AAVE: The Squeeze Is OnWe're watching a textbook compression pattern on AAVE—price trapped between ascending support at $173.25 and descending resistance at $198.53. These narrowing wedges don't last forever. The question isn't if it breaks, it's which direction and how violently. Current price: $175.48.

1. THE TECHNICAL REALITY 📉

• Wedge Compression: Ascending support at $173.25 (4 touches from $80.01) vs descending resistance at $198.53 (8 touches from $237.08)

• Trend Structure: Trading below all three major EMAs (20/50/200)—path of least resistance is down

• Rejection Signal: Massive 75.8% upper wick shows aggressive selling pressure defending higher prices

• Volume Context: 50% below average ($51k vs $101k)—no conviction behind bounce attempts

2. THE INDICATORS ⚖️

Bearish Signals:

• MACD bearish and diverging further negative (-1.98 vs -1.70 signal)

• ADX at 30.3 confirms moderate trend strength pointing south

• Bearish order block overhead at $193.18-$186.41 acting as supply ceiling

• Lower high structure with deteriorating momentum

Bullish Signals:

• RSI at 32 screaming oversold

• Stochastic at 16.6 in extreme territory

• Ascending trendline at $173.25 has held for months

The Conflict:

We're oversold, but oversold can stay oversold in a trending market. Weak volume means any bounce lacks conviction. The trendline is the last line of defense.

3. THE TRADE SETUP 🎯

🔴 Scenario A: Breakdown (Primary Path - 68% Confidence)

• Trigger: Rejection at $177-$179 zone (EMA20 resistance)

• Entry: Break below ascending trendline at $173.25

• Target 1: $169.36 (swing low + bullish OB top)

• Target 2: $162.19 (strong support low)

• Stop: 4H close above $193.18

• R/R: ~1:0.5 on first target, but probability-weighted favorable

🟢 Scenario B: Bullish Reversal (Alternative)

• Trigger: 4H close above $193.18 (flips bearish OB to support)

• Entry: Retest of $193.18 as support with volume confirmation

• Target: $210.36 (bullish change of character)

• Invalidation: Failure to hold $193.18 on retest

MY VERDICT

The higher probability play is watching for breakdown below $173.25 and riding it toward $169.36. We've got alignment—bearish structure, deteriorating momentum, weak volume, rejection wicks. But that ascending trendline is the make-or-break level. If it holds with a volume spike, I'd reassess quickly. Until then, the setup favors the downside.

Are you fading this oversold condition or playing the breakdown? What's your read on that $173.25 trendline?

Aaveusd

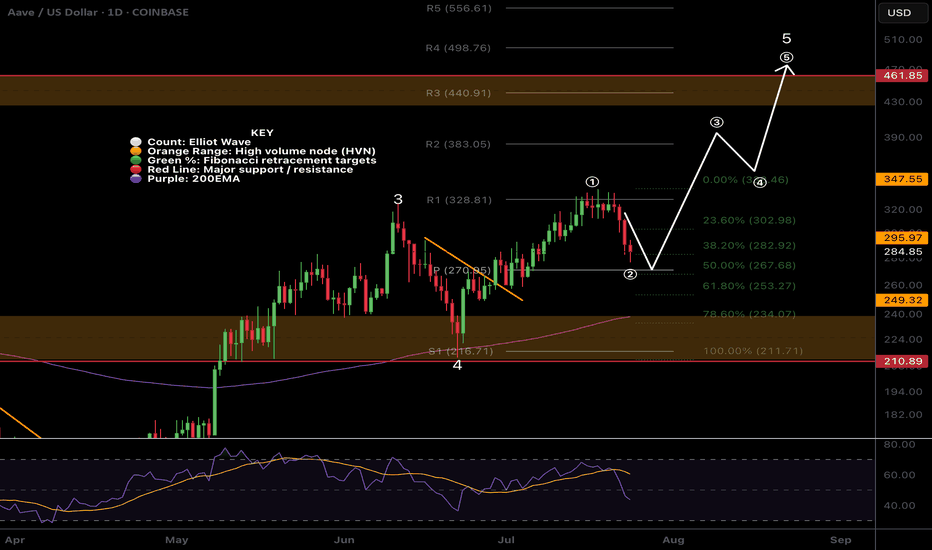

AAVE ANALYSIS (1D)Hello everyone.

