or my strategies feel free to ask them in the comment section below!

Let’s make some money together!

4hr 200 ema double bounce. Bullish divergence on the larger dipHere are those ema bounces I was talking about in the other chart. You can see the divergence on the lower dip which should still be playing out despite the volatility. The run back up to 9k was too fast, the momentum carried it past and the price action whipsawed back down to supports. Look for a TTM squeeze indicator on 4hr or higher time frame if you wanna look for safer entries but I think this range is a good dip buying opportunity so long as 8.1k holds. I'll post a new large time frame chart later, probably after the daily close. Good luck as always and do your own research!

200 EMA waiting to receive priceactionThe EURUSD has topped again above the 14 EMA.

It still is struggling against its uptrend.

It also tried out to get back to its 200 EMA level, but it didn´t succeed.

As the theory works, price level needs to come back to certain levels. In this case, it is the 200 EMA.

We can see that price moved now 360 bars without coming back to earlier levels.

We still can expect a drop down some moment before it will go back into it´s uptrend.

NZDUSD Technical Outlook: Bearish Bias, Rejection from 200 EMANzdusd has rejected from 200 EMA on H4 time frame. This zone will be strong resistance for this pair in future. Now this pair is staying below near term resistance at 0.6970. Below this level, we can look for sell and target will be 0.6900 area as pointed on the chart.