ETHEREUM at Major Support: Bullish Rally Incoming?COINBASE:ETHUSD is on the verge of a major move. The price has reached a key support level that has historically triggered strong buying interest. This zone has acted as a demand area multiple times, increasing the likelihood of a bullish reaction if buyers step in once again.

The market structure

Key facts today

Ethereum's price has dropped below $1,650 and $1,620, hitting a low of $1,537. Resistance remains at $1,600, with support at $1,550 and $1,535.

Ethereum's price has dropped amid reduced trading interest and inflows, particularly in Spot Ethereum ETFs, as traders shift focus to Bitcoin and altcoins like Solana, Dogecoin, and XRP.

Ethereum (ETHUSD) has seen a notable decline of nearly 8% in the past 24 hours, outpacing Bitcoin's 3% decrease, and this drop has led the ETHBTC ratio to approach its five-year low.

Key stats

About Ethereum

Ethereum — the world’s second-most famous blockchain network — is a platform for creating decentralized applications based on blockchain and smart contract technology (a command that automatically enforces the terms of the agreement based on a given algorithm). It's the chain that birthed DeFi (decentralized finance) and started the NFT craze which saw billions of dollars pour into cryptocurrency. Safe to say, it's one of the big dogs.

No news here

Looks like there's nothing to report right now

K.I.S.S => ETHHello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

📉 ETH Market Update – Keeping It Simple 📉

Since breaking below its last major low in December 2024, Ethereum (ETH) has been stuck in a bearish trend.

But don’t lose hope, bulls! 🐂

For the long-awaited altseas

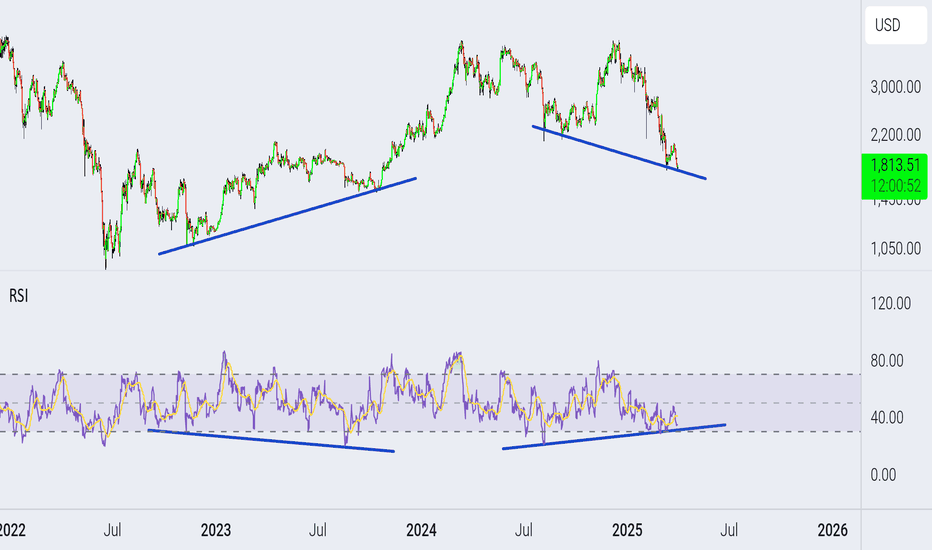

Eth Bullish Divergence Before the Last big rise to 4k we saw a Hidden bullish divergence.Now at this Moment we have a bullish divergence which could lead to a big jump in price.I am bullish above 1750k on the monthly Close.

Targets : 4k-7500k

Good Luck

BLong

Ethereum Not Dead- i know some peoples think ETH will go to 250$ or 500$, so wait for it...

- I've always maintained that I'm not a fan of ETH because of its scalability limitations and centralization, for that reason ETH needs some messy L1...L2...etc..

- That said, my opinion doesn’t matter much, ETH is here to s

BLong

ETH Ready for PUMP or what ?Currently, ETH is forming an ascending triangle, indicating a potential price increase. It is anticipated that the price could rise, aligning with the projected price movement (AB=CD).

However, it is crucial to wait for the triangle to break before taking any action.

Give me some energy !!

✨We sp

CLong

Eth looking for swing longThere is one last wave, Flat correction for the fourth wave the fifth major one.