Today I'm going to examine AAVE.

As you can see after a five upward impulsive wave, AAVE has faced a double Zig-Zag correction.

The reason why this pattern is a Double Zig-Zag is simply because the first A-B-C correction was not enough. Therefore another Zig-Zag correction was needed.

This kind of corrections only appears in the market when the main correction wave is not enough to balance the price according to the last impulsive wave.

There are two scenarios comes forward;

First: If it's a double Zig-Zag correction, there is always another possibility that this pattern could turn itself into a triple Zig-Zag. In this case, the mini wedge pattern you see on the chart will break the last low and create a way deeper correction. Target of a possible triple Zig-Zag is marked on the chart.

Bullish scenario: If the double Zig-Zag has ended which is what I'm seeing at the moment, the 4H ascending wedge you see on the chart will create a leading diagonal and a higher high, which will be seen as wave 2 for another five wave upward impulsive move. That's the opportunity you can't afford to miss.

Fortunately, the risk management comes very easy when Elliott patterns are clear.

If you're looking for a swing long position in here your stop-loss should be last low, just below the Wave Y. To make it better, wait for a daily candle close below it, so you won't be hunted for liquidity grabs.

Target of the possible wave 3 is marked on the chart as well.

Bulls Flexing StrengthHey guys, AAVE is setting up one of those textbook bullish continuation patterns that makes you sit up and pay attention.

The current price of $199.14 sits right in the equilibrium zone, perfectly balanced between premium and discount levels. What's immediately striking is the clean higher low formation that's been confirmed, with price holding firmly above all major moving averages. The EMA20 at $197.14, EMA50 at $196.87, and EMA200 at $193.39 are all stacked bullishly beneath current price, creating a support ladder that's characteristic of strong uptrends. This alignment doesn't happen by accident - it's the result of sustained buying pressure and institutional accumulation.

The ADX reading of 53.3 is absolutely critical to understanding the current market state. This indicator measures trend strength, and anything above 25 signals a trending market rather than choppy consolidation. At 53.3, we're looking at a strong, established trend that has momentum behind it. When you pair this with the MACD showing powerful bullish divergence (0.6012 vs 0.0205 signal line), the technical picture becomes crystal clear. The MACD histogram is expanding positively, indicating accelerating bullish momentum rather than a weakening trend.

The RSI at 68.7 is approaching overbought territory but hasn't reached extreme levels yet. This is actually ideal for continuation setups - we want to see strength, not weakness. The RSI has room to push into the 70-80 zone during strong trending moves, so this reading suggests we're in the middle of a move rather than at an exhausted top. The MFI at 66.8 confirms that money flow is supporting this price action, with capital flowing into AAVE rather than exiting.

From a Smart Money Concepts perspective, this setup gets even more interesting. Price is currently trading above a bullish order block that spans $196.09 to $197.71. This zone represents an area where institutions likely accumulated positions during the previous move up, and it's now acting as a demand zone. Order blocks are one of the most reliable SMC concepts because they mark areas where smart money has shown their hand. The fact that we're holding above this level suggests institutional support remains intact.

There's also an unfilled bullish Fair Value Gap sitting at $195.26-$195.54. FVGs represent inefficiencies in price action where the market moved too quickly, leaving behind an imbalance. These gaps act as magnets - if we see any pullback, this $195.26-$195.54 zone would be an ideal area for smart money to add to positions. It's essentially a discount entry point within the broader uptrend.

The bearish order block at $204.48-$199.70 represents the immediate supply zone we need to reclaim. This is where sellers previously showed strength, and reclaiming this zone with volume would be a significant bullish signal. A break above $204.48 with expanding volume would likely trigger stops and fuel a move toward the swing high at $206.80.

The market structure is showing higher lows, which is the definition of an uptrend. The recent swing low at $189.16 held firm, and the even stronger low at $186.85 provides an additional backstop. The Bollinger Bands show price trading above the middle band at $195.32, with the upper band at $202.02 within striking distance. When price walks the upper Bollinger Band in a strong trend, it often signals continuation rather than reversal.

Volume analysis reveals current levels at $19,995 versus an average of $22,867. While this is slightly below average, it's not concerning given we're in a consolidation phase. What we want to see is volume expansion as price approaches the $204.48 resistance zone. A breakout on declining volume would be suspect, but a breakout with volume above $25,000+ would confirm institutional participation. The 24h volume of $161 million shows healthy overall interest in AAVE.

The wick analysis is particularly revealing. The lower wick represents 24.9% of the candle range, while the upper wick is only 11%. This asymmetry tells a story - buyers are aggressively defending lower prices (creating large lower wicks), while sellers aren't showing the same aggression at higher prices (small upper wicks). This imbalance in supply and demand dynamics typically precedes upside moves.

For a complete trading setup, here's how I'd approach this: Entry zone is $197-199, with aggressive traders potentially entering at current levels given the strong technical backdrop. More conservative traders might wait for a pullback to the $195.26-$195.54 bullish FVG for a better risk-reward entry. The stop loss should be placed below $188.00 - a 4H close beneath the discount zone at $188.09 would invalidate the bullish market structure and break the higher low formation. This isn't just a random percentage-based stop; it's a structural level where the thesis breaks.

Target the swing high at $206.80 for TP1, which represents a 3.85% move from current levels. If we get a clean breakout above $206.80 with volume confirmation, look for extension targets at $210 and potentially $215 based on measured moves. The risk-reward on this setup is approximately 1:2.5 from current levels, which is solid for a continuation play. If entering from the FVG around $195, the R:R improves to nearly 1:4.

The confidence level on this setup is 78% - high conviction but not maximum. What keeps this from being a 90%+ setup is the slightly below-average volume and the fact that we're in equilibrium rather than deep discount. The ideal scenario would be a quick wick down to $195 on a volume spike (liquidity grab), followed by immediate reclaim and push through $204.48. That would be the textbook smart money playbook.

Alternative scenarios to consider: if price rejects hard at the $204.48 bearish order block without volume confirmation, we could see a deeper pullback to the $195.26 FVG or even the $189.16 swing low. This wouldn't invalidate the bullish thesis unless we close below $188.00. Consolidation between $197-204 for another 12-24 hours would actually be healthy, allowing the RSI to cool off slightly before the next leg up.

What are you thinking here? Are you waiting for a pullback to the FVG for a better entry, or taking the trade at current levels given the strong momentum?

The rally is back: from Ethereum to Toncoin!Recently, the pairs ETHUSD, TONUSD, LNKUSD, ADAUSD, and AAVUSD have been climbing amid improving market sentiment and inflows into ETFs — including spot ETFs (funds that buy the underlying asset itself rather than derivatives). Investors are reacting to ecosystem news and protocol upgrades that enhance the real utility of networks. As a result, the market has received fresh momentum: demand is expanding, and prices are following.

Five Growth Factors:

ETHUSD (Ethereum +15.3%) — Supported by inflows into spot ETFs and heightened developer activity around network upgrades, which strengthened buyer interest (spot ETFs are funds that directly hold ETH).

TONUSD (Toncoin +9.7%) — User growth driven by Telegram mini-apps and attention campaigns like SERA (a gaming/social ecosystem event; SERA is the initiative’s name) is expanding the user base.

LNKUSD (Chainlink +13.9%) — Adoption of CCIP (a cross-chain messaging and value transfer protocol) continues to grow, including through bridges (technology that transfers assets between networks) — on December 4, the Base–Solana bridge was announced (Base and Solana are blockchains; the bridge connects them).

ADAUSD (Cardano +16.2%) — December saw the launch of Midnight/NIGHT (Midnight is a privacy-focused sidechain — a separate network alongside the main one; NIGHT is its token). This gave Cardano a real new feature: private transactions and business-ready smart contracts.