BLong

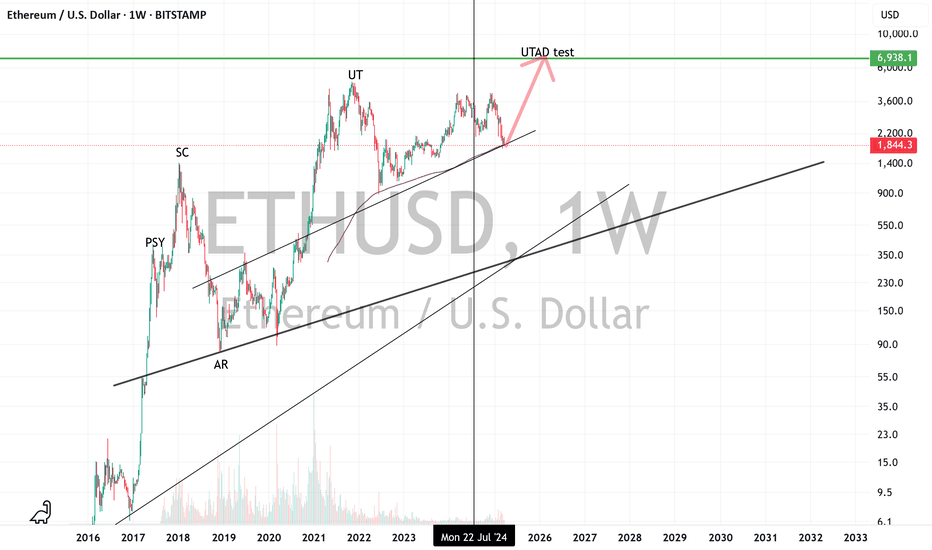

ETH - UpdateETH has been "crashing" lately but I think it is in the end state of a long rally. In fact I think we are in the last stage of Wyckoff distribution and we could see a major rally soon. Looking at the 300 SMA we bottomed there in June 22 and if we hold there, it could be the spring board for a massiv

BLong

ETHUSDFrankly, it has a very bad chart... The purple support area, $1,500, is the last stronghold for the bulls, and if it doesn't hold, we've officially entered a bear market and are headed towards $800-$1,000.

BShort

Ethereum - The Perfect Crypto Trade!Ethereum ( CRYPTO:ETHUSD ) is retesting massive support:

Click chart above to see the detailed analysis👆🏻

For the past four years, Ethereum has overall been trading sideways with significant swings towards the upside and downside. As we are speaking, Ethereum is retesting a significant conflu

ETH Weekly TF !This Ethereum (ETH/USD) weekly chart is packed with insightful price action, structural patterns, and ICT (Inner Circle Trader) concepts. Here's a detailed breakdown and thoughts:

🧠 High-Level Thoughts:

Currently Bearish Bias: The price recently broke down from a bullish structure, suggesting that

See all ideas

Displays a symbol's price movements over previous years to identify recurring trends.

Curated watchlists where ETHUSD is featured.

Gen 2: Crypto is here to stay - and it's brought some friends…

19 No. of Symbols

Proof of Work: Embracing the crunch

27 No. of Symbols

Smart contracts: Make the smart decision

36 No. of Symbols

Staking Coins: Pick up a stake

18 No. of Symbols

Top altcoins: Choose your alternatives carefully

28 No. of Symbols

See all sparks

Frequently Asked Questions

Ethereum (ETH) reached its highest price on Nov 10, 2021 — it amounted to 4,870.42 USD. Find more insights on the ETH price chart.

See the list of crypto gainers and choose what best fits your strategy.

See the list of crypto gainers and choose what best fits your strategy.

Ethereum (ETH) reached the lowest price of 87.12 USD on Mar 13, 2020. View more Ethereum dynamics on the price chart.

See the list of crypto losers to find unexpected opportunities.

See the list of crypto losers to find unexpected opportunities.

The safest choice when buying ETH is to go to a well-known crypto exchange. Some of the popular names are Binance, Coinbase, Kraken. But you'll have to find a reliable broker and create an account first. You can trade ETH right from TradingView charts — just choose a broker and connect to your account.

You can discuss Ethereum (ETH) with other users in our public chats, Minds or in the comments to Ideas.