AAVUSD (Aave +15.8%) — Progress toward protocol version v4 (the fourth major upgrade enhancing flexibility and reducing client risk): a public testnet and preparation for the mainnet are heating up expectations around functionality and token economics.

If interest in Ethereum ETFs remains strong, Ethereum can maintain its momentum. Toncoin benefits from easy access through Telegram apps; Chainlink gains strength as more services adopt its cross-chain “translator,” enabling secure data and token transfers; Cardano benefits from having a dedicated private network for business use cases; and Aave grows on expectations surrounding its upcoming core protocol upgrade.

FreshForex analysts note that in the coming weeks, the performance of ETH, TON, LINK, ADA, and AAVE will depend on three factors: sustained inflows into Ethereum-backed ETFs, real user and use-case growth (TON via Telegram mini-apps; LINK as the “connector” between blockchains), the pace of technological rollouts (the Midnight private network in the Cardano ecosystem and Aave’s transition from testing to the full v4 release). Investors are advised to maintain strict risk management and monitor the macroeconomic calendar.

AAVE/USDT — Critical Demand Zone 135–120: Reversal Signal?AAVE/USDT (3D) is developing a highly interesting structure after delivering a strong rebound from the major demand zone at 135–120, an area that has historically served as a large accumulation region for institutional players since 2023.

The long downward wick — clearly a liquidity sweep — shows how the market wiped out stop-losses beneath the zone before snapping back upward. This kind of wick is rarely random; it often signals smart money accumulation exactly where retail traders panic.

Still, despite the sharp recovery toward 180–190, the broader market structure remains in a pattern of Lower Highs, which means the medium-term trend is still technically bearish. AAVE is now positioned at a major inflection point: Is this the beginning of a structural reversal, or only a temporary bounce before another leg down?

---

🔵 Bullish Scenario — Reversal Begins Above 205

The bullish case gains real validity only if price can break and close above the 195–205 resistance cluster on the 3D timeframe.

A decisive breakout here would mark the first Higher High in months and potentially flip the trend.

If the breakout holds, upside targets include:

Target 1: 265–305 (major supply zone)

Target 2: 380–400 (macro swing high)

Target 3: 440+ if DeFi momentum expands

Key bullish confirmations:

Increasing buy volume during the breakout

Strong 3D candle close above 205

A clean retest of 195–205 turning into support

If these align, a full trend reversal becomes increasingly probable.

---

🔴 Bearish Scenario — Breakdown Below 120

The bearish case becomes dominant if price fails to defend the 135–120 demand block and instead closes firmly below 120 on the 3D timeframe.

If that happens, the mid-term downtrend likely resumes with the following targets:

Target 1: 99–84

Target 2: 70 (previous liquidity sweep low)

Target 3: 62 if capitulation expands

This scenario would suggest that the prior liquidity sweep was not a reversal signal but rather preparation for a deeper markdown phase.

---

📌 Key Patterns & Structural Notes

Liquidity Sweep: The long wick beneath the demand zone signals wiped-out liquidity and possible institutional absorption.

135–120 Demand Block: A crucial accumulation area that currently serves as the final defense for buyers.

Lower High Structure: Trend remains bearish until 205+ is reclaimed.

Range Market: Price is currently oscillating within a broader 120–225 range; a breakout of either side will determine the next macro move.

---

🎯 Final Summary

AAVE is now at one of its most important decision zones of the past year.

Break above 205 → bullish trend shift

Break below 120 → bearish continuation and deeper lows

Until one of these triggers is activated, AAVE remains in accumulation/consolidation mode, preparing for its next major directional move. Swing traders typically wait for one of these confirmations before entering large positions.

---

#AAVE #AAVEUSDT #CryptoAnalysis #PriceAction #TechnicalAnalysis #SupplyDemand #LiquiditySweep #DeFi #Altcoins #CryptoMarket

AAVE price analysisAfter nearly 5–6 months of waiting, CRYPTOCAP:AAVE has reached the $146 target, followed by a constructive rebound. The brief volatility spike on October 10–11 doesn’t change the broader structure.

From a fundamental perspective, CRYPTOCAP:AAVE remains one of the more robust DeFi assets. Price stability is notable considering the complete absence of ETF-related hype — which means any future catalyst could amplify the move.

If market conditions improve, OKX:AAVEUSDT has a reasonable probability of retesting the $500–600 ATH zone.

What’s your view: is CRYPTOCAP:AAVE preparing for a mid-term trend expansion or is the asset likely to stay in accumulation?

______________

◆ Follow us ❤️ for daily crypto insights & updates!

🚀 Don’t miss out on important market moves

🧠 DYOR | This is not financial advice, just thinking out loud

#AAVE Bears Ready For Further Downside | Must Watch For Bears Yello Paradisers! Are you watching what’s unfolding on #AAVEUSDT right now? Because if you’re not, this could catch you completely off guard. There’s a potential bearish breakdown brewing that could send #AAVE into much deeper territory. Let’s dive in before it's too late:

💎#AAVE has been trading inside a symmetrical triangle, caught between a descending resistance and ascending support. Each test of the upper boundary has been weaker, showing fading bullish momentum. Now, we’re pressing against the lower support line with sellers gaining control.

💎The current price is $222, and we’re right on the edge. A confirmed breakdown below the ascending support will flip the entire structure bearish. The 50 EMA is now acting as resistance, reinforcing this downward pressure and aligning with the broader setup.

💎If this bearish scenario confirms, the next downside target becomes the Support Zone around $195–180, but the real liquidity lies deeper. A sharp move could easily send #AAVEUSD into the Strong Demand Zone between $133–123, where we expect stronger buyers to finally show up.

💎However, this setup is invalidated if #AAVE breaks back above the Resistance Zone at $263. That would signal strength and likely trigger a fast bullish reversal targeting higher levels above $280.

Trade smart, Paradisers. This setup will reward only the disciplined.

MyCryptoParadise

iFeel the success🌴

AAVE/USDT;BUY LIMITHello friends

Given the price reaching the specified support and the strong support of the price by buyers in the specified range and the failure of the specified resistance, we can buy in steps with risk and capital management and move to the specified targets.

*Trade safely with us*

AAVE Near Crucial Support, Setting Stage for 14% Bounce to 326$Hello✌️

Let’s analyze Aave’s price action both technically and fundamentally 📈.

🔍Fundamental analysis:

Aave’s next big update (V4) will make its markets more connected and efficient. If it succeeds like the last upgrade, AAVE’s value could move toward $326 again. 💧

📊Technical analysis:

BINANCE:AAVEUSDT is approaching a key monthly support area. If this zone holds, price could see a potential 14% rebound toward the 326 level, with confirmation coming from sustained buying momentum around support. 📊💎

📈Using My Analysis to Open Your Position:

You can use my fundamental and technical insights along with the chart. The red and green arrows on the left help you set entry, take-profit, and stop-loss levels, serving as clear signals for your trades.⚡️ Also, please review the TradingView disclaimer carefully.🛡

✨We put love into every post!

Your support inspires us 💛 Drop a comment we’d love to hear from you! Thanks, Mad Whale

STABLECOIN SUPERCYCLE CAN SEND AAVE TO $5,000We have a #HVF forming that is yet to breakout.

The fundamental driver is of course stablecoin growth. Namely the ones that the United States allow to dominate in this space. Permissioned quasi CBDC's like USDT and USDC.

So what is AAVE if you don't know;

Aave (AAVE) is a decentralized finance (DeFi) protocol enabling users to lend, borrow, and earn interest on crypto assets without intermediaries through automated liquidity pools.

Liquidity Markets – Users deposit assets into pools to earn yield or borrow against collateral.

Flash Loans – Pioneered uncollateralized loans executable within a single blockchain transaction.

Community Governance – AAVE token holders vote on protocol upgrades, risk parameters, and expansions.

So there we have it ... congrats to hodler's of this protocol that was once called ETHLend.

Theres still plenty meat left on the bone for these next few years.

AAVE Breakdown from wave 5 wedge. Whats next?Local Analysis / Targets / Elliot Wave

CRYPTOCAP:AAVE broke down out of the wave (5) of 1 wedge per my previous analysis reaching the paths first target to find support the daily 200EMA and S1 pivot point. If price continues lower I expect it to bounce first before delivering a final thrust down in wave C of 2.

The major support High Volume Node, $210, is the target at the 0.5 Fibonacci retracement. Further breakdown brings up the golden pocket and S2 pivot, $175, and the alt-coin ‘golden pocket’ sits at $149 the 0.786 Fibonacci retracement. This is the most common area for alt-coin pull backs to terminate and a characteristic area for low volume, highly volatile assets in general due to the psychology as I discuss on my Fibonacci tutorial on YouTube.

RSI is making its way down into oversold but has plenty of room to fall with no bullish divergence yet.

Standard Deviation Band Analysis

Standard deviation bands are non-normally distributed unlike the renko chart shared in yesterdays report when time is removed. Price continues to spend way to much time at extremes with fast movement through the fait value zone. Bands are shifting significantly positive as time goes on due to price spending so much time in th eupper boundaries. This is a good sign of strength, dips remain shallow showing strong demand.

Price is testing the SD+2 threshold as support now and losing this would bring up the next target of the fair value regression line at $150 which adds confluence to the alt-coin ‘golden pocket’ targets in the technical analysis.

Safe trading

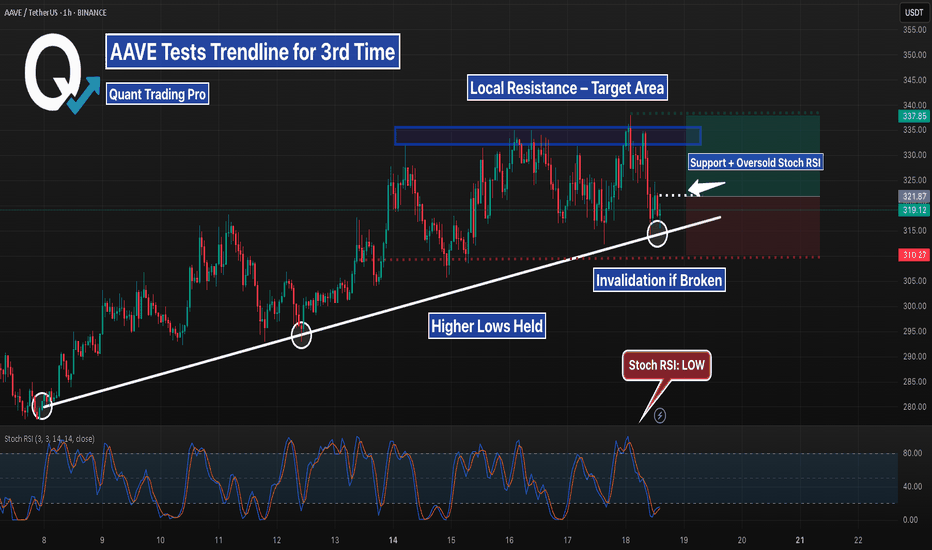

AAVE 4H Analysis | Key Triggers Ahead💀 Hey , how's it going ? Come over here — Satoshi got something for you !

⏰ We’re analyzing AAVE on the 4-Hour timeframe timeframe .

👀 On the 4-hour timeframe of AAVE, we can see that after breaking the trendline, its volume increased and it moved toward the $361 resistance, then entered a corrective trend. Currently, this coin is ranging inside a triangle consolidation, and the volume has dropped significantly.

⚙️ The RSI fluctuation of this coin is still below the 50 zone, and two key levels have been considered for its movement: 55.15 and 37.89. If the RSI passes beyond these levels, this coin can experience another movement leg.

🕯 The size and volume of the candles have decreased, with the red candles being bigger and more numerous than the green ones. This could be a sign of the end of selling pressure or the beginning of a new wave of selling pressure. The coin is in a very important area, and with today’s news it may move upward and end this corrective trend.

💰 On the 4-hour timeframe of the trading pair AAVEBTC, after a strong rally against Bitcoin, this coin is now in a triangle consolidation and the volume has dropped. A significant amount of this coin has been sold and converted to Bitcoin (buyer makers of Bitcoin). A ceiling and floor have also been formed as our alarm zones, where price action in these areas can help us make the best decision for this trading pair.

🔔 The alarm zone for this coin is considered at $323 for a long trade and $301 for a short trade. Today, this coin recorded a historic milestone in DeFi, and with the breakout and confirmation of the marked trendline and the activation of triggers, it can experience good growth. 🚀

❤️ Disclaimer : This analysis is purely based on my personal opinion and I only trade if the stated triggers are activated .

Is AAVE About to Explode Above or Collapse? Key Levels to WatchYello Paradisers! Is #AAVE quietly prepping for a major breakout… or is this just another setup to wipe out the impatient bulls before the real move begins?

💎#AAVEUSDT is moving in a textbook ascending channel, respecting both trendline resistance and support beautifully. The structure is clean, but deceptive. While many may assume this is an easy path higher, seasoned traders know better — especially with what’s happening near the critical resistance zone.

💎The red resistance zone ($270–$280) that was previously a major support during the last cycle is now acting as heavy resistance again. #AAVEUSD is currently battling this zone after several failed attempts to break through. But the structure still leans bullish as long as we stay within the ascending channel.

💎Both the 50 & 200 EMA are now acting as dynamic support. This is key — if the price remains above these EMAs and the lower channel boundary, momentum favors the bulls. A decisive breakout above $280 could trigger a parabolic rally toward the $375–$410 range, a level where serious resistance and profit-taking are expected.

💎However… if bulls get lazy and we see a strong breakdown below the ascending channel, especially below $237, the setup gets shaky fast. A complete invalidation of the bullish case occurs if AAVE loses $209 — from there, expect a breakdown structure to unfold with a likely test of much lower levels and a possible retest of the $150 zone.

Trade smart, Paradisers. This setup will reward only the disciplined.

MyCryptoParadise

iFeel the success🌴

AAVE Ending Diagonal?We have some more clarity with the local AAVE pattern and it does appear to be an Elliot wave ending diagonal. After a strong wave 3 ending diagonals form as a terminal pattern with a thrust above the trend line threshold and drop back down to complete a higher degree motif wave 1.

The following retracement has a high probability of terminating at the wave 4 bottom which in this case is at the High Volume Node support and 0.5 Fibonacci retracement at $210.

RSI has printed a series of bearish divergence from overbought but this took a long time to play out!

Analysis is invalidated if price breaks above $400.

Safe trading

AAVE ANALYSIS (4H)After grabbing the upper liquidity pool, AAVE has shifted into a bearish structure.

Currently, the price is trading below both the 50 EMA and the 200 EMA.

Additionally, we can clearly identify a textbook Head & Shoulders pattern on the chart.

With these confirmations, AAVE remains bearish, and the downside target should be around $270 – $266.

Thanks for reading.

$AAVE Set for all time high?AAVE tested the weekly pivot as support and after a secondary pullback to the 0.236 Fibonacci retracement, sky rocketed alongside BTC and crypto yesterday to a new local high.

Wave III looks truly underway with this kind of price action and the target remains the R5 weekly pivot at $1155. High Volume Node resistance at $460 and $670 are the next targets.

Weekly RSI has plenty of room to grow to get to overbought.

Analysis is invalidated below $111 so plenty of room to breathe!

Safe trading

$AAVE Local Expanded Flat Correction?CRYPTOCAP:AAVE Elliot wave count could be printing an expanded flat correction in wave 2.

5 waves up complete a motif wave with daily RSI in overbought. 3 clear waves down for wave A (or X) was next followed by a poke above all time on confirmed bearish divergence.

If the count is correct then our first target would be a swing below wave A and the ascending daily 200EMA at point . Further decline in wave C (or Z) brings up the previous wave 4 target and the High Volume Node major support $210 point

A steeper decline in wave 2, aligning with my September dump idea, brings up the golden pocket at but a more likely target is the alt-coin golden packet at 0.786, s3 daily pivot and High Volume Node support . This would be a great buy opportunity for me.

Safe trading

"The AAVE Heist Plan – Stealthy Entries, Big Exit!"🔥🤑 THIEF TRADER’S AAVE/USDT HEIST PLAN 🚀💰

Asset: AAVE/USDT

Plan: BULLISH HEIST 🚀📈

🎯 ENTRY STRATEGY (THIEF STYLE):

✔ BREAKOUT ENTRY: 310.00 (Aggressive heist!)

✔ PULLBACK ENTRY: 290.00 (Safe & sneaky!)

💎 THIEF’S LAYERING STRATEGY (MULTIPLE LIMIT ORDERS):

🔹 295.00 (First dip grab!)

🔹 290.00 (Second loot!)

🔹 288.00 (Third steal!)

🔹 282.00 (Final robbery!)

(Add more layers if you're a PRO thief!)

⛔ STOP LOSS (THIEF’S SAFE ESCAPE):

📍 266.00 (OG Thief SL!)

⚠ LADIES & GENTLEMEN THIEVES: Adjust SL based on your risk & strategy!

🎯 TARGET: 350.00 (Time to escape with the loot!)

🔥 WHY THIS HEIST WILL WORK?

✅ BULLISH BREAKOUT – Price ready to explode!

✅ SMART PULLBACKS – Sneaky entries for max gains!

✅ LAYERED LIMITS – Lower average cost, bigger profits!

✅ THIEF’S RISK MANAGEMENT – SL protects your bag!

⚠ THIEF’S ALERT:

📉 NEWS CAN TRAP YOU! – Avoid trading during high-impact news!

🔒 USE TRAILING SL! – Lock profits & run before the cops (bears) come!

💥 BOOST THIS TRADE & JOIN THE HEIST!

👉 LIKE 👍 | 🔄 SHARE 🔗 | 💬 COMMENT 🚀

💖 SUPPORT THE THIEF SQUAD – MORE HEISTS COMING!

🤑 SEE YOU AT THE TARGET, FELLOW THIEVES! 🏴☠️💰

$AAVE Continues to follow the path!CRYPTOCAP:AAVE was immediately reject from the swing high as expected, per the percentage band take profit rules.

Daily RSI has plenty of room to grow to reach the all time High Volume Node resistance which is the next target at $430.

Based on the depth of wave (2) after touching the daily 200EMA as support, wave 3 is still underway to complete the larger degree wave 5 with a poke above all high, the highest probability terminal target per Elliot wave rules.

Safe trading

For those interested in trading signals / diary & trade management / trading parameters etc... Signals updated for 15/08/25

✅ LSE:ONDO DEMA Percentage Band rule added

✅ CRYPTOCAP:BTC hit take profit #2 for 2.59RR

✅ CRYPTOCAP:AAVE (DEMA) HIt take profit 1 for 1.45RR

✅ CRYPTOCAP:ADA moved 10% after signal activation but still not hit take profit 1

✅ NASDAQ:AAPL (Apple) very close to take profit #1

✅ BTC added to completed trade signals along side Take profit 2 for google, 700, HBAR and a few stop (INJ, SOL, BTDR) and invalidations for META, SHIBINU, WLD)

Safe trading

$AAVE Daily Hidden Bullish divergence?CRYPTOCAP:AAVE and alts begin their retracement Wednesday but is this a long term top or just local? Im betting we have a higher to go this summer..

Hidden daily bullish divergence is printing on RSI at the daily pivot and 0.5 Fibonacci retracement which should all act as strong support provided BTC doesn't dump.

The 'alt-coin golden pocket' Fibonacci retracement 0.786 sits at the descending daily 200EMA and High Volume Node support offering a secondary target for reversal and continued upside.

Losing this and closing below would flip me bearish until a new bullish signal emerges.

Safe trading.